Consumers love to complain about MultiChoice Group’s services, but they’re not matching that by shutting their wallets to the company. The pan-African pay-television operator, which owns DStv and SuperSport, has, in fact, lifted its subscriber base by 1.4 million in the past year to reach 20.9 million households.

Consumers love to complain about MultiChoice Group’s services, but they’re not matching that by shutting their wallets to the company. The pan-African pay-television operator, which owns DStv and SuperSport, has, in fact, lifted its subscriber base by 1.4 million in the past year to reach 20.9 million households.

The numbers are included in the group’s annual financial results for the year ended March 2021, which were published on Thursday. The group had 8.9 million paying customers in South Africa and 11.9 in the rest of Africa as of 31 March, MultiChoice said.

“This represents an accelerated 7% growth year on year, driven by heightened consumer demand for video entertainment products, continued penetration of the mass market and an easing of electricity shortages in southern Africa,” the group said.

Although pressure remains on the top end of the market – especially the DStv Premium base, whose contribution to revenue continued to decline – the group saw good growth in the mass market segment

Group revenue was 4% higher at R53.4-billion. This performance, coupled with a focus on cost containment and a R1.5-billion reduction in trading losses in the rest of Africa, translated into a 28% increase in trading profit to R10.3-billion. The group declared a R2.5-billion dividend.

“Core headline earnings, the board’s measure of sustainable performance, was up a meaningful 32% year on year to R3.3-billion, while free cash flow grew a solid 10% to R5.7-billion,” the group said.

‘Financial flexibility’

It reported R8.5-billion in cash and cash equivalents at year-end. “Combined with R4-billion in undrawn facilities, this provides R12.5-billion in financial flexibility to support dividends and growth initiatives.”

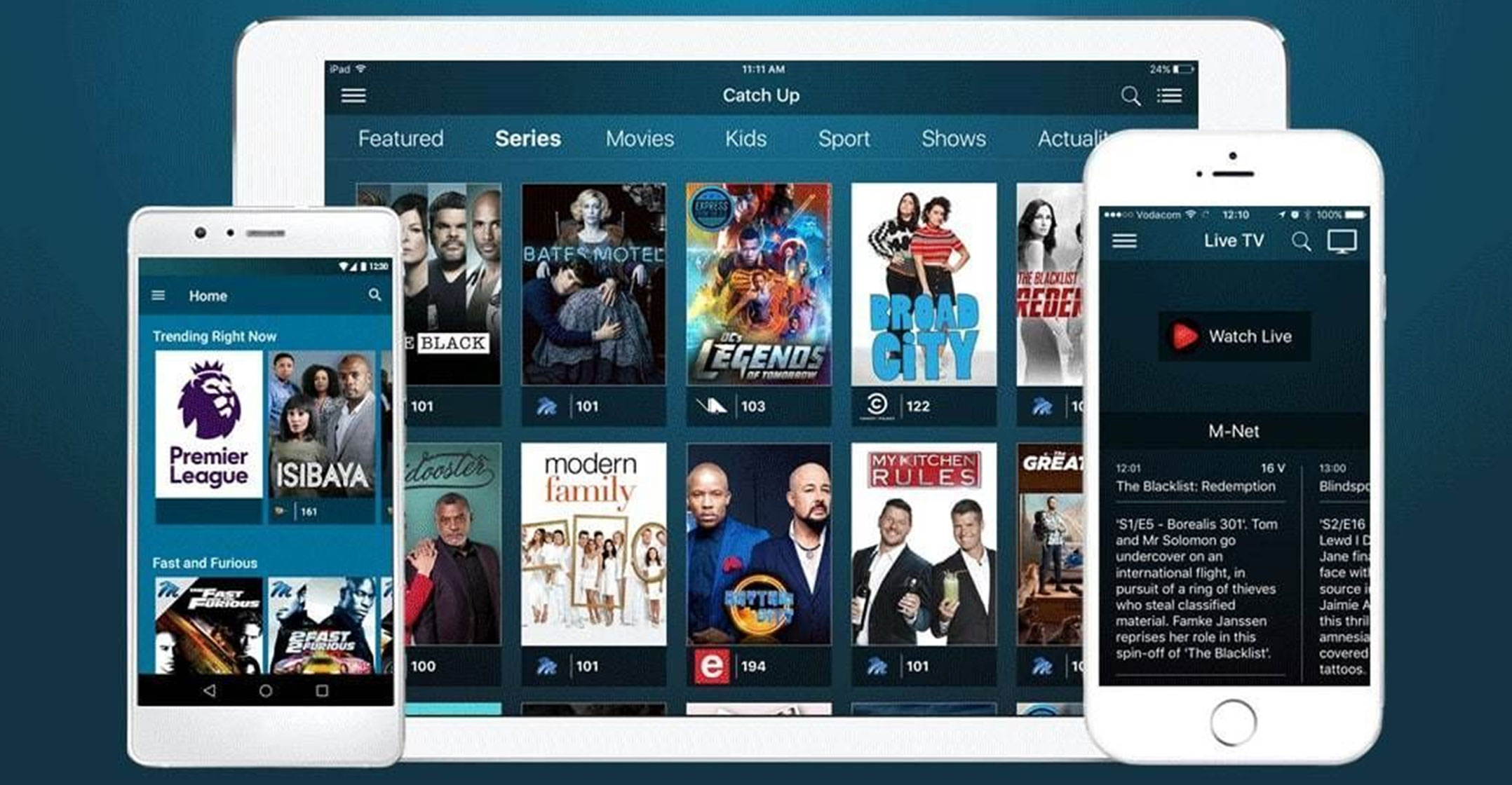

During the year, MultiChoice stepped up its investment in local programming as a way of differentiating itself from streaming rivals that are increasingly giving it a run for its money in homes with fast and uncapped Internet connections.

Despite production stoppages and travel restrictions brought about by Covid-19, MultiChoice said it managed to produce 19% more content hours than in the 2020 financial year — the total local content library now exceeds 62 000 hours. About 42% of the group’s general entertainment spend was on local content and it remains on track to reach a target of 45% by the next financial year.

Navigating Covid-19 wasn’t all plain sailing, however. Both advertising and commercial subscription revenues were significantly impacted, with advertising revenue down 11% year on year at R2.8-billion. Commercial subscription revenues started to recover in the latter part of the financial year but finished 35% lower than in 2020. “The hospitality industry is expected to take some time to return to normal trading,” MultiChoice said.

Navigating Covid-19 wasn’t all plain sailing, however. Both advertising and commercial subscription revenues were significantly impacted, with advertising revenue down 11% year on year at R2.8-billion. Commercial subscription revenues started to recover in the latter part of the financial year but finished 35% lower than in 2020. “The hospitality industry is expected to take some time to return to normal trading,” MultiChoice said.

“A focus on tight cost controls and the early implementation of cost-cutting initiatives underpinned an expansion in the group’s trading margin, from 16% to 19%. Cost savings amounted to R1.5-billion for the year, exceeding the group’s stretch target of R1.4-billion. Savings were largely fixed in nature with more than half relating to content and the balance to a broad range of initiatives such as sales and marketing and lower decoder unit costs,” it said.

On South Africa specifically, MultiChoice said the business “held up well” despite the tough economic environment, delivering year-on-year subscriber growth of 6% — or about half a million linear pay-TV subscribers on a 90-day active basis.

“Covid-19 and the associated lockdowns saw consumers prioritise video entertainment services, but the cancellation of live sport events combined with the inability of commercial subscribers to trade and a weak advertising environment impacted negatively on revenue generation, especially early in the financial year,” MultiChoice said.

Revenue from the South African operation increased 1% to R34.3-billion, while trading profit increased 9% to R11.1-billion, representing a margin of 32%. “This higher profitability can be attributed to the non-recurrence of three major sporting events expensed in the comparative prior period, a strong focus on the group’s cost optimisation programme, lower operational costs in a Covid-19 environment and a temporary shift in content costs as a result of delays in sporting events.” — © 2021 NewsCentral Media