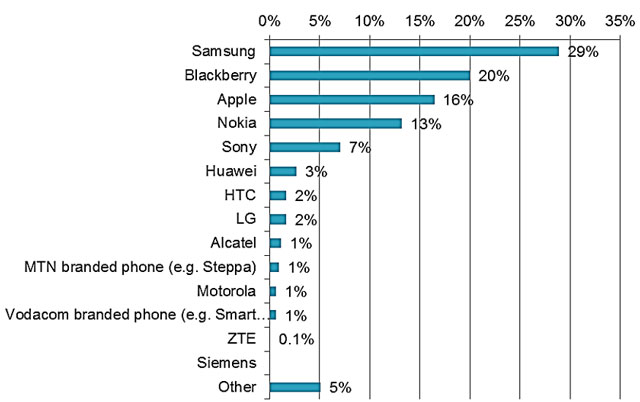

Samsung is the dominant cellphone brand in the minds of urban consumers, according to new research by BMI-TechKnowledge.

When asked what handset they would choose in the future, nearly a third of 1 500 survey respondents interviewed in metropolitan areas selected Samsung.

BlackBerry was placed second, with 20% of respondents selecting the Canadian brand’s phones as a future purchase choice.

Apple came in third place, with 16%, followed by Nokia (13%), Sony (7%) and Huawei (3%).

Respondents’ two most used downloaded applications were WhatsApp and Facebook, across all segments, and made up about 60% of responses. There was a tie for third place between Twitter and Instagram, BMI-T said.

Comparing previous research from two years ago showed that Cell C and Telkom Mobile had taken market share from Vodacom and MTN in the metros, it added. The average monthly spend on a cellphone for voice and data was R210/month.

Respondents with feature phones said the most important considerations when buying a phone were long battery life, camera functionality and Internet connectivity.

Features considered the most important on smartphones were the operating system, storage space and data connectivity.

BMI-T said South African smartphone penetration continued to grow rapidly, and was forecast to reach more than 83% of the population (over 16 years old) by 2019 after crossing the 50% mark in 2015.

The findings form part of BMI-T’s recently-released SA Consumer Digital Lifestyle Research Programme, which provides research into PC, tablet, smartphone and Internet usage and activities, along with the video-on-demand and fibre-to-the-home markets. — © 2015 NewsCentral Media