The current state of the global semiconductor market has been alternatively labelled by car manufacturers, politicians and executives as a shortage, a crisis and even a squeeze. For the companies at the centre of it all, the only word to describe what we’re seeing is a chip boom. It’s inexplicable, then, that any company which ought to be bathing in profits could still be losing money.

Enter GlobalFoundries. The New York-based company is the world’s third-largest contract chip maker and has just filed for a Nasdaq listing. With shares of leader TSMC more than doubling since the darkest days of the Covid-19 pandemic, and nearest rival United Microelectronics rising almost five-fold, investors ought to be clamouring over GlobalFoundries’ US$1-billion offering.

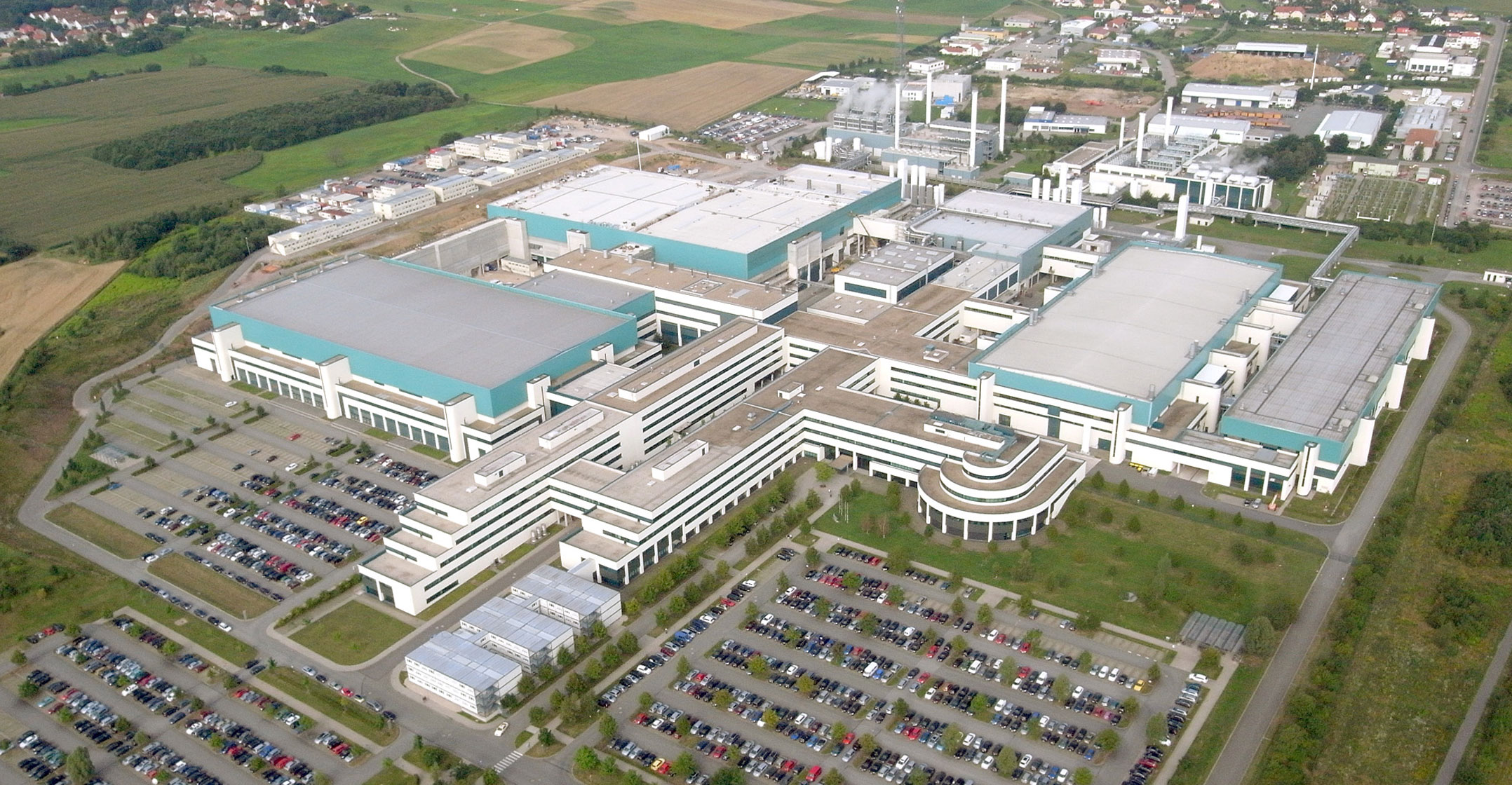

Like its rivals, GlobalFoundries manufactures chips based on the designs of clients, most of which don’t have their own factories. Rather than land the most advanced orders for components like smartphone processors and graphics chips, the company in 2018 reorientated its strategy towards chasing down older product types — which it euphemistically calls “feature rich” — that include parts that convert sound and images to digital signals.

Supplying older semiconductor products doesn’t attract the high prices commanded by TSMC, but they are much cheaper and easier to make. With modern cars lacking much-needed sensors, and even Apple noting the impact on iPad and iPhone sales, this ought to be a golden era for GlobalFoundries.

But even with manufacturing lead times blowing out to a record 21 weeks and prices being pushed upward — clear signs that demand outstrips supply — the company still can’t manage to make a profit. Revenue fell 17% last year¹, a second consecutive decline, and operating loss margins deteriorated. From a potential market of around $54-billion in 2020, it captured just $4.9-billion. Although the bulk of the pandemic-inspired chip boom and shortage has transpired through 2021, the truth remains that this company shrank last year while the foundry sector climbed 23%.

Peaks and troughs

What’s of greater concern is that peaks and troughs are a natural aspect of this industry. New product categories such as PCs, notebook computers and smartphones all drove past expansions, with declines following when that growth period ended. This time we’re seeing a super cycle spurred by faster telecommunications networks, cloud computing and streaming content, and electronically equipped cars. That helped GlobalFoundries increase revenue 13% in the first half (TSMC grew 18%.) But even then, it still posted a $198-million loss.

In its prospectus, the company crows about its clients’ increasing reliance on its services: “A key measure of our success as a differentiated technology partner is the mix of our revenue attributable to single-sourced business,” which it defines as “those that we believe can only be manufactured with our technology and cannot be manufactured elsewhere without significant customer redesigns”.

But that customer addiction hasn’t translated into an ability to fill its factories or raise prices to the extent needed to cover costs.

The single biggest expense for a chip foundry is the depreciation of equipment, which means that full or empty, the cost of those factories weighs on the bottom line. Over the past three years, capacity utilisation ranged from 70% to 84%, while a rule of thumb for the sector says that you need to hit at least 90% to break even. What you certainly don’t have when equipment lays idle is the negotiating power to ask clients to pay more. By contrast, TSMC is preparing to raise prices by as much as 20%.

And this year may be the top of the current cycle. Although shortages remain, the bulk of the struggles are over and most industries are getting back to normal. The company, citing Gartner, estimates the foundry sector will climb an average 10.1% between 2019 and 2025. With last year coming in at 23% and this year heading for 12% — and TSMC taking most of that expansion for itself — there may not be a lot of momentum left to push GlobalFoundries into profitable territory. And if it does manage to pop its head above water, keeping it there may be a struggle.

Seasonality, industry overcapacity, reductions in demand, and declines in average prices are all outlined in its filing under “risk factors”. If you want a playbook for how to lose money in a chip boom, just read GlobalFoundries’ prospectus. — (c) 2021 Bloomberg LP

¹Part of the decline was due to a one-time change to how it recognizes revenue, though gross profit was also offset accordingly.