AMD is in advanced discussions to buy Xilinx in a takeover that could be valued at US$30-billion, according to people familiar with the matter.

The deal could come together as early as next week, though things remain in flux, the people said, asking not to be identified discussing a private deal. The Wall Street Journal first reported on the negotiations.

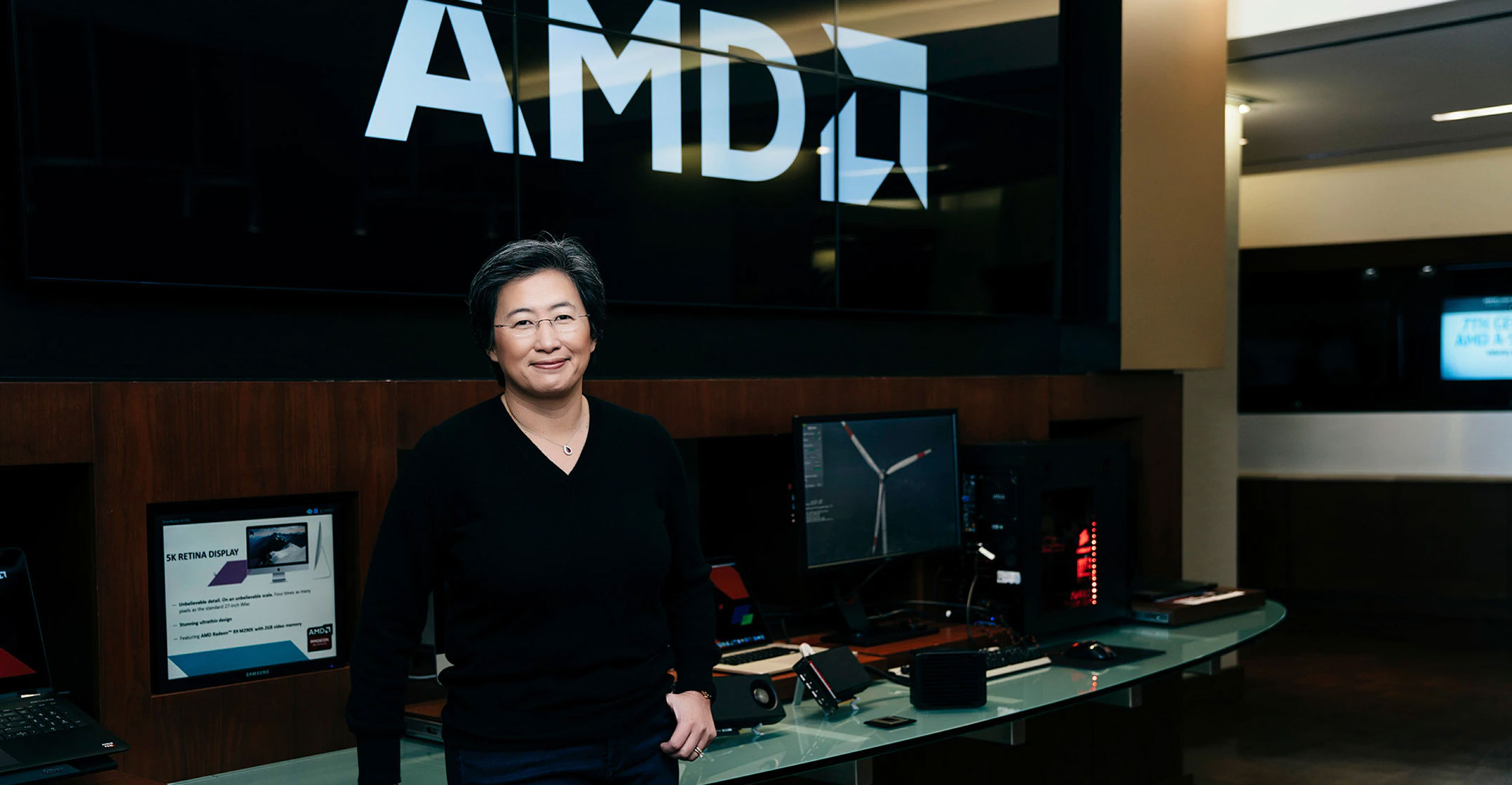

A combination with Xilinx would give AMD CEO Lisa Su more of the pieces needed to break Intel’s stranglehold on the profitable market for data-centre computer components. It would follow moves by rival Nvidia, which bought Mellanox Technologies and aims to use its pending acquisition of ARM to grab more of that business.

Acquiring Xilinx, which makes programmable chips for wireless networks, would also help AMD expand into a new market just as telecommunications carriers spend billions to build 5G networks.

Xilinx, based in San Jose, California, makes field programmable gate arrays, or FPGAs. That kind of chip is unique because its function can be altered by software, even after it’s been installed in a piece of machinery. Xilinx’s chips have historically been used in telecoms equipment, but under CEO Victor Peng the company is expanding into products targeted at data centres — where FPGAs can be used to accelerate workloads such as artificial intelligence. The other major supplier of advanced FPGAs is Intel, which acquired its market position through the purchase of Altera in 2015.

Representatives for AMD and Xilinx declined to comment.

Surged back

Xilinx shares closed at $105.99 in New York on Thursday. That gives it a market capitalisation of $25.9-billion, about a quarter of AMD’s value. Shares of Santa Clara, California-based AMD closed at $86.51. The stock has almost doubled this year.

Under Su, who took the helm in 2014, AMD has surged back from the brink of failure. It’s made gains against longtime rival Intel in desktop computer processors and laptops. The company is also working to reverse its fortunes in the server business, where chips can cost as much as a small car. For years, Intel had relegated AMD to less than 1% of that market.

AMD’s interest in Xilinx reflects the increasing demands of cloud services providers such as Amazon.com and Google. Those companies are spending heavily on new data centres to meet the surge in demand for computing power delivered via the Internet. They’re also racing to enhance services, such as search, with artificial intelligence software, and many companies are experimenting with building their own hardware to do so. That’s putting greater pressure on chip providers to advance their offerings.

For AMD investors, how the company intends to finance the deal may prove crucial in persuading them to sign off. The chip maker has only recently shed concerns about its cash reserves and was haunted by debt incurred from a takeover of graphics chipmaker ATI Technologies in 2006. At the end of its most recent quarter, AMD had cash and equivalents of $1.8-billion, less than several other chip makers.

For AMD investors, how the company intends to finance the deal may prove crucial in persuading them to sign off. The chip maker has only recently shed concerns about its cash reserves and was haunted by debt incurred from a takeover of graphics chipmaker ATI Technologies in 2006. At the end of its most recent quarter, AMD had cash and equivalents of $1.8-billion, less than several other chip makers.

Nvidia is using stock to partially fund its purchase of ARM. Analog Devices’ acquisition of Maxim Integrated Products is an all-stock deal. That partly reflects a huge run-up in the value of chip companies in recent years, lead by AMD and Nvidia.

Xilinx shares have not rallied as much. The stock is up 8% this year compared to a gain of 27% in the Philadelphia Stock Exchange Semiconductor Index. AMD has surged nearly 90%, making it the second best performer behind Nvidia.

The approval of chip-industry transactions has been complicated by the ongoing trade war between China and the US. The Asian country is the biggest purchaser of chips and America is home to the biggest group of producers. — Reported by Ian King, (c) 2020 Bloomberg LP