DCD Wind Towers should have been a South African success story. When DCD opened its doors in the Eastern Cape in 2013, it was the first factory set up to take advantage of the country’s abundant wind-power resources. Government policy was fuelling a clean-energy bonanza, and DCD brought valuable jobs to an impoverished province.

DCD Wind Towers should have been a South African success story. When DCD opened its doors in the Eastern Cape in 2013, it was the first factory set up to take advantage of the country’s abundant wind-power resources. Government policy was fuelling a clean-energy bonanza, and DCD brought valuable jobs to an impoverished province.

“We took unemployed people, some of whom were in their 30s who’d never had a job,” Alta-Mari Grebe, who was the company’s GM, said by phone. “We really had a good thing going.”

A sudden change of heart by the government in Pretoria brought the country’s promising wind and solar energy programme to a crashing halt. In June this year, DCD’s state-of-the-art equipment was auctioned off.

DCD’s unrealised potential is a footnote in South Africa’s story of the last decade, one of chronic under-performance that is pushing the continent’s dominant powerhouse to the edge of economic and political disaster.

With debt surging and the coronavirus pandemic threatening the deepest economic contraction in almost 90 years, business leaders are warning that President Cyril Ramaphosa’s government can no longer procrastinate. With the situation deteriorating rapidly, they say, South Africa faces a choice between loosening the grip of vested interests to embrace radical — and likely painful — reform, or risking a sovereign debt crisis and more permanent scars.

‘Wasteland’

“We are looking at a wasteland,” said Martin Kingston, chairman of Rothschild & Co’s South African unit and deputy president of Business Unity South Africa, the country’s main business organisation. “The ramifications of not taking the necessary action in the near future are catastrophic.”

The fact that government officials broadly agree with the prognosis underlines the seriousness of South Africa’s plight. Yet addressing the challenge is far from straightforward, and will require a wholesale change in the ANC government’s approach to marshalling the R6-trillion economy.

Investors in South Africa are wearily familiar with policy inconsistency. The frustration of the renewables sector was a result of former President Jacob Zuma’s decision to start pursuing an ultimately unsuccessful nuclear power deal with Russia from about 2014, leaving purchase agreements with renewables companies unsigned. That ultimately brought a halt to what was one of the world’s most successful clean-energy programmes.

Telecommunications companies have waited over a decade for the sale of spectrum needed to expand their services and potential offshore oil resources lie untapped because the requisite laws haven’t been passed. Labour unions have used their political power to block everything from education reform to the closure of heavily polluting coal-fired power plants.

South Africa may now be running out of road. Without urgent action, national debt could exceed 140% of GDP by the end of the decade, according to an emergency budget presented in June. That’s almost on a par with Lebanon, and compares to only about 26% in 2008, when the last global economic crisis began.

Covid-19 is accelerating the downturn. By the time coronavirus restrictions were imposed in the country in March, South Africa was already in recession and unemployment, at 30.1%, was at a 17-year high. One of the world’s strictest lockdowns has probably left millions more jobless and slashed economic output, while the number of confirmed cases has surged to over half a million regardless.

The economy probably contracted more than 30% on an annualised basis in the second quarter, according to central bank forecasts, and portfolio outflows in the first three months of 2020 were at the highest level on record. Consumer confidence is at the lowest since 1985, when the United Nations Security Council urged further economic sanctions against South Africa over its apartheid policies and the whites-only government declared a partial state of emergency.

All of this is bad news for Ramaphosa, who came to power promising to revive the economy. Surging debt and a stagnant economy would hurt him, opening the door to populists in the ANC whose interventions could further weaken investor confidence.

Pressure

After more than two decades in power, pressure is growing on the party of Nelson Mandela. In municipal elections in 2016, it lost control for the first time of the country’s biggest city, Johannesburg, and the capital, Pretoria, to opposition coalitions. While the political opposition nationally remains splintered and ineffective, the ANC won last year’s elections with its lowest ever share of the vote.

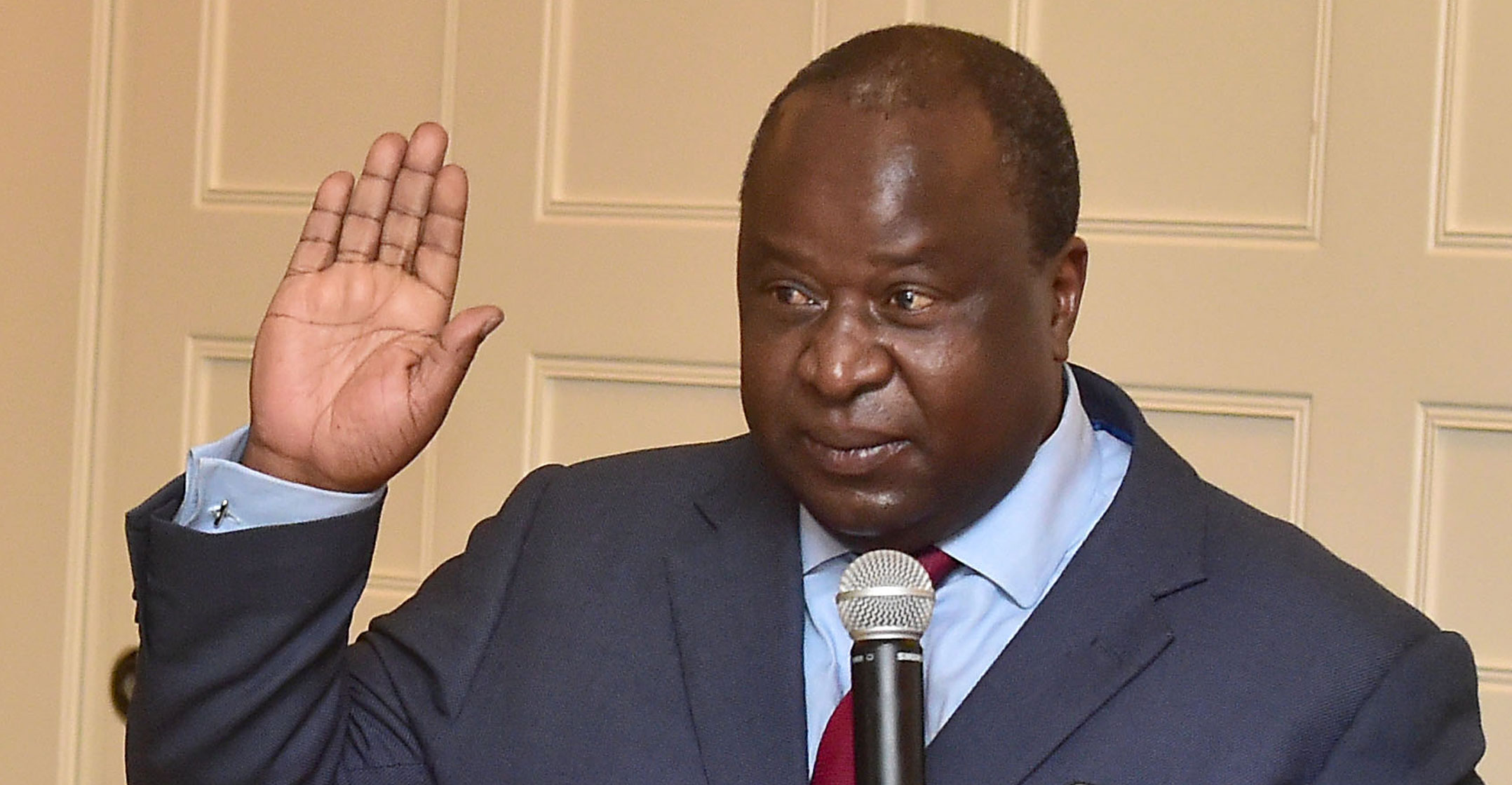

The government is moving to act. Finance minister Tito Mboweni’s emergency budget stressed the need to keep debt in check and last month South Africa took out a US$4.3-billion loan from the International Monetary Fund, its first ever from the organisation at a sovereign level. The president launched a drive in June to attract private investment in infrastructure over the next decade.

For the first time, government officials, unionists and business leaders are in lockstep on the need for change to tackle ills from unemployment to a housing shortage. They are less united on the path forward, however.

South Africa is not a nation that’s short of plans. Its problem lies in finding the political will to overcome powerful vested interests and implement them, according to Thabi Leoka, an independent economist in Johannesburg.

“We’re not making the tough decisions that we ought to have made,” she said. “Instead, we’ve seen two plans that were released, one from the ANC and the other from business, which means that we are still at the creating plans instead of implementation stage.”

And for all the government rhetoric, the early signs are not promising.

Allegations of corruption around efforts to procure personal protective equipment to fight the virus stretch to the president’s office, with his spokeswoman implicated. The first projects in Ramaphosa’s infrastructure drive took over a month to be announced when they had been promised within days. And even though the country is regularly subjected to power outages, the energy minister has dragged his feet over opening a new clean energy investment round.

“A crisis is what is needed to break the current political impasse to make way for meaningful reform. However, it is becoming increasingly clear that the crisis that is Covid-19 is a lost opportunity,” said Boingotlo Gasealahwe, Africa economist at Bloomberg Economics. “I shudder to think how much worse things must get before any action is taken.”

R12-trillion

One possible way ahead lies in leveraging pension funds that are flush with cash, giving South Africa the financial wherewithal to solve some of its problems. Together with private pensions and bank assets, South Africa has R12-trillion available for investment, according to Business for South Africa, an alliance of the country’s main business organisations.

Yet for now it’s hard to argue that much has changed. State-owned companies that were saddled with debt during Zuma’s scandal-ridden nine-year reign remain dysfunctional, little new legislation has been passed and there have been no significant convictions for graft despite widespread evidence of pervasive corruption.

True, Mboweni has pledged to cut government spending by R230-billion over the next two years, partly by freezing most civil servant wages — after earlier agreeing to raise them despite years of above-inflation pay rises. But he may struggle to get his way in the face of entrenched labour opposition.

That sets up a battle ahead over South Africa’s economic and political future.

“Structural economic reforms are going to be contested and they are going to be contested very, very hard,” said Lumkile Mondi, an economics lecturer at the University of The Witwatersrand in Johannesburg. “It is going to be a very hard sell.” — Reported by Antony Sguazzin and Prinesha Naidoo, (c) 2020 Bloomberg LP