US President Donald Trump said on Friday that the US would take a 10% stake in Intel under a deal with the struggling chip maker that converts government grants into an equity share, the latest extraordinary intervention by the White House in corporate America.

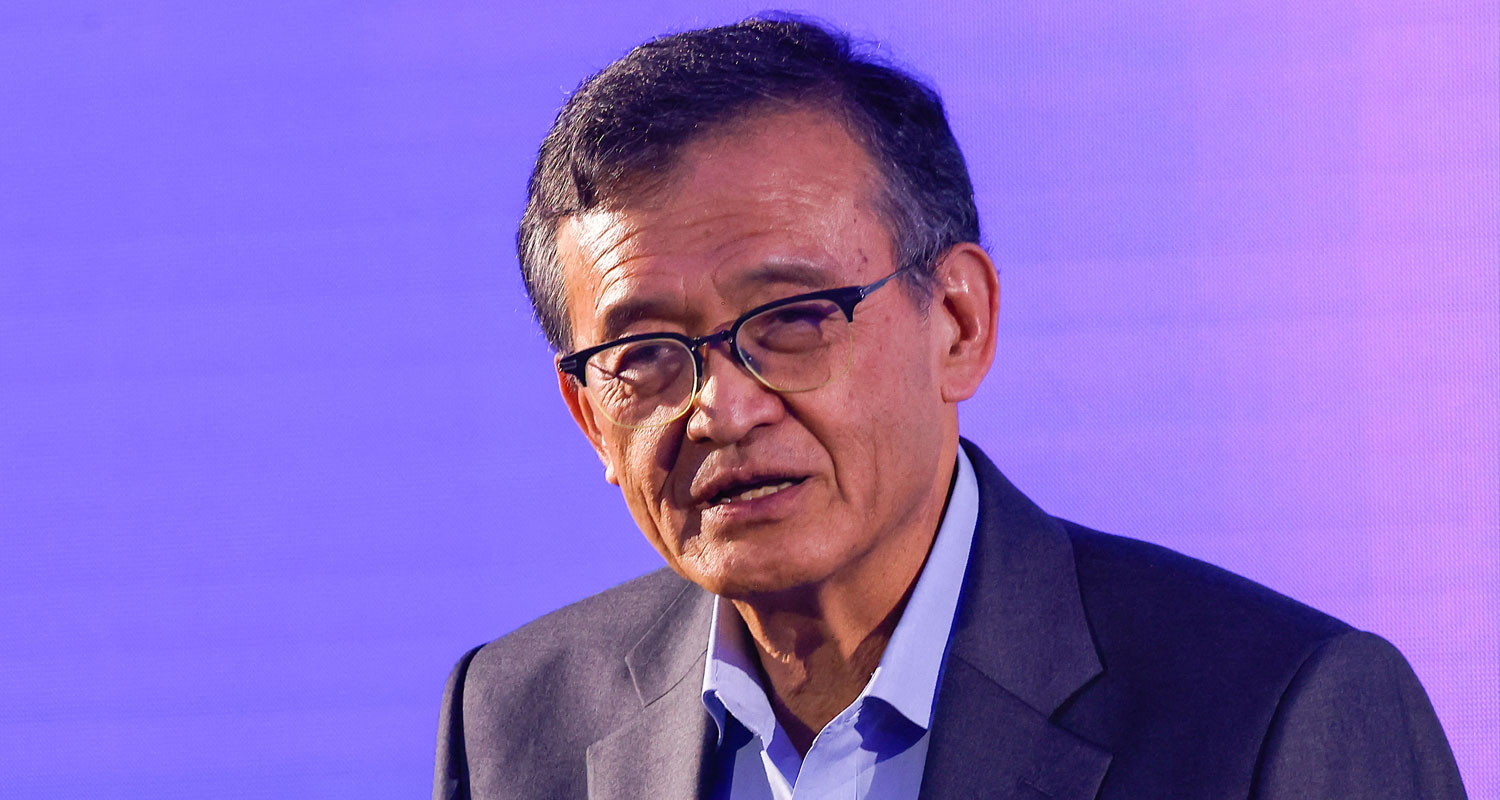

The deal puts Trump on better terms with Intel CEO Lip-Bu Tan, after the president recently said the CEO should step down due to conflicts of interest. It will ensure that the chip maker will receive about US$10-billion in funds for building or expanding factories in the US.

Under the agreement, the US will purchase a 9.9% stake in Intel for $8.9-billion, or $20.47/share, which represents a discount of about $4 from Intel’s closing share price of $24.80 on Friday.

The purchase of the 433.3 million Intel shares will be made with funding from the $5.7-billion in unpaid grants from the Biden-era Chips Act and $3.2-billion awarded to Intel for the Secure Enclave programme, also awarded under Trump’s predecessor, Democratic President Joe Biden.

Intel stock rose roughly 1% in the extended session on Friday after closing up 5.5% during regular trading.

Trump met with Tan on Friday, a White House official said. That followed Trump’s 11 August meeting with the Intel CEO after Trump demanded that Tan resign over his ties to Chinese firms.

“He walked in wanting to keep his job and he ended up giving us $10-billion for the United States. So we picked up $10 billion,” Trump said on Friday.

Commerce secretary Howard Lutnick said on X that Tan had struck a deal “that’s fair to Intel and fair to the American people”.

Foundry fumbles

The Intel investment marks the latest unusual deal with US companies, including a government agreement allowing AI chip giant Nvidia to sell its H20 chips to China in exchange for receiving 15% of those sales.

Other recent deals include an agreement for the Pentagon to become the largest shareholder in a small mining company, MP Materials, to boost output of rare-earth magnets and the US government’s winning a “golden share” with certain veto rights as part of a deal to allow Japan’s Nippon Steel to buy US Steel.

The federal government’s broad intervention in corporate matters has worried critics, who say Trump’s actions create new categories of corporate risk.

Read: Intel shares dive as Trump calls for CEO’s immediate exit

Ahead of the US deal with Intel, Japan’s SoftBank agreed to take a $2 billion stake in the chip maker on Monday.

Some industry observers still question Intel’s ability to surmount its problems.

Daniel Morgan, senior portfolio manager at Synovus Trust, said Intel’s problems are beyond a cash infusion from SoftBank or equity interest from the government, singling out Intel’s contract chip manufacturing business, known as its foundry unit.

“Without government support or another financially stronger partner, it will be difficult for the Intel foundry unit to raise enough capital to continue to build out more fabs at a reasonable rate,” he said. Intel “needs to catch up with TSMC from a technological perspective to attract business”, he added.

The government’s stake is to be passive ownership and does not include a board seat, Intel said. The government will be required to vote with Intel’s board when shareholder approval is necessary, with “limited exceptions”. Intel did not specify the exceptions.

The equity stake also includes a five-year warrant at $20/share for an additional 5% of Intel stock, which the US can use if Intel loses control of the foundry business.

Federal backing could give Intel more breathing room to revive its loss-making foundry business, analysts said, but it ceded the AI market to Nvidia and has lost market share to AMD in its CPU business for several years. It has also faced challenges in attracting customers to its new factories.

Tan, who became CEO in March, has been tasked to turn around the American chip-making icon, which recorded an annual loss of $18.8-billion in 2024 — its first such loss since 1986. The company’s last fiscal year of positive adjusted free cash flow was 2021. — Aditya Soni, David Shepardson, Andrea Shalal and Nandita Bose, with Juby Babu and Max A Cherney, (c) 2025 Reuters

Get breaking news from TechCentral on WhatsApp. Sign up here.