The US has sharpened its assault on China’s technology industry with a flurry of export bans and stifling restrictions on companies, an escalation that leaves Beijing with few options to retaliate.

Washington’s moves are part of a longer-term strategy to prevent China from dominating the industries of the future and arming its military with advanced weaponry, while also securing its tech supply chain by enticing chip makers to set up shop in the US.

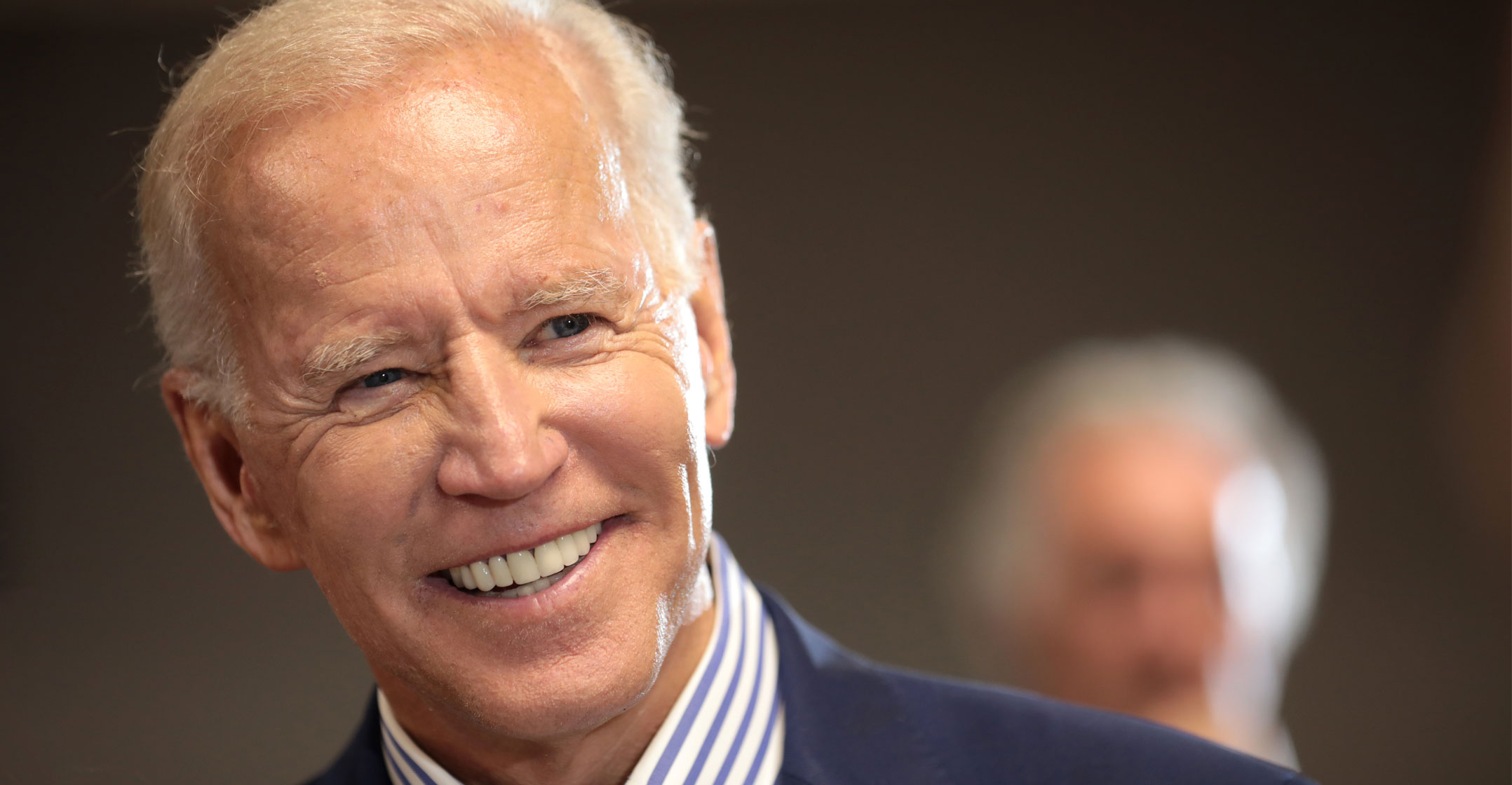

US President Joe Biden’s administration last week escalated those efforts to hobble its main geopolitical competitor, blacklisting dozens of Chinese tech firms, while signs emerged Japan and the Netherlands are aligning with US restrictions on selling crucial chip-making equipment to China, a major blow to Beijing’s ambitions to produce advanced semiconductors.

In response, China has accused the US of protectionism, lodged a complaint with the World Trade Organisation and courted chip-making powerhouse South Korea, a key US ally. Beijing is also reportedly preparing a multibillion-dollar aid package for its semiconductor industry, a crucial sector for the global economy given the widespread use of chips in everything from cars and mobile phones to guided missiles.

But China doesn’t have many options, or incentives, to go further.

Similar to Beijing’s actions during the trade war with former President Donald Trump’s administration — when it failed to follow through on threats to add US companies to a so-called unreliable entities list — any moves to block American investment threatens an economy already reeling from President Xi Jinping’s zero-tolerance Covid policies, which are only now being rolled back.

“China’s lack of good options is precisely why the US is striking hard and fast now with export controls,” said Reva Goujon, a director at the Rhodium Group who advises corporate clients on US-China relations and industrial policies.

Eased

The tech battle comes as US-China relations have eased since hitting a low point earlier this year following a visit to Taiwan by US house speaker Nancy Pelosi. After Biden and Xi met at the Group of 20 summit in Bali last month, the US watered down a legislative proposal that would’ve named Taiwan a “major non-Nato ally”, a sign that Washington is trying to avoid another showdown that risks derailing the relationship.

Beijing’s response to the recent US moves on semiconductors has been “very reserved”, according to Henry Wang Huiyao, founder of the Centre for China and Globalisation, a policy research group in Beijing. The Biden-Xi talks and an upcoming visit to China by US secretary of state Antony Blinken have laid the groundwork for more understanding and hopefully some relaxation of sanctions, Wang added.

The new actions unveiled this week — which follow export controls announced in October aimed at preventing China’s access to machines and knowhow to make high-end chips — placed a number of Chinese companies on a so-called entity list, requiring suppliers to get difficult-to-obtain US government licences.

Among the most notable firms on that list is emerging chip equipment maker Shanghai Micro Electronics Equipment Group, or SMEE, which could stifle Beijing’s efforts to create next-generation semiconductors. The machines that make semiconductors are among the most complicated devices produced by humans and defy reverse engineering, making it difficult for China to develop its own domestic capabilities if it can’t get the equipment elsewhere.

“Having SMEE on the entity list is a major blow for China’s chip sector,” said Martijn Rasser, a former analyst at the Central Intelligence Agency who’s now a senior fellow at the Centre for a New American Security think-tank.

“It’s the one company that Beijing saw as having potential to produce advanced chip-making machines, which is essential for China to be a competitive force in the global semiconductor ecosystem,” he said. “Those hopes are now greatly diminished, if not dashed altogether.”

Under the Biden restrictions, China is severely limited in its ability to buy those chip-making machines from abroad. The critical American gearmakers Applied Materials, Lam Research and KLA can no longer sell their advanced equipment to Chinese customers. But a complete blockade requires cooperation from Japan’s Tokyo Electron and Dutch lithography specialist ASML Holding.

Those US efforts gathered momentum this week with Japan and the Netherlands nearing an agreement to join Washington in tightening controls over the export of up-to-date chip-making machinery to China. The two governments are considering a ban on the sale of machinery capable of fabricating chips that are at least three generations behind the latest advances available on the market, in line with the rules Washington set out in October.

Also on the blacklist is China’s leading memory chip maker, Yangtze Memory Technologies, which was once close to a deal to supply Apple, and is a competitor to Samsung Electronics and Micron Technology for mobile phone and PC components.

Even if China wins the WTO case, the US can veto any ruling by bringing it to the trade organisation’s appellate body, which the Trump administration paralysed in 2019.

They can invest more, but the issues right now are not really a lack of resources. It’s these technological chokepoints they are still vulnerable to

China’s best option may be to pour money into developing its own hi-tech chips. Beijing is preparing to unleash a $143-billion aid package for its chip industry, according to Reuters. But it’s not clear how much impact this will have, given the mixed results from the tens of billions that China has already funnelled into the sector.

“They can invest more, but the issues right now are not really a lack of resources,” said Adam Segal, chair in emerging technologies and national security at the Council on Foreign Relations. “It’s these technological chokepoints they are still vulnerable to.”

There’s a risk that unilateral actions could eventually alienate key US partners, said Jon Bateman, a senior fellow at the Carnegie Endowment for International Peace. Also, Beijing hasn’t yet shown a willingness to leverage its dominance of rare earth minerals or its role as a manufacturing hub because it “has more to lose than to gain”, he said, but that could change.

“China has a lot of capability to retaliate but very limited willingness to do so thus far,” he said. “We may be surprised when that finally happens.” — Iain Marlow and Emily Birnbaum, with Ian King, Bryce Baschuk and Rebecca Choong Wilkins, (c) 2022 Bloomberg LP