Blantyre Capital, a London-listed investment management firm, and Greenpoint Capital, a South African private credit investment firm, have offered R250-million to rescue cinema chain Ster-Kinekor Theatres, which was placed into business rescue 14 months ago.

Blantyre Capital, a London-listed investment management firm, and Greenpoint Capital, a South African private credit investment firm, have offered R250-million to rescue cinema chain Ster-Kinekor Theatres, which was placed into business rescue 14 months ago.

The proposal, which has been drafted by business rescue practitioner Stephen Smyth, could save 800 jobs if it is adopted by 75% or more of the creditors.

“The offer from Blantyre and Greenpoint is to provide financing of up to R250-million (or euro equivalent) to fund future operations, facilitate the exit of business rescue and to partially refinance the existing capital structure,” the proposal reads.

Read: Ster-Kinekor placed into business rescue

Blantyre and Greenpoint will make a facility amount – the R250-million – available to the company as senior secured debt.

Most of these funds will be used to settle business rescue costs, transaction costs, capital expenditure and associated costs, VAT consequences from the business rescue settlement, and dividends, being about R188-million in total.

These will either be settled on day one following completion of the transaction or in the subsequent months should certain conditions be met.

A portion will be retained for the business to drawn down on as working capital should it be required, being about R62-million in total.

The proposal is supported by a binding offer from the investor in waiting, which is already invested in cinema

Smyth, the business rescue practitioner, has also proposed taking a R3.75-million fee (1.5% of the proposed deal value) over and above the normal fees he is paid as practitioner.

“The proposal is supported by a binding offer from the investor in waiting, which is already invested in cinema (and understands the industry) and for which the funds are immediately available,” the document reads. “The proposal provides for the quickest and most efficient way to exit Ster-Kinekor Theatres from business rescue and return it to solvency, while also seeking to maximise recoveries to creditors.

“It would provide a growth platform for Ster-Kinekor; a recapitalised business with a strengthened balance sheet, which should allow the business and its key stakeholders who have supported the business during the past two years of the pandemic…”

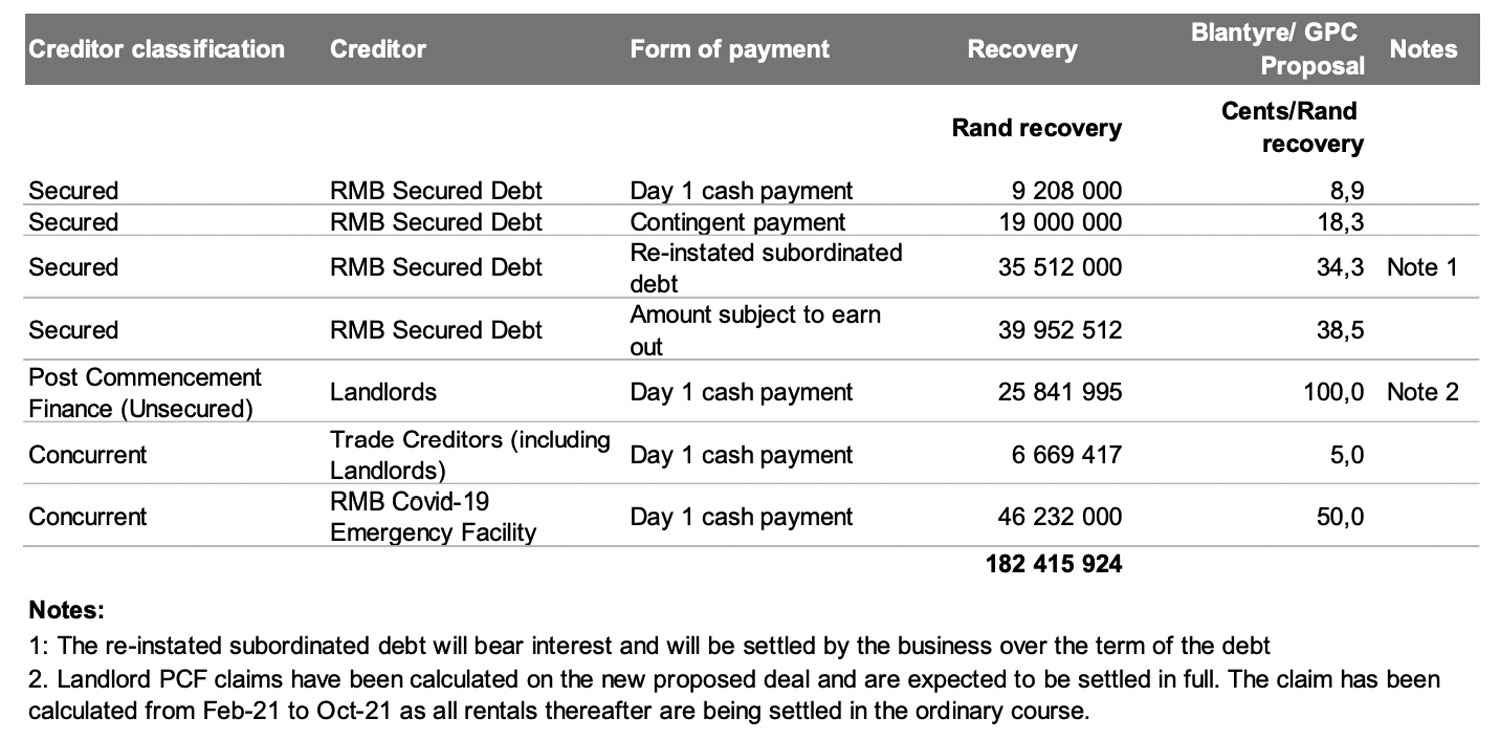

The rescue plan, if implemented, estimates the following recoveries for creditors:

If the vote on the proposal is rejected, the business rescue practitioner will apply for immediate liquidation of Ster-Kinekor. – © 2022 NewsCentral Media