Microsoft won a court’s okay to move forward with its US$69-billion deal to buy Activision Blizzard, defeating an effort by the US Federal Trade Commission to block the largest-ever gaming deal.

Microsoft won a court’s okay to move forward with its US$69-billion deal to buy Activision Blizzard, defeating an effort by the US Federal Trade Commission to block the largest-ever gaming deal.

The decision by judge Jacqueline Scott Corley in San Francisco means Microsoft could close its merger with Activision ahead of an 18 July deadline everywhere except for the UK, which vetoed the deal in May.

Microsoft has said it struck the deal to acquire Activision in order to add mobile games — an area where it has virtually no presence. Activision owns King, the maker of Candy Crush. The combination will vault Microsoft to the number-3 slot among global videogame companies behind China’s Tencent Holdings, the publisher of League of Legends, and game console rival Sony, Microsoft had said.

Activision rose as much as 6% on the news, and was trading up 4.4% to $86.31 at 11.08am in New York. Microsoft fell less than 1% to $330.06.

“We’re grateful to the court in San Francisco for this quick and thorough decision and hope other jurisdictions will continue working towards a timely resolution,” Microsoft president Brad Smith said. “As we’ve demonstrated consistently throughout this process, we are committed to working creatively and collaboratively to address regulatory concerns.”

Activision said the deal will benefit consumers and workers.

‘Next step’

The merger “will enable competition rather than allow entrenched market leaders to continue to dominate our rapidly growing industry”, Activision CEO Bobby Kotick said.

“We are disappointed in this outcome given the clear threat this merger poses to open competition in cloud gaming, subscription services and consoles. In the coming days, we’ll be announcing our next step to continue our fight to preserve competition and protect consumers,” FTC spokesman Douglas Farrar said in an e-mail.

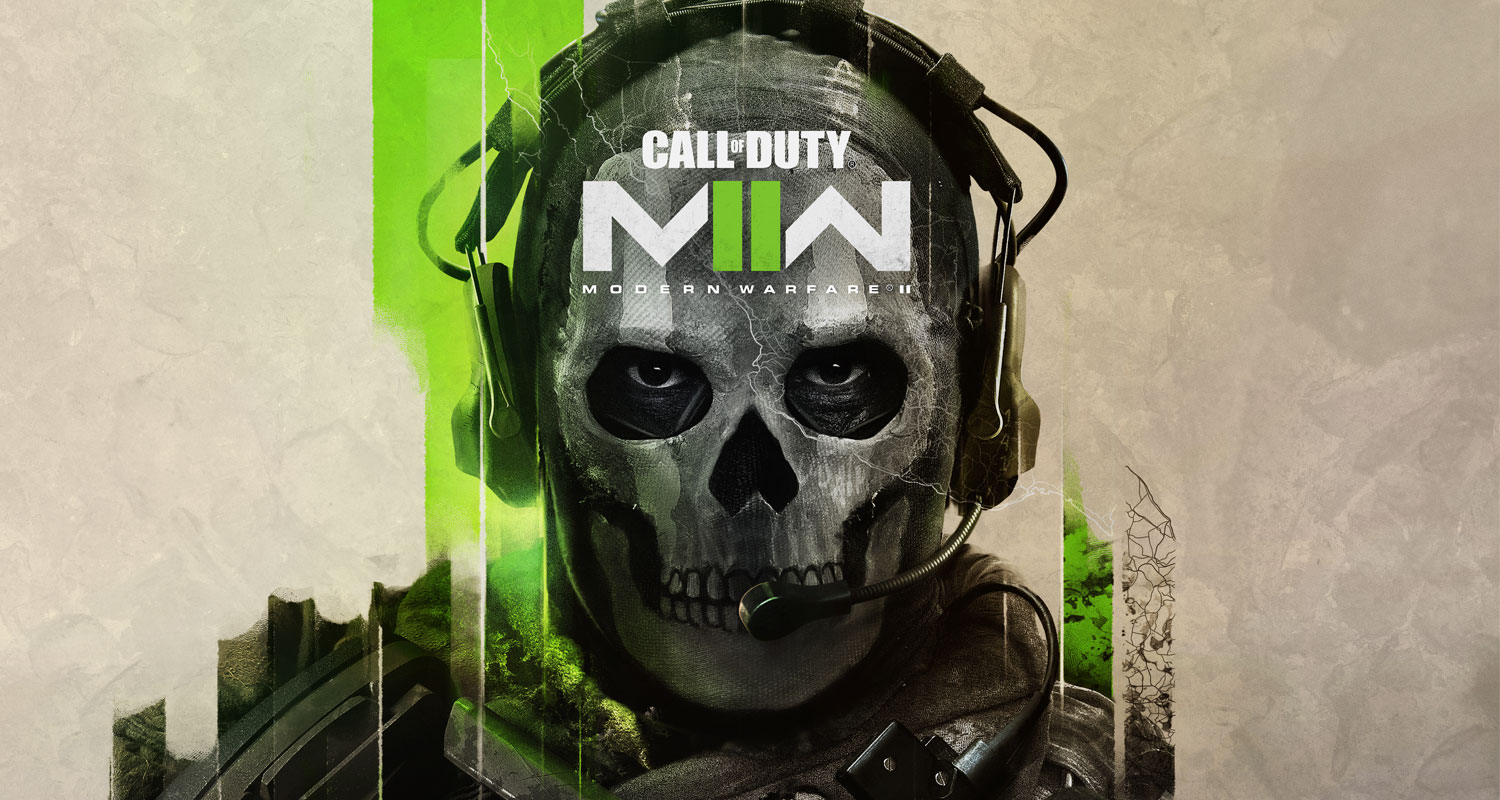

In a decision, Scott Corley denied the FTC’s preliminary injunction, which sought to block the deal on the grounds it would harm gamers. At a June hearing, the FTC argued Microsoft’s acquisition of Activision would harm competition since the combined company would have an incentive to withhold key titles, like top-selling shooter Call of Duty, from rival consoles and subscription services.

The lawsuit was part of an effort by FTC chair Lina Khan to more aggressively police mergers, particularly those by the biggest tech platforms. Since US President Joe Biden appointed her to helm the agency in June 2021, the FTC has killed mergers between Lockheed Martin and Aerojet Rocketdyne Holdings as well as Nvidia’s bid to buy SoftBank Group’s ARM.

Microsoft’s paltry mobile gaming presence will see a boost after the tech giant rolls in Activision Blizzard’s Candy Crush and Call of Duty Mobile. Mobile gaming is the fastest-growing segment of the gaming industry and is valued at $92-billion — half of the global gaming market, according to analytics firm NewZoo.

However, critics have concerns that Microsoft will use its new leverage to disadvantage competitors like Sony by decreasing access to its blockbuster titles or publishing more games exclusively to Xbox and PC. — Malathi Nayak and Leah Nylen, with Dina Bass and Cecilia D’Anastasio, (c) 2023 Bloomberg LP