Credit and debit card fraud have declined nationally, the SA Banking Risk Information Centre (Sabric) said on Tuesday.

Credit card fraud between January and September this year, totalling R300,6m, dropped by 18% compared to the same period in 2011, said Sabric’s commercial crime office general manager Susan Potgieter, in Midrand.

Debit card fraud declined by 7%.

Potgieter told reporters this was attributable to more efforts by banks to tackle fraud, more policing of card fraud, and more awareness by consumers of the dangers of fraud.

The national trend was, however, not reflected in Gauteng, where 54% of all card fraud took place. Credit card fraud had shown a 0,36% increase, while there was a slight decrease of 3,8% in debit card fraud.

“We have the biggest challenge here, and there are a lot of reasons for it,” Potgieter said. She cited Gauteng’s larger population and status as an economic hub as reasons. “Where business goes, crime follows, because there’s more opportunity.”

Gauteng was followed by the Western Cape and KwaZulu-Natal. The three provinces accounted for 91% of all card fraud in the country.

She said research had found that much of the credit card fraud being conducted was done by organised crime based in Johannesburg.

Potgieter emphasised the fraud was not being conducted by any one nationality but was “mixed crime”.

“To tie it to any particular jurisdiction is irresponsible.”

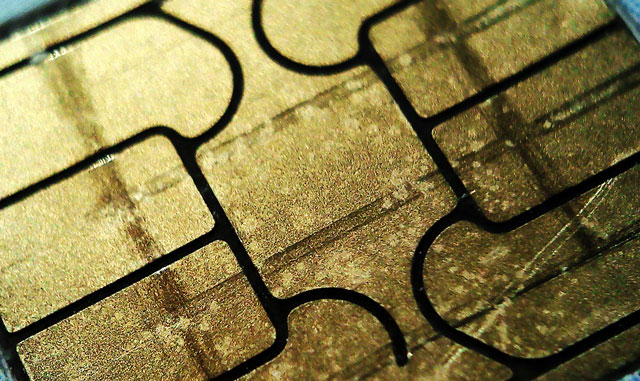

She said a common form of credit or debit card fraud involved “skimming”, where the victim’s card was run through a small, hand-held machine and its electronic data stolen.

Skimming could take place in businesses or at ATMs that had been tampered with.

Tampered ATMs had a skimming machine attached to the card reader and disguised to blend in with the rest of the machine. This machine would also likely have a small spy camera to capture the pin code.

Potgieter said all ATM users should take care to cover the keypad when they entered their pin codes, even if no one appeared to be looking.

The type of fraud had changed. There were fewer incidents of counterfeit cards, but there had been a spike in instances of what was dubbed “card-not-present” (CNP) fraud.

This involved transactions done online or over the telephone. Card holders had their card information — the numbers on the card and their name — stolen.

“CNP fraud is most certainly the trend of the day. It’s quite possible it’s still a growing trend,” Potgieter said.

She said consumers should only use websites that were reputable, or that had added security such as pre-registration of cards. They should make sure their cards were not left in the open where information could be taken. “You have to treat your card like it was cash.”

“Phishing” sites were another danger — fake websites designed to look like the legitimate sites of banks and other businesses.

People should make sure the computers they used for transactions were secure, as spyware — computer software that logged a user’s keystrokes — could allow for personal details to be stolen.

This information could also be stolen at ATMs. — Sapa