For decades there has been a prevailing belief to “buy low and sell high” in order to be profitable when investing. It’s time to retire that expression.

For decades there has been a prevailing belief to “buy low and sell high” in order to be profitable when investing. It’s time to retire that expression.

Legendary investor Howard Marks has publicly stated his opinion that selling an asset (even when you have made a profit) may be foolish. His justification for this statement is that, although taking profits never made anyone broke, selling an investment interrupts compound interest and can cause you to lose out on excess returns. Let’s explore why this sentiment holds true and how it can benefit you in the long term.

Compound interest: Is it really that powerful?

Now, you may have heard the saying that compound interest is the eighth wonder of the world, and there is good reason for that. Compound interest plays on momentum and is responsible for nearly all investment success. If you have ever watched your favourite team score that winning goal in the last 10 minutes after being down the whole match, then you know that momentum has a funny way of driving a team to success — the same goes for investments.

Let’s explain this through a simple example.

You are given two options. Every day for a period of time, you can either receive a dollar or you can receive a single cent that will double in value, which would you choose? You might be inclined to choose the dollar option: it is worth 100 times more in value than a cent, after all. It seems like the logical choice. But consider that on the 12th day, the person who chooses the dollar will have $12 and the person who chooses the cent will have $20.48.

That’s the magic of compound interest.

Now that you know how powerful compound interest is, you can see why interrupting compounding is not ideal.

Does this mean you should never sell an investment?

Marks says there are two situations where you should sell: either there is a better investment opportunity or when the reason you invested in something is no longer true.

For example, if you’ve invested in a stock that was making a lot of revenue but has now stopped returning that money, or if the company is facing legal trouble that could sink the business, then you should think about selling. The same goes for if you discover a much better investment, which is known as opportunity cost or the cost of missing out on an opportunity. Other than these two main reasons, Marks believes that selling for any other reason does more harm than good.

But trading an asset can’t be that harmful to investment gains, can it?

Yes, it can. A study was done on the S&P 500 (an index of the top 500 US stocks) and its return profile from 1996 to 2015. It was found that, on average, the S&P 500 returned 8.2% year-on-year for 19 years straight. To put that into perspective, if you invested $1 000 in 1996, it would be worth $4 469 in 2015, or a 347% return.

The study then further looked at the effects of missing out on top trading days in the market due to people trying to trade and not simply invest and hold.

What they found was staggering.

From the above graph, you can see that if you missed out on the top 10 trading days because you were trying to time the market, your returns shrank to just 4.5%/year. That means you earned less than half the returns on your $1 000 investment (making a total of $2 307). Missing out on the top 20 trading days means your returns came in at just 2.1%/year — that’s a loss of $2 987 extra. Finally, missing on the top 40 days, you actually lost 2%/year for 19 years — causing you to have $681 at the end of the period instead of $4 469 from just holding.

This study demonstrates the power of long-term investing over trading.

So, the question becomes this: do you think it’s worth taking the risk of trying to trade the markets if it means losing out on most of your investment’s potential return?

What does this mean for me?

The cryptocurrency market is like every other financial market. The main difference is that the historic returns are higher over most comparable time periods and the price swings, otherwise known as volatility or risk, are greater. But that makes it even harder to try to trade and time the best buying and selling points.

However, if you take a long-term view and look at the bigger picture, the crypto market shows a clear trend and the returns have been well worth the extra risk.

As seen above, the crypto market, represented here by bitcoin, follows a clear trend. If you try and trade it day-to-day this can become a costly mistake and you could miss out on earning some incredible returns that compound over time.

How do I know what to invest in for the long term?

Nobody knows with 100% certainty which investment will be the best over the long term. But you can use a smart trick that almost all investors use: diversification. The adage of not putting all your eggs in the same basket.

Diversification accomplishes two things:

- It reduces your risk and makes your overall investment journey a less volatile ride.

- It spreads your bets across multiple potential winners and can be considered a clever way to invest in an emerging innovative space, like cryptocurrencies, where the winner could be anyone.

As an investment analyst at Revix, Chris Beamish, loves to say, “Investing in crypto is like investing in the Internet in the 1990s.”

Early-stage innovative technology has been a great investment opportunity as the world has clearly seen with the rise of the Internet.

“Out of the top 50 Internet stocks at the very peak of the dot-com bubble in 2000, 88% of those stocks didn’t make it and went bust by 2017. But the winners in that top 50 ended up being Amazon, Google, eBay and Yahoo,” says Beamish. “The small allocation made to these winners made up for the losses of the losers and ended up returning around 14%/year during that period.”

Crypto bundles or diversified baskets of cryptocurrencies that either track the overall crypto market or certain sectors within the crypto space are the easiest and smartest way to gain exposure and invest in the market. It’s similar to investing in an ETF, where you get loads of low-cost diversification through a single investment product.

When it comes to crypto bundles, there really isn’t a more trusted name in town than Revix. Not only will you constantly hold the largest and most reputable cryptocurrencies, but your bundle will also automatically rebalance every month to keep you up to date with any possible new winners entering the space. This way you never miss out on holding what could potentially be the next Amazon.

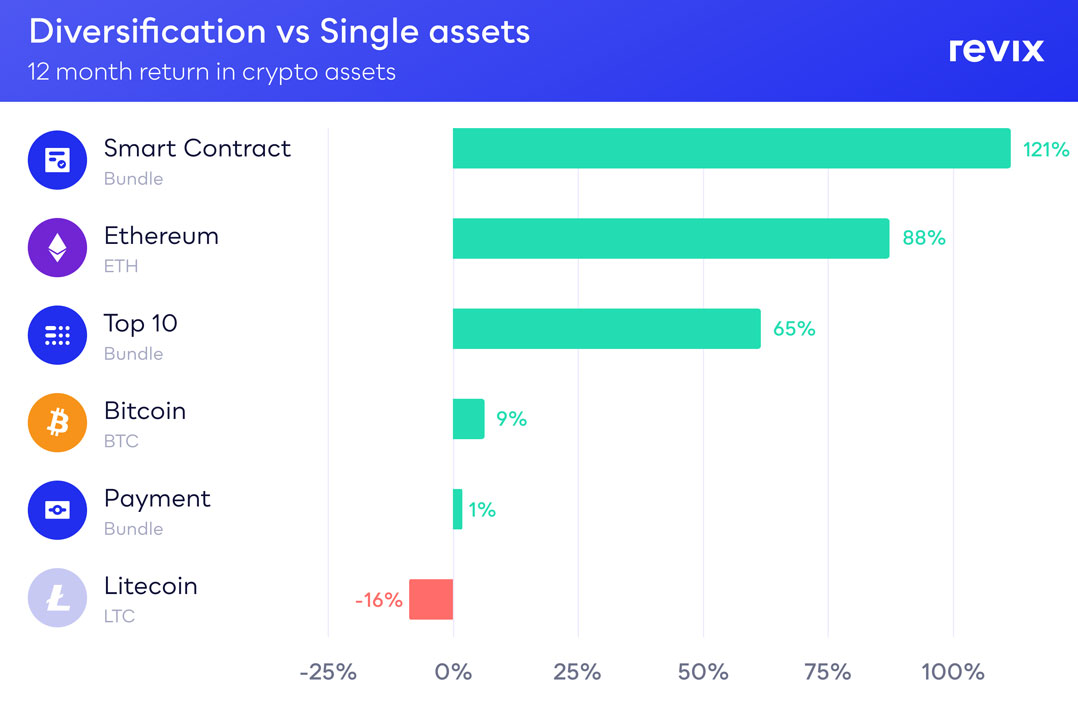

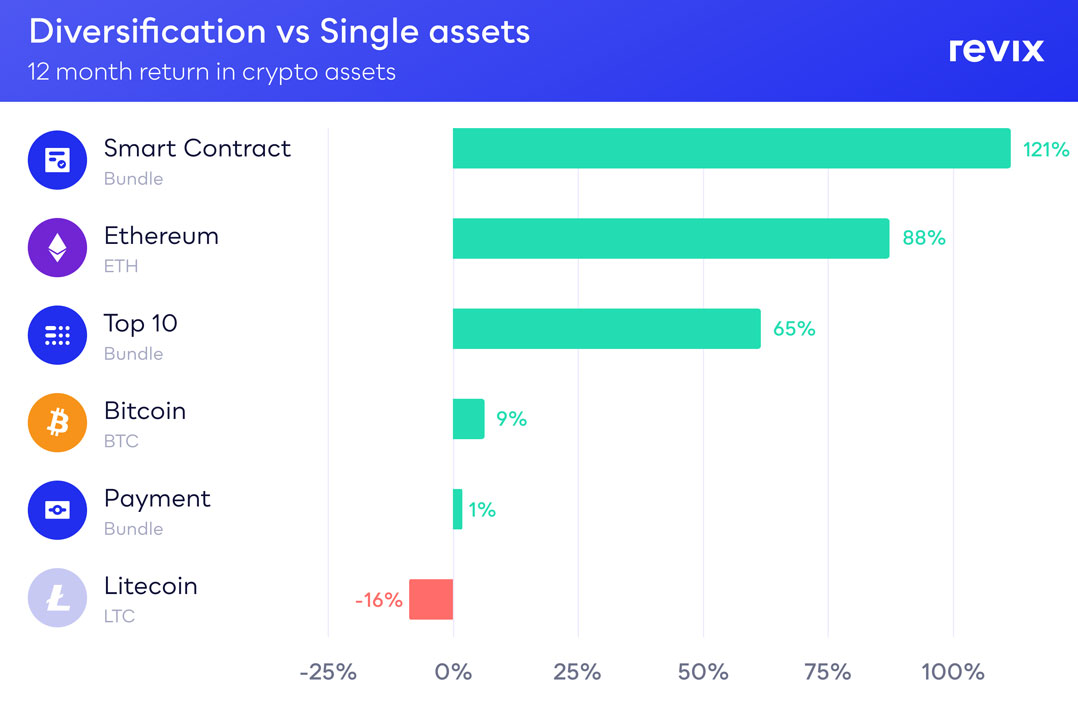

As you can clearly see above, Revix’s bundle approach to investing in cryptocurrencies has beaten the major cryptocurrencies of each sector:

- Smart Contract Bundle (+121%) beat ethereum (+88%)

- Top 10 Bundle (+65%) beat bitcoin (+9%)

- Payments Bundle (+1%) beat litecoin (-16%)

This should show you how diversifying your investments can have major benefits over a longer time period.

Where can I invest in single cryptos as well as diversified bundles?

Revix is a Cape Town-based crypto investment platform, backed by JSE-listed Sabvest, that offers something unique to you, the investor.

You can either invest in standalone cryptocurrencies — like bitcoin, solana, ethereum, uniswap, cardano and more — or set yourself apart from the rest by investing in ready-made diversified crypto bundles which look similar to ETFs.

Revix’s crypto bundles allow you to effortlessly own an equally weighted basket of the world’s largest and, by default, most successful cryptocurrencies without having to build and manage a crypto portfolio yourself. Revix currently offers three bundles, namely the Top 10 Bundle, Payment Bundle and Smart Contract Bundle.

- The Top 10 Bundle is like the JSE Top40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 75% of the crypto market.

- The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies looking to make payments cheaper, faster and more global.

- The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like ethereum, solana and polkadot that allow developers to build applications on top of their blockchains, similar to how Apple builds apps on top of iOS.

About Revix

Revix brings simplicity, trust and great customer service to investing in cryptocurrencies. Its easy-to-use online platform allows you to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Disclaimer

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose and, before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.

To learn more visit www.revix.com.

- This promoted content was paid for by the party concerned