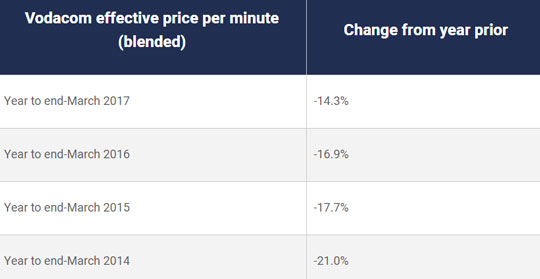

The effective price per minute of mobile voice calls on South Africa’s largest mobile network has more than halved since 2013. While not explicitly disclosed by the operator, the current blended price per minute (across both prepaid and post-paid) on Vodacom’s network is around the 46c mark. Voice prices are down 42,2% over the past three years (a fact it included in a presentation to the market on Monday). In the prepaid space, where tariffs tend to be lower, the effective voice rate is closer to the 30c/minute level.

The effective price per minute of mobile voice calls on South Africa’s largest mobile network has more than halved since 2013. While not explicitly disclosed by the operator, the current blended price per minute (across both prepaid and post-paid) on Vodacom’s network is around the 46c mark. Voice prices are down 42,2% over the past three years (a fact it included in a presentation to the market on Monday). In the prepaid space, where tariffs tend to be lower, the effective voice rate is closer to the 30c/minute level.

It is important to note that this is an effective price per minute. In other words, it includes the effective rate per minute for bundled voice minutes in contracts, as well as the rates for calls in promotional bundles on prepaid. An example of this is Power Hour, where 60 minutes cost R8 (13c/minute). On contract, the out-of-bundle price of calls (anywhere from R1 to R1,90) bears little resemblance to the reality of what most people end up paying. So, too, the base rate for calls on Vodacom’s five prepaid plans.

Key to driving these prices lower has been two things: first, the intervention by government and the regulator (Icasa) to dramatically force down mobile termination rates since 2013. The current rate of 13c is almost one tenth of what it was in 2009/2010 (R1,25/minute)! This, despite what operators argued, provided an artificial floor to prices. Second is the shift to in-bundle usage. Vodacom has been the most successful of the operators to shift customers onto integrated price plans on post-paid (its Smart and Red packages, which bundle a large amount of voice minutes alongside SMSes and data) and bundled use in prepaid. A quarter of all mobile prepaid revenue is now in-bundle, from 20% a year ago.

Vodacom says it sold a billion voice bundles in the year to 31 March 2017. That is an incredible number, given that four years ago it reported an amount of 333m. In total, 16,4m customers use bundles (primarily voice and/or data) and its targeted and personalised “Just 4 You” offers are seeing substantially better conversions. Here, it is targeting propositions to customers based on their behaviour (and needs and wants). The operator sold 728m Just 4 You bundles last year, nearly triple the amount it managed in the 2016 financial year (to March last year). Expect a lot closer focus on this segmentation.

Against this backdrop of a more than 50% decline in voice prices since 2013, however, Vodacom’s revenue from mobile voice in South Africa is only down 20% in the same period. It has dropped from R29,2bn in FY2013, to R23,2bn in FY2017 (it hit a peak of R29,4bn in FY2012).

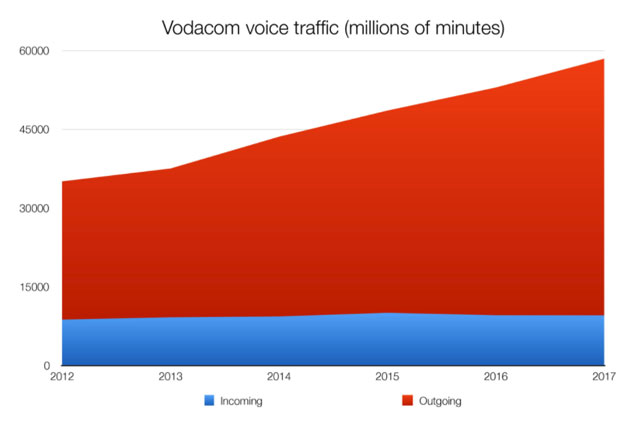

The reason for this is that voice calls have soared. The total number of minutes on outgoing calls, or calls being initiated on the Vodacom network (to other networks or other Vodacom numbers), is up 73% over the four years. Incoming calls are up 4%, with the total 56% higher. This should not be surprising, given Vodacom’s market position (with about 50% of the market, depending on the measure).

In FY2017, Vodacom had 58,4bn minutes registered on its network. Put another way, that equates to 160m voice minutes per day, on average (for perspective, a day is 1 440 minutes).

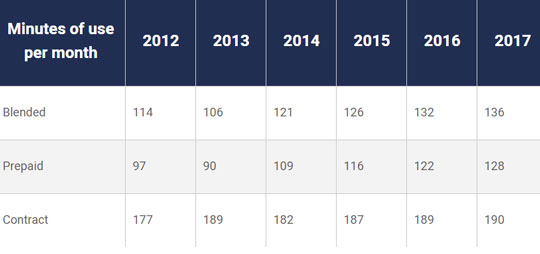

Minutes of use per month per subscriber is up strongly in the prepaid space since 2013 and is flat in the contract market (a great result, all things considered).

But voice is not the only product where prices have dropped significantly. Because of bundle use, effective data prices have also declined. But that’s a story for another day.

- Hilton Tarrant works at immedia. This column was first published on Moneyweb and is used here with permission