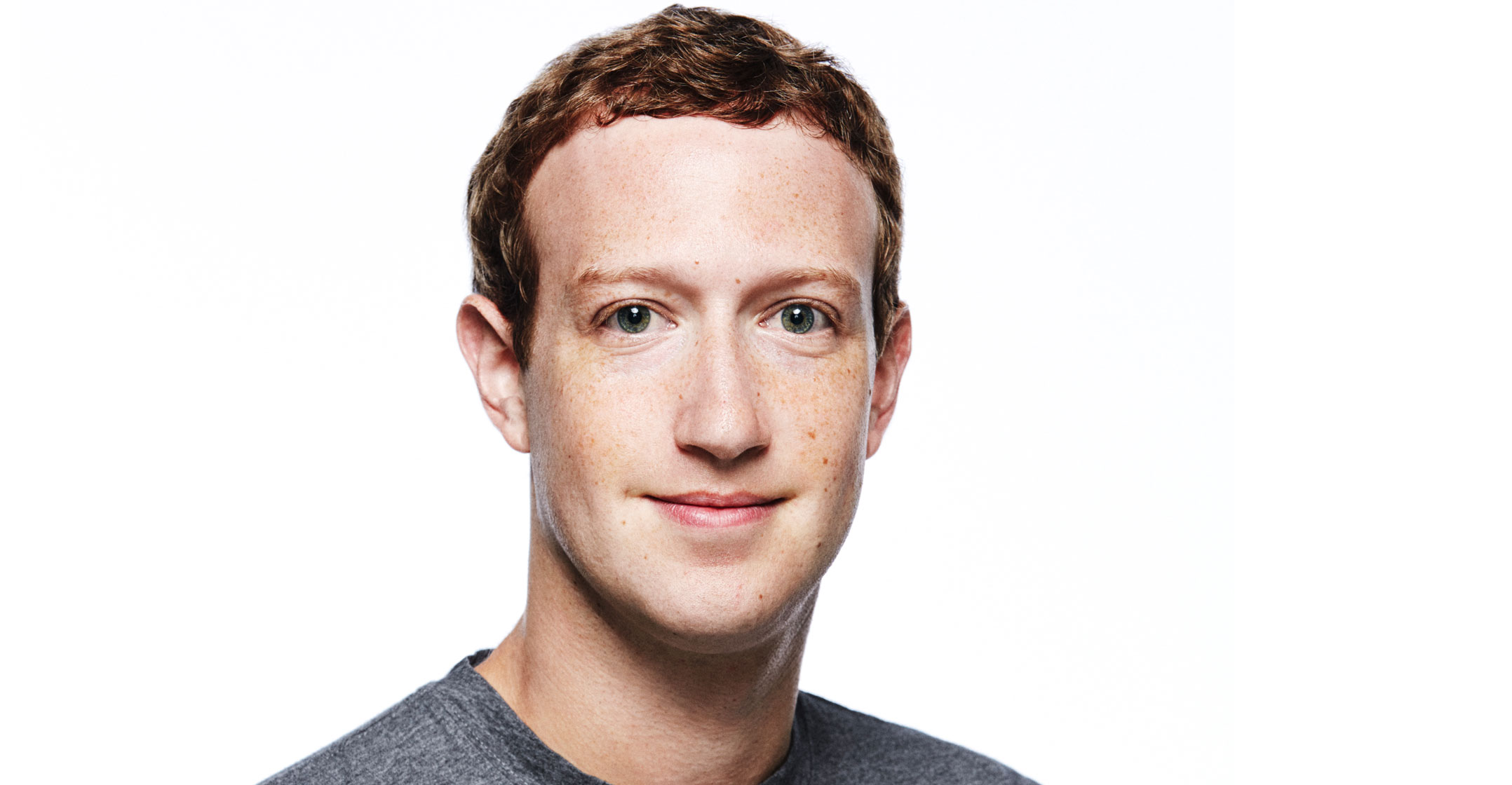

Facebook has always had one absolute leader, cemented by a share class structure that maintained Mark Zuckerberg’s voting control even when he sold millions of shares. Some investors grumbled, but most were happy to stay quiet as the stock surged. This week’s plunge upended that dynamic, increasing calls for changes at the top.

“It’s never an issue until things go wrong,” said Pivotal Research Group analyst Brian Wieser. He thinks a change in Facebook leadership is inevitable, and said the latest numbers could hasten that. “It’s really hard to imagine the status quo holding.” A Facebook spokeswoman declined to comment.

On Thursday, Facebook fell 20%, costing investors $120-billion — the biggest single-day loss for an individual stock in history. Shareholders who had weathered months of renewed debate over Facebook’s role in society and the ethics of its business model suddenly turned tail when they realised growth had run out on Facebook’s core money-making app. Growth rates will decline by “high single-digit percentages” each of the next two quarters, chief financial officer David Wehner said.

The loss of faith emboldened voices that have called for Zuckerberg to share more of his voting power and give up his role chairing the board to a more independent figure.

“Zuckerberg answers only to Zuckerberg,” said Jonas Kron, director of shareholder advocacy at Trillium Asset Management, which supported a shareholder proposal last year to replace Zuckerberg as chairman of the board. Since Thursday’s sell-off, he has received new phone calls and e-mails from other investors expressing support. He declined to identify those people.

For more than a year, Facebook and other social media companies have been under fire from policy makers and regulators for letting fake news, trolls and Russian manipulators proliferate on their services. Now that they’re cracking down, it’s denting growth and spooking investors. Authentic accounts and real information may be good for business longer term. But Kron said Facebook could have avoided some of the trouble if Zuckerberg’s power was checked by an independent chairman.

Other big tech companies like Microsoft, Apple and Alphabet split the roles of CEO and chairman. Twitter suffered its own stock-market plunge this week, dropping 21% on Friday after user growth stagnated. It is roughly the same age as Facebook and has a similar founder-led mentality, but it already has a separate executive chairman.

Zuckerberg wields too much power, said Calvert Research and Management CEO John Streur. Earlier this year, he grew concerned about Facebook’s approach to privacy and customer data. In April, when he realised engaging with the company wasn’t going to change much, his fund sold its Facebook shares.

Displeasure

“Facebook’s governance structure remains below industry standards, with a large amount of authority concentrated in the founder and CEO,” Streur said. “Shareholder rights are not well respected, limited controls are in place around executive compensation and concerns have been raised about the effectiveness of risk oversight, including privacy and security risk.”

This isn’t the first time shareholders have publicly voiced their displeasure. In 2012, the California State Teachers’ Retirement System asked Facebook to separate the CEO and chairman roles and dispense with the share structure that gave Zuckerberg such an iron grip. In April, the pension fund’s chief investment officer, Chris Ailman, said Facebook’s data-privacy crisis was fuelled by Zuckerberg’s near total control. Calstrs owned more than four million Facebook shares at the end of March.

When Zuckerberg tried to pull off a plan to sell almost all his stock while still maintaining control, some investors sued. Last September, just before the class-action lawsuit went to trial, Facebook backed down.

In a post on Facebook, Zuckerberg said he no longer needed the new share structure because the company’s stock had risen so much he was able to fund his philanthropy without selling too much of his stake. This week’s plunge will force the CEO to offload more of his shares to keep the same level of donations.

Zuckerberg’s own words show how much the company could benefit from an independent director on its board, Kron said. In blog posts and during his April appearance in the US congress to explain how a Trump campaign-linked firm accessed millions of users’ information, Zuckerberg said Facebook hadn’t taken a broad enough view of its responsibility.

“That’s exactly what an independent board chair does,” Kron said. Miscalculating how strong the backlash to Facebook’s old policy of allowing third-party app developers to port away user’s data could have been avoided by having someone with a wider, questioning perspective, he said.

Trillium submitted a proposal to separate the CEO and chairman roles just a few days before Wednesday’s disappointing results. A similar one in 2017 won the votes of 51% of non-insider investors, according to the investment firm. Kron expects that number to rise this time.

“It is difficult to escape the conclusion that there are systemic problems in the ways Facebook has been managed,” Pivotal’s Wieser wrote in a note before the results. Even if Zuckerberg maintains voting power, having more independent board members would at least give shareholders more of a voice, the analyst said.

How should Facebook write the job description for a potential independent chairman? “Someone with gravitas, someone with vision, business and technology chops,” Kron said. They’d also need “strong understanding of social impacts — the ability to think through unintended consequences”, he said.

One suggestion: Bill Gates. The Microsoft founder experienced similar rapid growth followed by a period of instability marked by a bruising antitrust battle. After a lost decade, the company emerged stronger, with new leaders and strategies.

“When Microsoft got to the other side of that, they had an independent chair,” Kron said. “Bill Gates relinquished his chairmanship.” — Reported by Gerrit De Vynck and Emily Chasan, with assistance from Olivia Carville, Sarah Frier and Jef Feeley, (c) 2018 Bloomberg LP