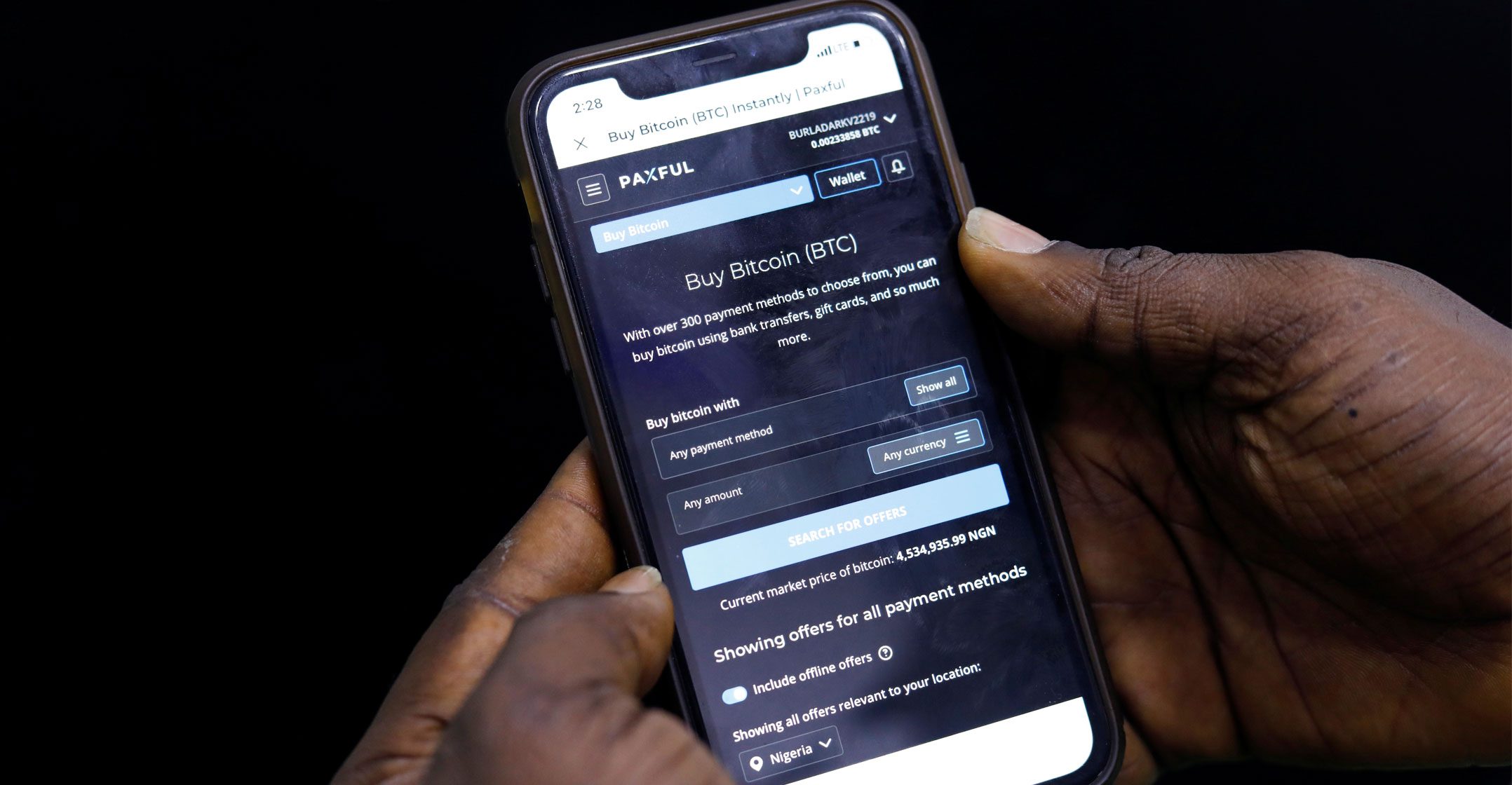

Four months ago, Abolaji Odunjo made a fundamental change to his business selling mobile phones in a bustling street market in Lagos: He started paying his suppliers in bitcoin.

Odunjo sources handsets and accessories from China and the United Arab Emirates. His Chinese suppliers asked to be paid in the cryptocurrency, he said, for speed and convenience.

The shift has boosted his profits, as he no longer has to buy dollars using the Nigerian naira or shell out fees to money-transfer firms. It is also one example of how, in Africa, bitcoin — the original and biggest cryptocurrency — is finding the practical use that it has largely failed to elsewhere.

“Bitcoin helped to protect my business against the currency devaluation, and enabled me to grow at the same time,” Odunjo said from his two-by-eight metre shop.

“You don’t have to pay charges, you don’t have to buy dollars,” the 30-year-old said, raising his voice above the sound of loud haggling and the honking horns of scooters.

Odunjo is one of many people at the heart of a quiet bitcoin boom in Africa, driven by payments from small businesses as well as remittances sent home from migrant workers, according to data shared exclusively with Reuters and interviews with around 20 bitcoin users and five cryptocurrency exchanges.

Leap in transfers

Monthly cryptocurrency transfers to and from Africa of under US$10 000 — typically made by individuals and small businesses — jumped more than 55% in a year to reach $316-million in June, the data from US blockchain research firm Chainalysis shows.

The number of monthly transfers also rose by almost half, surpassing 600 700, according to Chainalysis, which says the research is the most comprehensive effort yet to map out global crypto use. Much of the activity took place in Nigeria, the continent’s biggest economy, along with South Africa and Kenya.

This represents a reversal for bitcoin which, despite its birth as a payments tool over a decade ago, has mainly been used for speculation by financial traders rather than for commerce.

Why a boom in Africa? Young, tech-savvy populations that have adapted quickly to bitcoin; weaker local currencies that make it harder to get dollars, the de facto currency of global trade; and complex bureaucracy that complicates money transfers.

The bitcoin users interviewed, based in five countries from Nigeria to Botswana, said the cryptocurrency was helping people make their businesses nimbler and more profitable, and helping those working in places like Europe and North America hang on to more of the earnings they send home.

Yet risks abound.

Bitcoin and other cryptocurrencies are unregulated in many countries and their legal status is unclear, meaning there is no safety net and little recourse if you lose funds.

For many, converting local currencies to and from bitcoin relies on informal brokers. Prices are volatile, and buying and selling is a complex process that demands technical knowledge.

In 2018, the Nigerian central bank warned cryptocurrencies were not legal tender, and investors were unprotected.

A steady stream of customers comes and goes from Odunjo’s shop, one of a dozen units along a dark corridor in an indoor section of the market known as Computer Village.

Odunjo makes two or three transfers a month of around 0.5-0.7 bitcoin ($5 900-$8 300) each, to suppliers in Shanghai and Zhangzhou. East Asia, Chainalysis found, is one of the top partners for bitcoin trading with Africa.

Wider trends

Odunjo’s trades offer a microcosm of the wider trends at play in both Nigeria and across the continent.

In Nigeria, small cryptocurrency transfers totalled nearly $56-million in June, nearly 50% more than a year before. The number of transactions jumped over 55% to 120 000.

Gauging how cryptocurrencies are used in particular locations is tough, though. Digital coins offer a high degree of anonymity, and though the value of transactions can be tracked on the blockchain, the identity or whereabouts of a user cannot.

Chainalysis, which tracks crypto flows for financial firms and US law enforcement, gathered the data by analysing Web traffic and trading patterns, though locations can be obscured by virtual private networks. It separated transfers of under $10 000 from larger sums common among professional traders.

With Nigeria’s oil-dependent economy rocked by low crude prices and Covid-19, the central bank has twice devalued the naira this year. As a result, Odunjo and other importers must pay more to buy increasingly scarce dollars.

With Nigeria’s oil-dependent economy rocked by low crude prices and Covid-19, the central bank has twice devalued the naira this year. As a result, Odunjo and other importers must pay more to buy increasingly scarce dollars.

The naira’s fall has pushed many Nigerians towards bitcoin, the interviews showed, as they seek methods of purchasing goods from overseas without having to buy dollars.

Sylvester Kalu, who runs a clothing starch maker in Uyo, eastern Nigeria, uses bitcoin to buy supplies from Istanbul and Shenzhen.

“Everything is oil. When the price of oil dropped, forex became scare,” he said. “That became a very big problem.”

The 30-year-old said his transactions totalled around two bitcoin ($20 000) a time, adding: “I don’t need anyone in the banks, I don’t need a person to use the back door to get dollars.”

Timi Ajiboye, who runs Lagos exchange BuyCoins, said its monthly cryptocurrency volumes jumped over three-fold to $21-million in June after the naira was devalued in March. Exchanges across Africa spoke of a similar boom.

Yellow Card, which operates in five countries, said its monthly crypto volumes had jumped five-fold in 2020 to $25-million in August. A big driver was workers using bitcoin for remittances, it added.

Quicker and cheaper

Luno said the combined monthly bitcoin trading volumes of all market participants in South Africa and Nigeria had jumped by half this year to more than $536-million in August.

For some people working abroad, in other continents or other African countries, sending money home via bitcoin can be quicker and cheaper.

A Nigerian worker in London sending £100 in cash to Lagos via a big traditional money-transfer firm, for example, would pay fees of around 5%. Costs are lower when sending larger amounts or using a debit card, but the exchange rates on offer are typically several percentage points less favourable than the market rate.

Bitcoin fees vary depending on the exchange or broker, but would typically total about 2%-2.5% for sending £100. However, both exchanges and over-the-counter (OTC) brokers carry risks, from hacks to scams.

And bitcoin, while handy for transfers, isn’t much use on the ground — shops and landlords rarely accept it, for instance. This means friends or family sent funds by workers must convert it back to traditional currency, often via a broker at their end, introducing additional risk.

And bitcoin, while handy for transfers, isn’t much use on the ground — shops and landlords rarely accept it, for instance. This means friends or family sent funds by workers must convert it back to traditional currency, often via a broker at their end, introducing additional risk.

Yet the bitcoin users interviewed said many OTC brokers, who rely on word-of-mouth reviews, functioned reliably in an increasingly competitive market and were loath to imperil the reputations they needed to stay in business.

And for a growing number of people, the potential rewards outweigh the pitfalls.

“People are very adoptive of any technology that will make their life easier,” said Frankline Kihiu, a crypto broker in Kenya’s capital, Nairobi. “In most African countries, there are lots of government restrictions that bitcoin takes away.” — Reported by Alexis Akwagyiram and Tom Wilson, with additional reporting by Nneka Chile, (c) 2020 Reuters