The Competition Commission has recommended the approval of Groupe Canal+’s proposed acquisition of MultiChoice Group, marking a significant development in the African media landscape. While this decision aligns with expectations, it’s important to note that final approval still rests with the Competition Tribunal.

When fully accounted for – including the value of shares Canal+ already holds – the deal implies a total MultiChoice valuation of R55-billion, even though the actual purchase price for the shares Canal+ does not yet own is around R35-billion. This makes it the largest ever media deal in Africa’s history. However, for stakeholders concerned with media diversity, sustainability, and fair competition, the implications are more complex.

Competition concerns and striking omissions

The Competition Commission concluded that the transaction is “unlikely to substantially lessen or prevent competition in any market”. Consequently, it imposed no conditions on unbundling MultiChoice’s premium exclusive sports or content rights. This absence of stipulations on the concentration of these rights and fair sublicensing criteria is striking, especially considering MultiChoice’s dominant position in subscription television and live sports broadcasting in South Africa. Two prior complaints alleging anticompetitive conduct had been lodged against MultiChoice – one from e.tv, which was quietly settled, and another from the SABC, which appears to have disappeared without public explanation.

This piece was originally published on Michael Markovitz’s Substack, Media Explorations – read the original article here

Because Paris-headquartered Canal+ is foreign owned and controlled, the transaction triggers South Africa’s 20% foreign ownership cap1. To comply, MultiChoice will restructure its domestic operations through a layered ownership arrangement by creating a new entity, LicenceCo, which will hold the South African broadcasting licence and be majority-owned by historically disadvantaged persons (HDPs) and workers. While foreign voting control over the licence must remain under the 20% legal threshold, the cap does not apply to economic interest – meaning Canal+ can hold 49% of the financial stake in the broader MultiChoice Group without breaching foreign control limits over the licensed entity2.

Public interest commitments: promising, but lacking transparency

Additionally, the merged entity has committed to a public interest package that includes R26-billion over three years for local content production, supplier development and skills training – alongside commitments on employment protections, increased HDP and worker ownership, export promotion, local news diversity, and continued South African incorporation. The commission explicitly framed these undertakings, based on past MultiChoice spend, as sufficient to address stakeholder concerns under South African law. The final decision now rests with the tribunal.

While the package sounds substantial, a significant share likely overlaps with MultiChoice’s existing expenditure patterns – and the exact uplift or incremental increase is unclear due to limited financial disclosure.

Canal+ CEO Maxime Saada expressed optimism about the merger, stating: “This is a major step forward in our ambition to create a global media and entertainment company with Africa at its heart.” He added: “We are committed to investing in local content and supporting South Africa’s creative and sports ecosystems.”

MultiChoice Group CEO Calvo Mawela echoed this sentiment. “The recommendation from the Competition Commission is a key step forward towards the completion of the transaction and a recognition of the strong package of public interest commitments provided by the parties.”

Despite these assurances, concerns remain about the sustainability of South Africa’s three 24-hour television news channels – SABC News, eNCA and Newzroom Afrika. These channels rely heavily on carriage fees from MultiChoice, and advertising revenue alone does not suffice to sustain their operations. While the commission indicated that Canal+ has committed to procuring local news content and ensuring diversity, specifics regarding funding amounts, duration and conditions remain unclear.

Despite these assurances, concerns remain about the sustainability of South Africa’s three 24-hour television news channels – SABC News, eNCA and Newzroom Afrika. These channels rely heavily on carriage fees from MultiChoice, and advertising revenue alone does not suffice to sustain their operations. While the commission indicated that Canal+ has committed to procuring local news content and ensuring diversity, specifics regarding funding amounts, duration and conditions remain unclear.

Who holds strategic control?

Some may argue that MultiChoice isn’t really under foreign control, given that voting control over their broadcasting entity is retained by South African shareholders through LicenceCo. While this ownership structure appears to satisfy regulatory requirements, it does not necessarily equate to strategic control. Canal+ holds 49% of the economic interest, which encompasses capital, influence and cross-border decision-making power. Editorial outcomes are influenced not solely by voting shares but also by budgets, commissioning decisions, platform prioritisation and pricing models. These levers are increasingly shifting from Randburg to Paris.

Therefore, while control of the broadcasting licence may remain South African on paper, the deeper influence over content funding, prioritisation and editorial direction is shifting. This transition could have future implications for the sustainability of South African television news.

Media plurality and fair competition

The commission’s decision stands in contrast to its recent assertive stance in the Competition Commission’s provisional Media and Digital Platforms Market Inquiry report, where it addressed concerns about Big Tech’s dominance and its impact on the news ecosystem. In this case, despite MultiChoice’s substantial market power and Canal+’s position as its only major competitor in African pay TV, the commission has approved the merger without robust competitive safeguards.

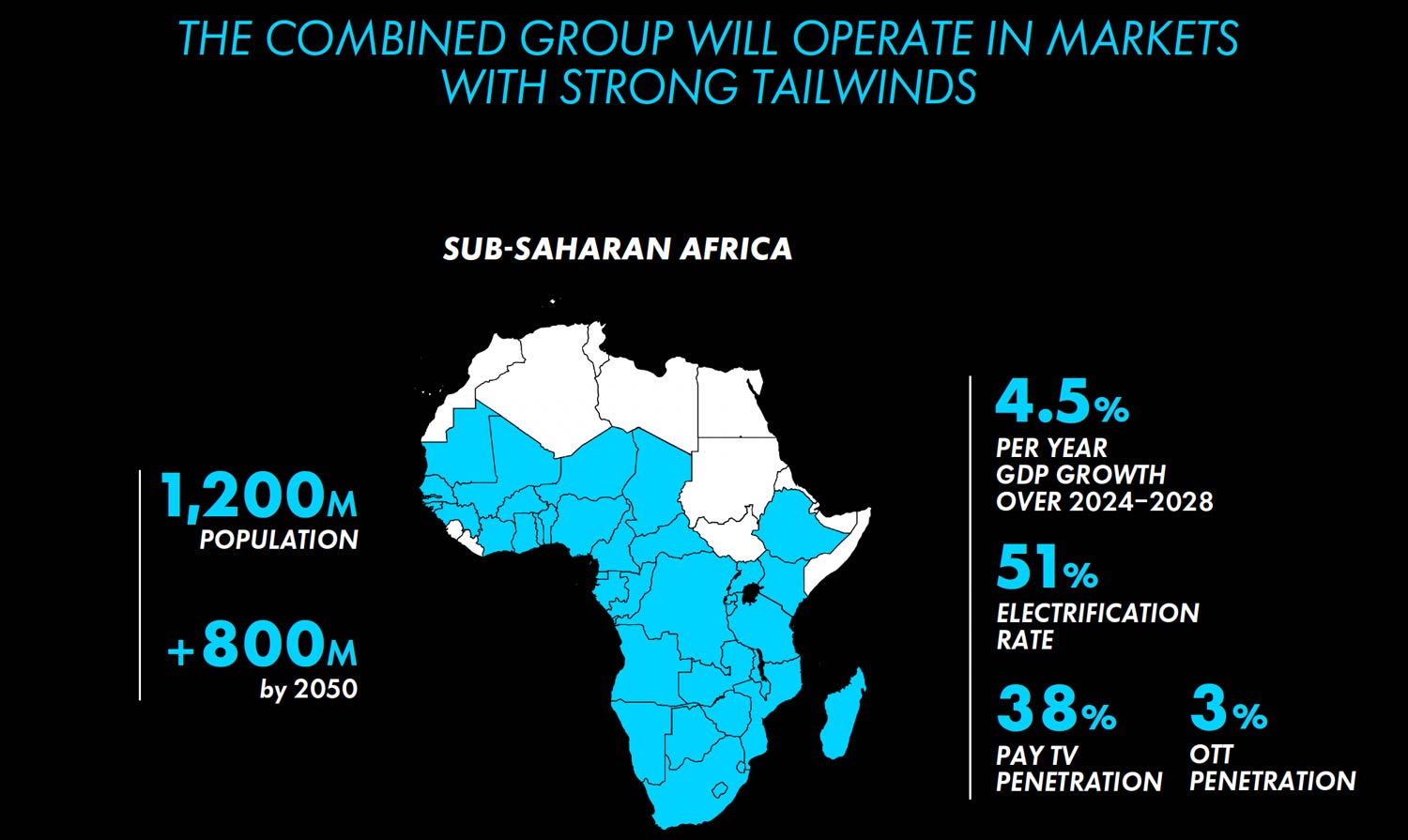

MultiChoice’s acquisition by Canal+ is more than just a business deal; it marks a major structural shift in Africa’s media landscape. This shift calls for vigilance from regulators, policymakers and civil society to safeguard media plurality and address the concentration of sports rights and premium content under globalised ownership.

Footnotes

¹As a South African regulator begins to review regulations that could eventually enable Elon Musk to secure a Starlink licence in South Africa, we now have two outspoken and interventionist right-wing billionaires — Vincent Bolloré and Elon Musk — who stand ready to extend their reach into the country’s audiovisual and telecommunications markets.

²These chronically outdated ownership and control provisions are easy to work around and have not progressed to take into account these structuring arrangements. As written before, our broadcasting legislation needs a fundamental overhaul.

- The author, Michael Markovitz, is director of the Gibs Media Leadership Think Tank

- Read more contributions from Michael Markovitz on TechCentral