After all the controversy Facebook has generated in recent months, it seemed almost inevitable that at some point the social media giant would get what it had coming. A reckoning. Wednesday’s disappointing earnings report and Thursday’s historic 19% stock drop appeared to be a fitting conclusion to an easy narrative.

But the story isn’t that simple.

Yes, the privacy protections the company put in place after a series of scandals played a role in the dismal earnings. But the company’s bigger problem is that the main social network — the invention that made it a corporate behemoth — simply can’t grow much more. And the new dollars Facebook will mint in the next few years will have to come from businesses that are less certain, like ads in chat applications, virtual reality, television-like video content and social media updates that disappear.

Facebook’s winning strategy has centred on advertising in its news feed. People come to the social network, scroll through, and see the ads between their friends’ baby photos and news links. Whenever Facebook needed to make more money, it just dialled up the frequency of ads, or aggressively courted more and more people around the world to sign up for Facebook.

But there are now 2.23 billion people using Facebook. That’s two-thirds of the world’s Internet-connected population. That’s about the same size as Christianity. Who else can the company sign up?

It doesn’t help that some of the folks who do use Facebook are mad at the company for its various lapses on data privacy and content moderation. The social network’s user growth in the second quarter was its slowest ever, and flat in North America. It lost some users in Europe. Meanwhile, it stopped cramming more ads into the news feed. Too many ads, and people will be turned away. The only place Facebook can replicate its tried-and-true business model is its photo-sharing application Instagram, which also has a kind of news feed. The rest is still an experiment.

Another one of the fastest-growing Internet companies, Netflix, has given investors a scare that the ride is coming to an end. The owner of the world’s largest paid online TV network reported slower subscriber growth in the second quarter, and the company’s stock has fallen nearly 10% since last week.

As with Facebook, investors will need to decide if this is a short-term blip, or a sign of a long-term problem. Netflix is coming off its best year of subscriber additions yet, but growth at home has slowed.

Waiting for the right time

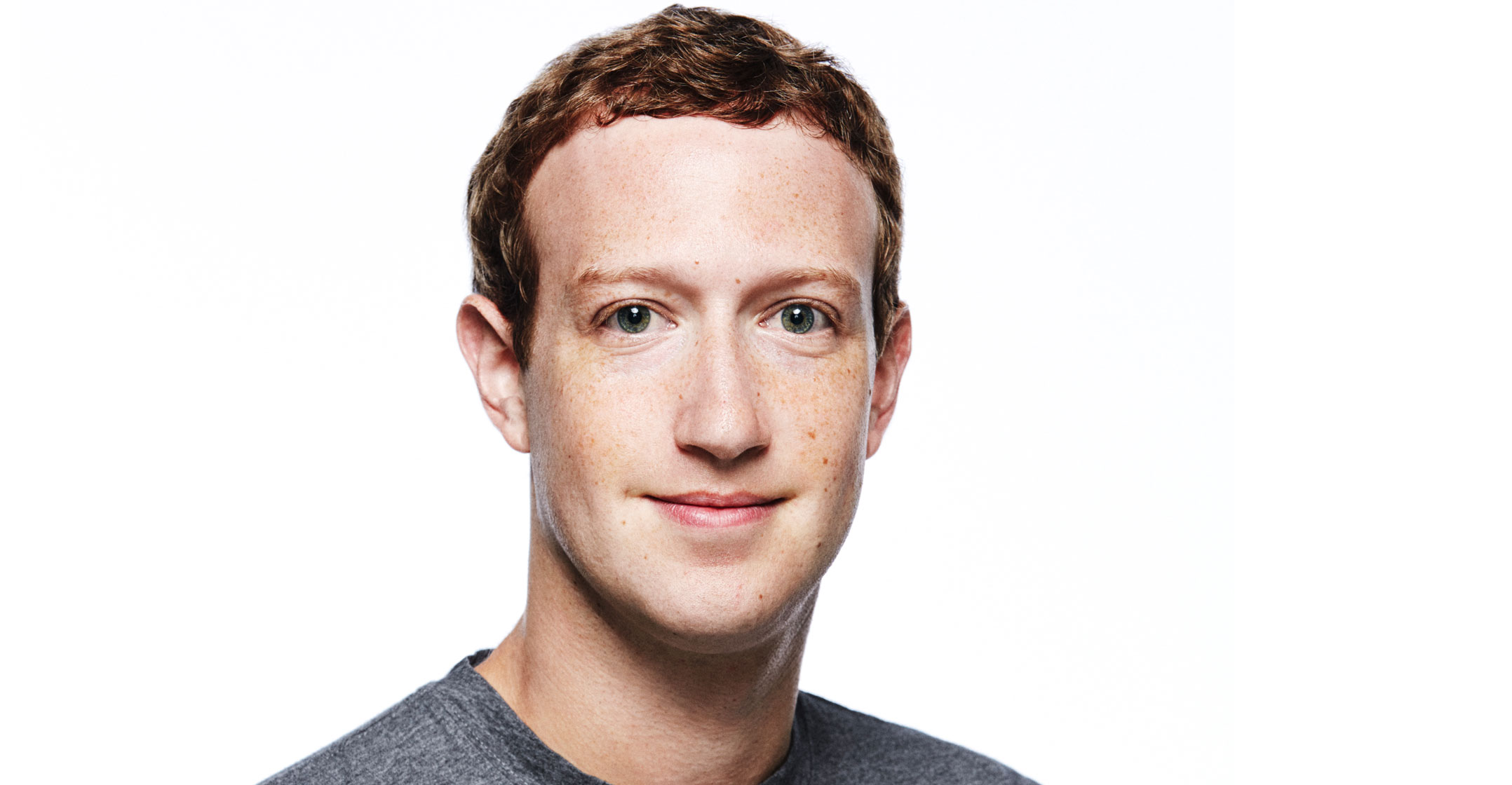

The transition to new lines of revenue didn’t have to be this dramatic for Facebook. The company acquired WhatsApp for $22-billion in 2014, and spun off its own chat app, Messenger, the same year. For years it told Wall Street it was just waiting for the right time to make money off of these properties. CEO Mark Zuckerberg said the company could afford to be patient until those apps reached a billion users. Now they are well beyond that level, but Zuckerberg says the company is still experimenting with potential business models.

All that puts Facebook under pressure, because all these new initiatives “frankly aren’t big enough over the short and medium term to alter the decelerating growth”, Eric Sheridan, an analyst at UBS, wrote in an investor note. Investors have to decide how long Facebook should be given the benefit of the doubt.

The road to new business models involves another thing investors hate: narrower margins. A lot of the ways Facebook will make money in the future are more expensive, curbing profitability. Making virtual reality headsets involves manufacturing hardware and, in some cases, selling it at a loss in order to entice customers to a new product. Making a new kind of Internet television has already cost Facebook hundreds of millions of dollars in content deals. And in the long term, Facebook plans to split the resulting advertising revenue with the content creators.

There’s also the cost of cleaning up Facebook’s problems. The company is hiring thousands of people to work on investigating issues with fake news and foreign interference in national elections. And it’s investing in expensive engineers to build an artificial intelligence that can streamline that work in the future.

“In light of increased investment in security, we could choose to decrease our investment in new product areas,’’ Zuckerberg said on Wednesday’s call with investors. “But we’re not going to, because that wouldn’t be the right way to serve our community and because we run this company for the long term, not for the next quarter.’’

Operating margins will trend in the 30% range, Facebook said, compared to the more than 40% investors had become used to.

Facebook also said the company’s revenue was going to be impacted in part because it’s giving users more control over their privacy settings. Its advertising engine depends on user data to accurately target people with what they might be interested in. The company is rolling out stronger controls to users in light of Europe’s General Data Protection Regulation, which went into effect during the quarter.

But that’s not the biggest factor. Zuckerberg said that the vast majority of users actually didn’t take Facebook up on its offer to use less of their data.

Facebook is known for its obsession with growing at all costs. But maybe it’s been too good at what it set out to do. Now that it’s reached a saturation point in the world, it’s having trouble grappling with the responsibility that comes with such a size, and also with the prospects for its future. That’s opened up the company to more risks than Wall Street was bargaining for, said Brian Wieser, an analyst at Pivotal Research, in a note to investors.

“The company has not managed its growth as well as most of us thought,’’ Wieser wrote. — Reported by Sarah Frier, (c) 2018 Bloomberg LP