Intel’s search for a new CEO will focus heavily on outsiders, with the chip maker considering candidates such as Marvell Technology head Matt Murphy and former Cadence Design Systems CEO Lip-Bu Tan, according to people familiar with the situation.

The company has enlisted executive search firm Spencer Stuart to help find a new chief and is evaluating candidates, said the people, who asked not to be identified because the deliberations are private. That includes looking well beyond Intel’s walls for talent — a break with tradition.

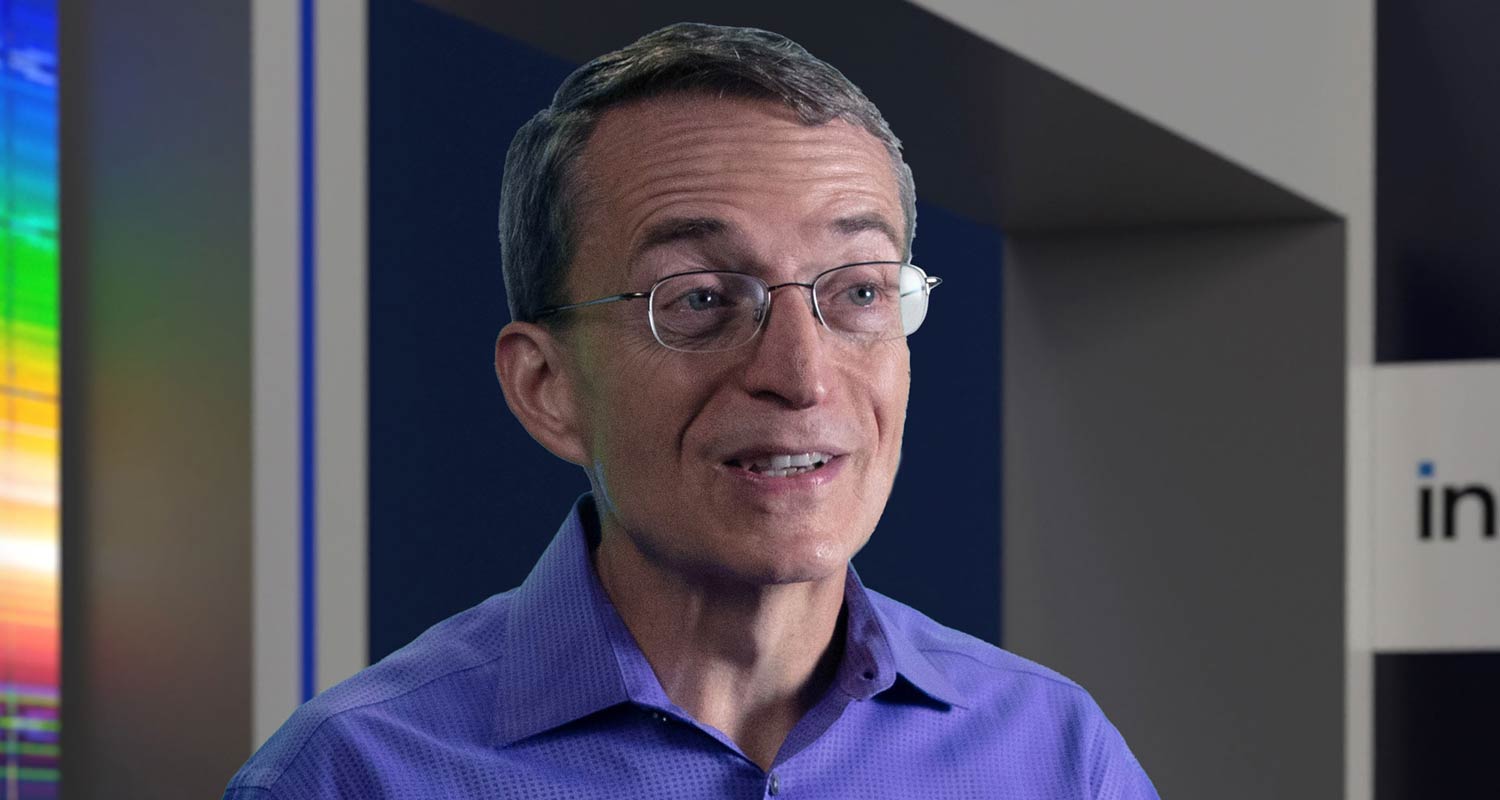

This week’s sudden ouster of CEO Pat Gelsinger set off an urgent search for new leadership at a time when the chip maker’s fortunes are shaky and its bench has been depleted by years of management turnover. Gelsinger took the reins just three years ago, and since then has focused on a complex, expensive effort to turn the struggling company around.

That didn’t give him time to resurrect one of Intel’s other legacies — an executive training programme that once supplied leaders for the rest of the industry. For now, chief financial officer David Zinsner and executive vice president Michelle Johnston Holthaus are serving as interim co-CEOs.

Marvell shares slipped as much as 2.3% on Tuesday after it was reported that Murphy was under consideration. Intel fell more than 6% at the close in New York, continuing a retreat that began on Monday.

All but one of the company’s leaders since its foundation in 1968 have been homegrown, and the exception, Bob Swan, was given the job as a stopgap measure when the board was forced to remove Brian Krzanich. That drama broke a run of carefully choreographed successions that contributed to the company’s five decades of stability. Krzanich’s tenure also saw the departure of a number of Intel veterans.

Earlier exodus

As the board hunts for Gelsinger’s permanent replacement, analysts say, it may be hard-pressed to choose from within, partly because the earlier exodus means there are fewer strong internal candidates. On the other hand, there’s little optimism that the company will be able to bring in an external saviour who can shake things up immediately.

“It may be challenging to find a replacement with the right experience and background, with the capacity to manage a complex organisation such as Intel and able to effectively deal with the multitude of headwinds,” KeyBanc Capital Markets analyst John Vinh wrote in a note on Monday.

Intel declined to comment on potential candidates for the CEO role. Marvell, Murphy and Tan didn’t immediately respond to requests for comment. Reuters previously reported that the 65-year-old Tan, who served on Intel’s board until earlier this year, was in contention for the job.

Read: Pat Gelsinger is no longer CEO of Intel

One way to balance the insider-outsider equation would be to hire an old Intel executive who left during the management tumult of recent years — like Gelsinger.

Such candidates would include Stacy Smith, a former Intel executive who joined the company’s board this year. The ex-Intel CFO, who also spent time in the company’s sales organisation, exited during Krzanich’s tenure in 2018 and was a previous applicant for the top job. A more recent departure is Gregory Bryant, who ran Intel’s personal computer unit. He joined Analog Devices in 2022.

Also in this cohort is Ampere Computing CEO Renee James, who created a start-up that is trying to rival Intel in server chips. She served as Intel’s president until sidelined by Krzanich. Former Lenovo Group executive Kirk Skaugen, who left Intel in 2016, was in charge of Intel’s server chip unit when it dominated the industry.

Another potential recruitment pool: Intel’s biggest customers, many of which have embarked on their own chip programmes with various levels of success. Johny Srouji is the senior vice president of Apple’s successful internal chip unit. The iPhone maker’s in-house programme started a trend that’s been replicated elsewhere, most notably by Amazon Web Services, Microsoft, Google and Meta Platforms, which all have significant chip teams.

When Intel was trying to bring Gelsinger back to the company about four years ago, some other chip company leaders, including Marvell’s Murphy, were reported as being under consideration. Intel has now approached him for the latest search, the people said.

Despite a severe decline in its fortunes, Intel remains one of the most important companies in the technology industry. It still ranks among the largest chip makers by revenue, and more than 70% of the world’s PCs and servers run on its processors. Its plan to build additional factories in the US is a cornerstone of the federal government’s push to make more chips on American soil.

Whoever Intel chooses, the new CEO will need time to make up for the more than US$20-billion of revenue lost to competitors over the last couple of years.

“In addition to no bench, a new outside CEO coming to Intel is a multiyear gig that is a tall order in a cycle of innovation that is more intense than ever,” said Rosenblatt Securities analyst Hans Mosesmann.

Excluding acolytes

Given the technical nature of the industry — chip design and manufacturing requires a blend of electronics engineering, chemistry and physics that is usually led by teams of PhDs – Intel may be reluctant to promote CFO Zinsner on a permanent basis. When CFO Swan was the company’s interim leader, analysts questioned whether he understood the technical side of the business well enough to make strategic decisions.

Gelsinger, who was brought back to Intel after a decade away, talked up his bonds to the company’s past and his plan to restore its strengths. Now, that may no longer be a selling point. The immediate need to win over Intel’s competitors and turn them into customers for its outsourced manufacturing business might involve excluding long-term Intel acolytes.

Read: Intel board lost confidence in CEO Pat Gelsinger

If the board is looking for the most immediately transferable skills, TSMC, AMD and Nvidia would be the most obvious talent pools. During the company’s last CEO search, AMD’s Lisa Su was mentioned as a favourite pick by many analysts. But since then, the company she runs has risen to greater levels of success, taking market share from Intel and emerging as the top contender to catch Nvidia in artificial intelligence chips. AMD is currently worth more than twice as much as Intel by market capitalisation.

Recruiting from Nvidia could also be difficult. Co-founder and CEO Jensen Huang has created a unique management structure that eschews a traditional hierarchy. Huang has dozens of direct reports in a horizontal structure, making it almost impossible to identify who among them might be best positioned to take a step up — at Nvidia or at another company like Intel.

Taiwan’s TSMC, meantime, has blown past Intel in manufacturing capabilities and made itself the leading producer of chips for other companies. It manufactures the world’s most advanced chips, working for Apple, AMD, Nvidia and a host of others. At the head office in Hsinchu, executives regarded as instrumental in steering TSMC’s meteoric ascent include Intel veteran Kevin Zhang and his peer deputy, co-chief operating officer Cliff Hou. In the US, TSMC Arizona CEO YL Wang recently scored a notable triumph, helping that plant achieve better yields than its comparable facility back at home.

Taiwan’s TSMC, meantime, has blown past Intel in manufacturing capabilities and made itself the leading producer of chips for other companies. It manufactures the world’s most advanced chips, working for Apple, AMD, Nvidia and a host of others. At the head office in Hsinchu, executives regarded as instrumental in steering TSMC’s meteoric ascent include Intel veteran Kevin Zhang and his peer deputy, co-chief operating officer Cliff Hou. In the US, TSMC Arizona CEO YL Wang recently scored a notable triumph, helping that plant achieve better yields than its comparable facility back at home.

It’s uncertain, however, if senior TSMC leaders would consider jettisoning the world’s best contract chip maker to go save a much less stable company. But former TSMC chairman Mark Liu, who spent some early years of his career at Intel and retired from the Taiwanese chip maker earlier in 2024, may be someone that Intel can lure over — even though he is older than an average American CEO. Liu turns 70 this year.

Read: Qualcomm backs away from possible deal to buy Intel

“We don’t expect it to be easy for Intel to find a new leader with the credentials to lead Intel out of this challenge,” Wolfe Research analyst Chris Caso wrote in a report. “Gelsinger came with a wealth of Intel experience, and there hadn’t been many viable candidates.” — Ian King, Ryan Gould and Jane Lanhee Lee, with Debby Wu, (c) 2024 Bloomberg LP

Get breaking news from TechCentral on WhatsApp. Sign up here