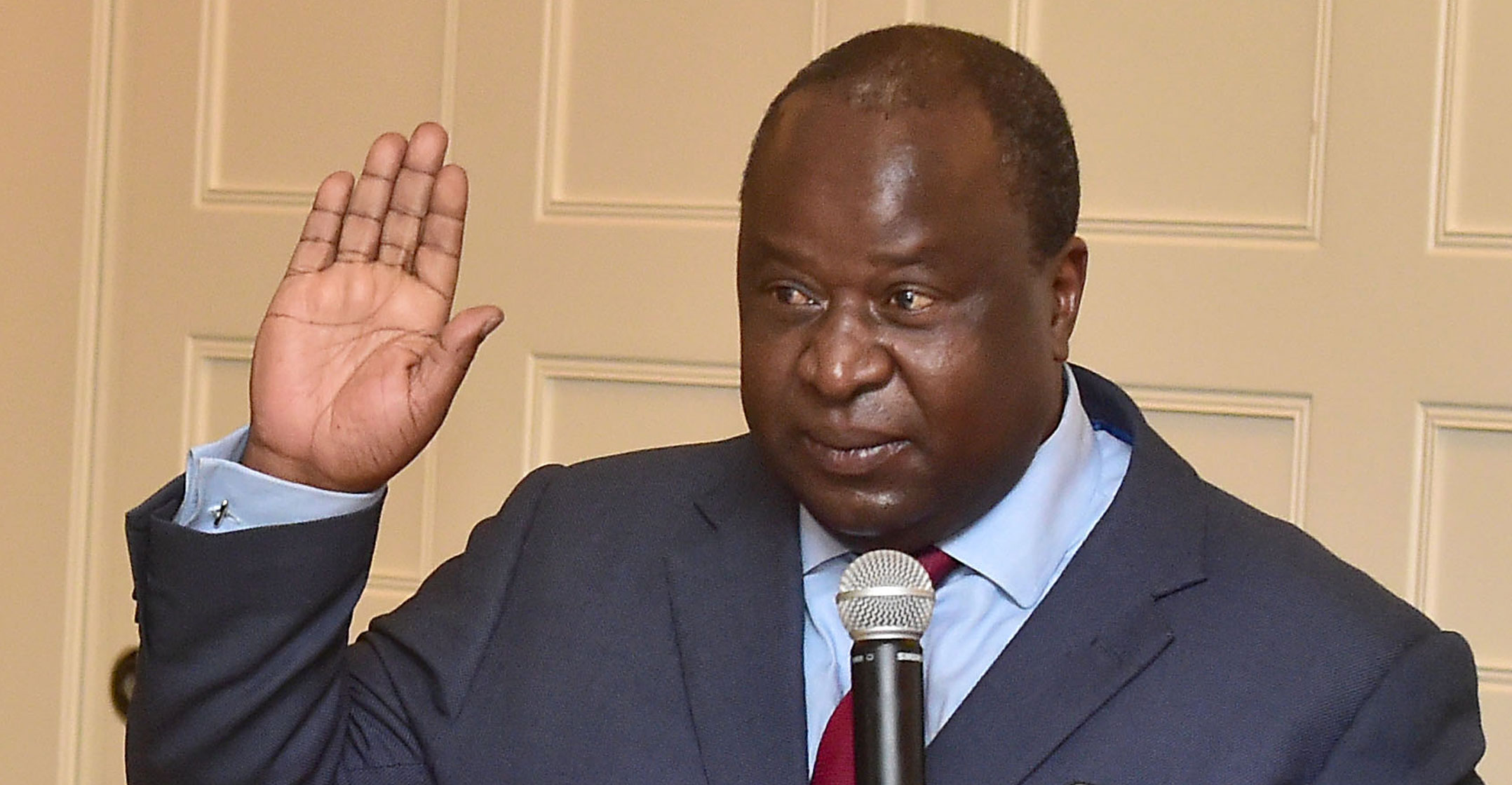

Finance minister Tito Mboweni has provided more details on the second set of measures that are aimed at assisting individuals and businesses through the Covid-19 pandemic.

“There is a critical need for government interventions to assist with job retention and support businesses that may be experiencing significant distress,” national treasury said in a statement on Thursday.

Last month, Mboweni announced the initial measures to assist tax compliant businesses with cash-flow assistance and provide an incentive for businesses to retain their lower-income employees.

“Since the announcement, economic conditions have worsened and national treasury and the South African Revenue Service have received a large number of requests for assistance, including requests from large businesses that are also experiencing substantial cash-flow difficulty.

“National treasury recognises that the short-term interventions announced in the first fiscal package do not go far enough in assisting businesses or households through the crisis – especially as the lockdown has since been extended,” national treasury said.

These measures are in line with the president’s recent address to the nation on further economic and social measures in response to the Covid-19 pandemic. The measures will help businesses focus on staying afloat and paying their employees and suppliers.

R70-billion

“Assisting businesses now will ensure that our economy is in a better position to recover once the health crisis starts to subside. If businesses survive this testing time, the economy will be better placed to strive collectively towards economic growth that is inclusive (providing more opportunities for employment) and revenue generation (so that we are able to work towards improving the state of our fiscus),” national treasury said.

The measures are expected to provide around R70-billion in support, either through reductions in taxes otherwise payable or through deferrals of tax payments for tax compliant businesses.

The interventions include:

Skills development levy holiday: From 1 May 2020, there will be a four-month holiday for skills development levy contributions (1% of total salaries) to assist all businesses with cash flow. This provides relief of around R6-billion.

Fast-tracking of VAT refunds: Smaller VAT vendors that are in a net refund position will be temporarily permitted to file monthly instead of once every two months, thereby unlocking the input tax refund faster and immediately helping with cash flow. Sars is working to have its systems in place to allow this in May 2020 for category A vendors that would otherwise only file in June 2020.

Three-month deferral for filing and first payment of carbon tax liabilities: The filing requirement and the first carbon tax payment are due by 31 July 2020. To provide additional time to complete the first return, as well as cash-flow relief in the short term, and to allow for the utilisation of carbon offsets as administered by the department of mineral resources & energy, the filing and payment date will be delayed to 31 October 2020, providing cash-flow relief of almost R2-billion.

A deferral for the payment of excise taxes on alcoholic beverages and tobacco products: Due to the restrictions on the sale of alcoholic beverages and tobacco products, payments due in May 2020 and June 2020 will be deferred by 90 days for excise compliant businesses to more closely align tax payments through the duty-at-source system (excise duties are imposed at the point of production) with retail sales. This is expected to provide short term assistance of around R6-billion.

Postponing the implementation of some budget 2020 measures: The 2020 budget announced measures to broaden the corporate income tax base by 1) restricting net interest expense deductions to 30% of earnings and 2) limiting the use of assessed losses carried forward to 80% of taxable income. Both measures were to be effective for years of assessment commencing on or after 1 January 2021. These measures will be postponed to at least 1 January 2022.

An increase in the expanded employment tax incentive amount: The first set of tax measures provided for a wage subsidy of up to R500/month for each employee who earns less than R6 500/month. This amount will be increased to R750/month at a total cost of about R15-billion.

An increase in the proportion of tax to be deferred and in the gross income threshold for automatic tax deferrals: The first set of tax measures also allowed tax compliant businesses to defer 20% of their employees’ tax liabilities over the next four months (ending 31 July 2020) and a portion of their provisional corporate income tax payments (without penalties or interest). The proportion of employees’ tax that can be deferred will be increased to 35% and the gross income threshold for both deferrals will be increased from R50-million to R100-million, providing total cash-flow relief of about R31-billion with an expected revenue loss of R5-billion.

Case-by-case application to Sars for waiving of penalties: Larger businesses (with gross income of more than R100-million) that can show they are incapable of making payment due to the Covid-19 disaster may apply directly to Sars to defer tax payments without incurring penalties. Similarly, businesses with gross income of less than R100-million can apply for an additional deferral of payments without incurring penalties.

The following tax measures aim to assist individual taxpayers and to provide financial backing from the fiscus to donate to the Solidarity Fund:

Increasing the deduction available for donations to the Solidarity Fund: The tax-deductible limit for donations (currently 10% of taxable income) will be increased by an additional 10% for donations to the Solidarity Fund during the 2020/2021 tax year.

Adjusting pay-as-you-earn for donations made through the employer: Employers can factor in donations of up to 5% of an employee’s monthly salary when calculating the monthly employees’ tax to be withheld. An additional percentage that can be factored in of up to 33.3%, depending on the employee’s circumstances, will be provided for a limited period for donations to the Solidarity Fund. This will lessen cash-flow constraints for employees who donate to the Solidarity Fund.

Expanding access to living annuity funds: Individuals who receive funds from a living annuity will temporarily be allowed to immediately either increase (up to a maximum of 20% from 17.5%) or decrease (down to a minimum of 0.5% from 2.5%) the proportion they receive as annuity income, instead of waiting up to one year until their next contract “anniversary date”. This will assist individuals who either need cash flow immediately or who do not want to be forced to sell after their investments have underperformed.

The above measures will be given legal effect in terms of changes to the two bills, the Draft Disaster Management Tax Relief Bill and the Draft Disaster Management Tax Relief Administration Bill. — SANews