The tension between Eskom and energy regulator Nersa escalated on Wednesday after the regulator published a discussion paper on Eskom’s revenue application.

The tension between Eskom and energy regulator Nersa escalated on Wednesday after the regulator published a discussion paper on Eskom’s revenue application.

In a statement issued barely two hours later, Eskom accused Nersa of “misrepresenting” its application “to include various matters that are still under consideration by both the courts and by Nersa itself”.

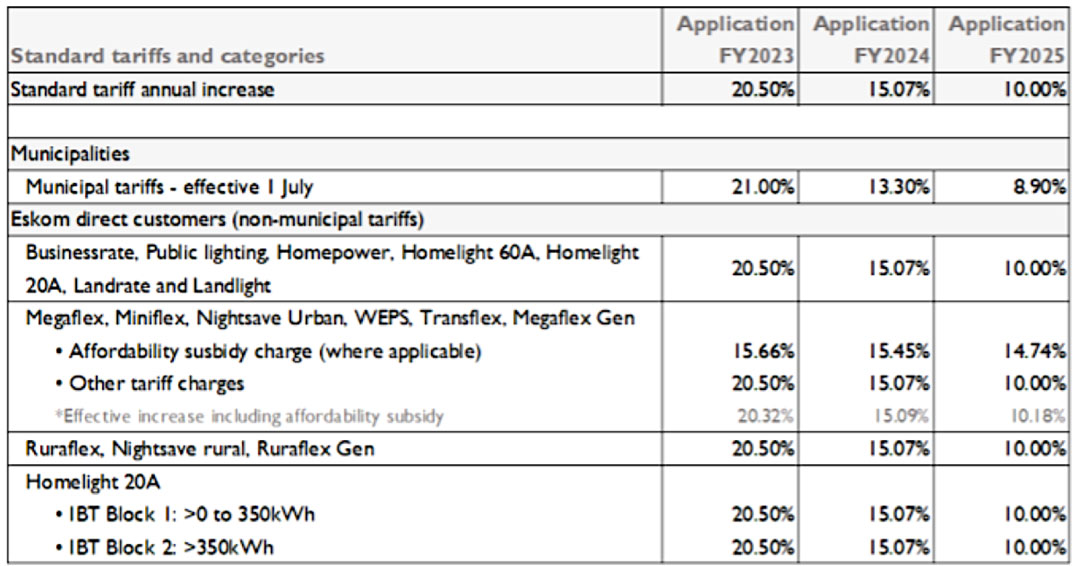

Eskom chief financial officer Calib Cassim has confirmed that Eskom has applied for an average tariff increase of 20.5% for the next financial year. The new tariffs will apply from 1 April next year for Eskom’s direct customers and from 1 July for municipalities.

This includes R14.4-billion in revenue in relation to under-recovery in previous years. Nersa has already finalised its decisions relating to the quantum and the timing of the recovery regarding these amounts.

According to Nersa’s discussion document, the total increase may amount to 54.35%, taking into account additional amounts Eskom applied for as clawbacks from previous years that Nersa has not yet determined as well R46=billion under consideration by the supreme court of appeal.

The high court earlier reviewed and set aside a decision by Nersa to deduct a total of R69-billion of government assistance to Eskom from Eskom’s allowable revenue.

In terms of a settlement Eskom has received some of this amount, but the larger part is still outstanding pending Nersa’s appeal against the high court ruling.

Toxic

No court date has been set yet and it is doubtful that the case will be decided before 25 February next year when Nersa has to determine Eskom’s new tariffs – but the regulator has included it in its calculation of the possible tariff increase.

Chris Yelland, managing editor of EE Business Intelligence, says Nersa is not acting in good faith. He says the relationship between Eskom and Nersa is toxic and that this is driven from Nersa’s side.

Yelland is concerned that the Nersa board just rubberstamps the recommendations from the electricity subcommittee without properly interrogating and understanding the impact.

Last week, Nersa burnt its fingers for the umpteenth time when the high court granted a semi-urgent application by Eskom to compel it to process this tariff application with regard to the next financial year according to the existing rules.

Since 1 January 2017, Eskom has taken each and every Nersa tariff determination on review.

The latest events follow Nersa on 30 September rejecting the Eskom application, which was submitted early in June.

The latest events follow Nersa on 30 September rejecting the Eskom application, which was submitted early in June.

The court rejected Nersa’s argument that the multi-year tariff methodology had lapsed and that Eskom mistakenly used it to prepare its application. Nersa had to concede that it left a vacuum by failing to fulfil its mandate and prepare a new methodology in time.

It takes Eskom about nine months to prepare the complex application and Nersa usually takes about six months to process it before the legislated deadline of 15 March to table the new tariffs in parliament.

The court subsequently ruled that the methodology does not lapse until it is replaced. It ordered Nersa to process the application for the next financial year according to the existing methodology. It also set a timeline, which compelled Nersa to publish the Eskom application on Wednesday for stakeholder comment.

The deadline for written stakeholder submissions is 14 January, and after that Nersa will hold virtual public hearings before taking a decision.

The deadline for written stakeholder submissions is 14 January, and after that Nersa will hold virtual public hearings before taking a decision

From the Nersa discussion document it looks as though the regulator may deviate from the methodology the court ordered it to use.

“The court order did not appropriate or prohibit the powers of the energy regulator from exercising discretion when considering the application which discretion may be on, deviating from portions of the methodology if the strict application with result in irrational and unreasonable outcome or exercising a balancing act if the outcome will render the decision unreasonable…,” reads the discussion document.

Such deviation will require additional consultation within the already very tight deadline.

While Nersa will only consider Eskom’s tariff application for the next financial year, the utility’s submission for the two years thereafter is included in the published document.

Eskom wants 15.07% more in 2023/2024 and a further 10% increase in 2024/2025.

The utility has given the following indication of what the average increase could mean for different groups of consumers. Municipal tariffs in this table refer to the bulk tariff municipalities pay to Eskom. Each municipality must use the ultimate Nersa determination to calculate its own set of electricity tariffs to be paid by end users from 1 July.

Nersa must also approve those tariffs before implementation.

- This article was originally published by Moneyweb and is republished by TechCentral with permission