The US government is weighing new limits on sales of chips and other vital components to China’s Huawei Technologies, sparking another furious round of lobbying by technology companies.

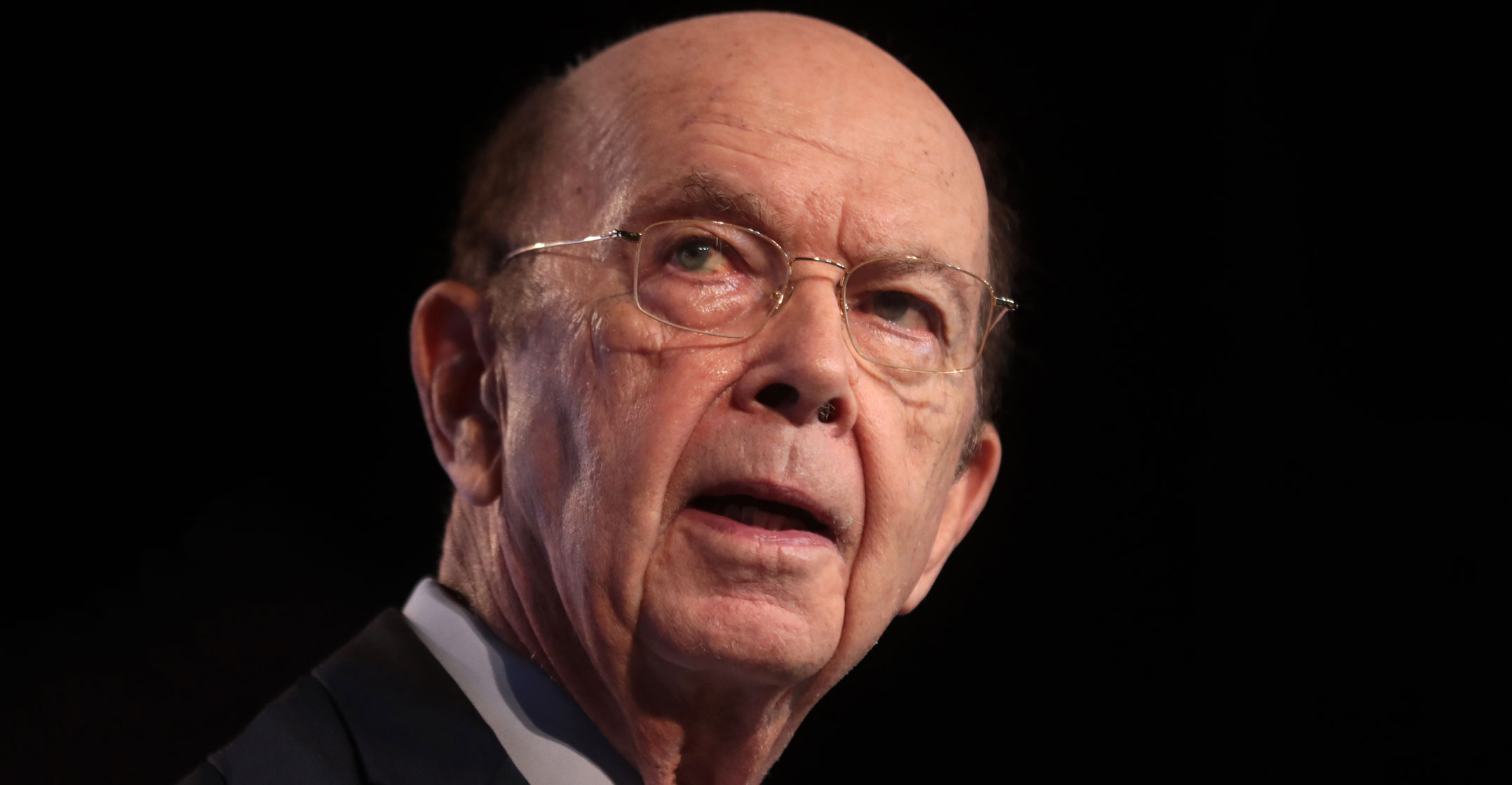

Industry associations representing US chip makers, software companies and manufacturers have written to secretary of commerce Wilbur Ross in recent weeks arguing against the changes. They urge President Donald Trump’s administration to at least hear them out before introducing tougher rules to close what US officials consider loopholes letting American companies keep working with Huawei.

In May, the US announced an export ban against Huawei, saying it’s a national security threat. The Chinese company’s placement on the so-called Entity List means it is cut off from US components, and American companies are required to get licences to resume business with the firm. Huawei has denied it helps the Chinese government gain illicit access to information and that its equipment is insecure.

Some US companies have continued selling to Huawei even after the blacklisting, citing rules that limit the government’s ability to restrict exports. De minimis provisions exempt certain products if companies can prove the majority of work done to create the items happens outside the US. The current threshold effectively kicks in when 75% of the work occurs overseas. The administration is considering raising that to 90%, and broadening the list of products, people familiar with the discussions said. The change could come as soon as January, added the people, who asked not to be identified discussing policy deliberations.

“Secretary Ross met with SIA and heard their views, as officials from the department regularly engage with private industry,” a commerce department spokesman. “Moreover, the department is constantly reviewing policies, along with its inter-agency partners, to better address national security, but the department cannot speak to specific proposals that may or may not be under consideration.”

Threshold

Many US tech companies have operations outside the US that help them argue their products are exempt. Chip makers run design bureaus around the world to support 24-hour development cycles and many have outsourced manufacturing to Asian contractors. But if the de minimis threshold rises to 90%, the industry will struggle to keep slipping through this loophole.

“We respectfully request the administration refrain from pursuing these regulatory changes and consider carefully the potentially significant harms they would cause,” John Neuffer, president of the Semiconductor Industry Association, wrote in a 5 December letter to Ross.

The US government may publish the changes as final rules, not as a proposal that allows input from the industry and other stakeholders, added Neuffer, while imploring the administration not to pursue that approach.

The tech companies argue that a tougher Huawei ban only harms the US as many of the components they supply to Huawei can be obtained elsewhere, so US companies would lose sales to overseas rivals.

The tech companies argue that a tougher Huawei ban only harms the US as many of the components they supply to Huawei can be obtained elsewhere, so US companies would lose sales to overseas rivals.

“Over the long term, companies in the US would be forced to reduce investment in the research needed to maintain US technology leadership, ultimately degrading the innovation that contributes to our economic leadership and national security,” Neuffer wrote.

US tech companies have already struggled to comply with the original Huawei ban, while keeping access to the Chinese market, the largest in the world. The government in Beijing has threatened to retaliate against companies that stop supporting Huawei, a national champion and a top maker of telecommunications gear and smartphones.

In November, the commerce department said it started approving some applications for licences to do business with Huawei, while rejecting others. It characterised the approvals as “narrow”. Microsoft got a licence. It’s unclear which other companies got approved and how the decisions were made. — Reported by Jenny Leonard and Ian King, (c) 2019 Bloomberg LP