Samsung Electronics’ earnings report and outlook reflect doom and gloom. Many are surprised. Positive signs from chip rival TSMC and smartphone stalwart Apple had fed the belief that the South Korean giant would put the worst behind it.

Samsung Electronics’ earnings report and outlook reflect doom and gloom. Many are surprised. Positive signs from chip rival TSMC and smartphone stalwart Apple had fed the belief that the South Korean giant would put the worst behind it.

The key takeaway here is that a rising tide doesn’t lift all boats.

On the surface, as the one of the world’s biggest technology companies, it might be reasonable to suggest that Samsung ought to benefit from the turnaround enjoyed by major rivals.

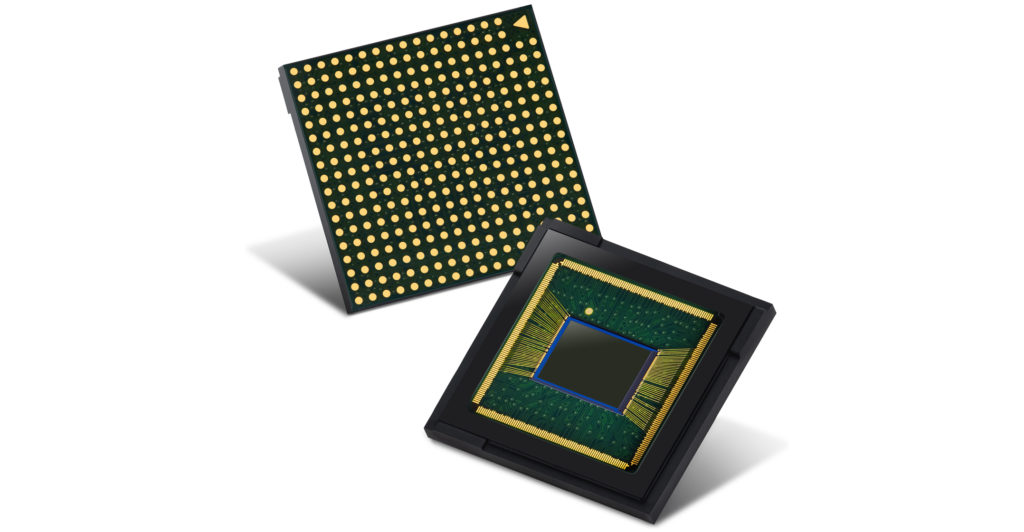

In reality, a major reason why Samsung is suffering while others rebound is that the company’s big strengths — memory chips and displays — are precisely the weakest parts of the tech sector right now.

Its semiconductor unit posted a 56% drop in operating income for the period and its display business fell 77%. Between them, these component divisions usually contribute half to two-thirds of its profit. TSMC, Intel and even AMD don’t dabble in such commodity products. When things are good in memory and displays, Samsung soars because it’s the world’s largest supplier of both. But when times are bad, like now, it suffers the most.

That pain will continue in both divisions this quarter, with executives noting in a conference call that continued weakness in demand will hurt both revenue and profits.

Will surely improve

Bulls will find positive signs if they want. The memory chip market will surely improve as the year progresses, but heck, it couldn’t get much worse. And the whole world — from TSMC to Intel to Xiaomi — is betting that a 5G roll-out will juice sales across the board.

Just because TSMC, Apple and Intel reported solid results and gave optimistic outlooks doesn’t mean that every company in the sector is set to benefit from a turnaround in hardware. AMD, Intel’s chief competitor in computer chips, provided guidance just a day earlier that could be characterised as a bit light. Its shares fell 6%, their largest decline since August.

Samsung’s 1.5% miss on net income was a break from the previous two quarters, when it surpassed analyst estimates. We already knew sales and operating figures from preliminary results provided earlier this month that hinted that things had reached a bottom and pointed to positive signs ahead. Operating income fell 34%, but was better than estimates, which makes this weak net profit figure confounding.

Samsung’s 1.5% miss on net income was a break from the previous two quarters, when it surpassed analyst estimates. We already knew sales and operating figures from preliminary results provided earlier this month that hinted that things had reached a bottom and pointed to positive signs ahead. Operating income fell 34%, but was better than estimates, which makes this weak net profit figure confounding.

The only division that didn’t share the pain is smartphones, a sandbox that Apple also plays in. Operating profit from that division climbed 67% from a year prior. But Samsung noted that the figure will remain only “steady” this quarter since an expected revenue boost from new models, including a foldable handset, will be offset by higher marketing costs.

In the end, it may be best to look at reality. Samsung has chosen a strategy that allows it to dominate a select part of the tech industry. Unfortunately, that means feeling the most pain when such a bet doesn’t pay off. — Reported by Tim Culpan, (c) 2020 Bloomberg LP