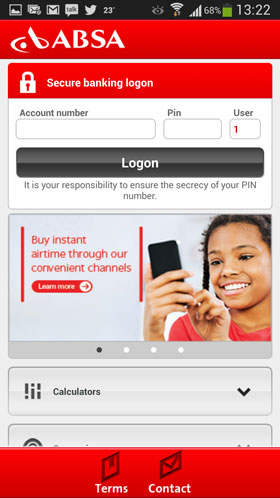

Three weeks ago, in mid-April, Absa became the last of South Africa’s big banks to launch a mobile transactional banking application for smartphones and tablets, beaten at the finish line by First National Bank, Standard Bank, Nedbank and Investec.

But Absa, South Africa’s second largest retail bank by customer numbers, says its clients can expect a much faster pace of innovation now that it has built the technology foundations needed for this.

“Our banking app is built in such a way that every eight weeks we will bring innovation on top of it,” says Absa retail banking chief Arrie Rautenbach, speaking to TechCentral in an exclusive interview. “This will not be digital innovation in isolation, but rather off the back of the full retail banking proposition. So, at some point you will see the home loans app coming on there. It’s all around this single customer solution set. We have the capability now to export that up into Africa because the tracks are in place.”

Rautenbach says Absa “made compromises” by waiting such a long time to bring an app to market. “We could have done it significantly earlier, but then it would have been static for a period of time. We decided to wait a bit longer, to use the right architecture that allows us to innovate continuously. The speed to market is going to be unmatched in the South African and African context.”

Absa is promising an update to the app every eight weeks, and has a roadmap of developments through to 2015. The next version, due out in June, will support BlackBerry smartphones for the first time, and bring new functionality to the iPhone, iPad and Android versions.

Absa chief information officer Alpesh Patel, who has just finished leading a complex and complete overhaul and consolidation of Absa’s IT assets, tells TechCentral that the decision to take longer to develop the app was a “well thought-through and strategic decision”.

The bank is keen to be seen to be an innovator in technology and products in a slow-growing economy where retail banks are increasingly poaching one another’s customers. First National Bank, in particular, has done well to use technology and clever marketing to create the perception that it is more innovative than its rivals.

But Absa is fighting back. By midyear, it will launch the Pebble payment device, developed in South Africa by Thumbzup, a company led by technology entrepreneur Stafford Masie. It’s a small piece of hardware that can be used to accept payments from chip-and-pin or magnetic credit and debit cards using a mobile phone, tablet computer or PC. The device connects to the 3,5mm audio jack on smart devices and has both a slot of chip cards and another for swiping magstripe cards.

“The Pebble innovation is going to be world class,” says Rautenbach. “It will solve the South African and Africa needs and is very different to what you currently see in the marketplace. We have to get cash out of the system, and the Pebble allows us to move into a part of the market that has never been digitised.”

Once a pilot has been conducted in South Africa, Absa intends taking the Pebble to the other markets in which it operates across Africa.

Though Absa is not keen to disclose how much it spends in total on IT each year for competitive reasons, Patel will say that about R2bn of its IT budget goes into “innovation” projects — this includes projects such as the app and the Pebble — and it’s the bank’s intention to maintain this level of spending in the years ahead.

“The idea is to run your maintenance efficiently to be able to get more into the investment pot. We recognise we have to continue investing and our plan is to be north of R2bn on a sustainable basis.”

The bank has spent the past couple of years integrating its disparate IT systems, creating a combined technology function that supports all areas of the business, including the retail and business bank, Absa Financial Services and Barclays Africa.

“Barclays Africa ran its own IT, on the applications side from the UK, and on the infrastructure side from South Africa,” Patel explains. “About 15 months ago, we combined it all and de-layered the organisation and it became a lot more aligned to the business.”

Each business also used to have its own “digital” arm — focused on technology-based customer-facing solutions — and this, too, has been consolidated into its own single stream.

This integration, together with the fact that the bank is owned by Barclays, allows it to leverage global contracts for lower prices where it makes commercial sense. It doesn’t always make sense to be part of global buying since software vendors, for example, offer special emerging-markets pricing.

“Architecturally, wherever it makes sense, we are aligning more and more with the worldwide operations,” Patel explains. “We have seats around all the global tables.”

Absa’s mainframe “stack” has been engineered to the same standards as the Barclays mainframe in London. It remains a “wholly independent” mainframe, but by having a common engineering standard, Absa IT staff in South Africa are able to support the UK mainframe if needed, and vice versa, says Patel.

The consolidation of the IT systems of the retail and business bank, Absa Capital, Barclays’ operations in Africa and Absa Financial Services has led to nearly a 10% annual cost saving in nominal terms. Although some IT staff were let go — “many through natural attrition” — Patel says the number in the overall scheme of things was “tiny”. He says he can’t disclose the number of staff affected because of an agreement with the affected trade unions.

“As painful as the first six months of the process was, the best thing we did was move decisively once we’d gone through all the governance processes and stuff,” he adds.

Rautenbach says the increasingly competitive South African banking market is forcing all the banks to be more creative and innovation and technology play a crucial role in doing that.

“In the past, consumers were comfortable with an aggregated approach. Now we need capabilities to deal with customers at an individual level,” he says.

“The technology behind that has to be world class. That’s where differentiation sits. We run our business in a fully integrated way. We have the capability to bring it all together in the back end.”

Absa intends to spend more money on analytics to “ensure the final solution we are bringing to customers is relevant, applicable and timeous”, Rautenbach says. “We can now price at an individual customer level, which is a significant innovation that technology has allowed us to bring to the South African market.” — (c) 2013 NewsCentral Media