Facebook, a centralised corporate giant with a history of customer data-use controversies, is an unlikely candidate for bringing cryptocurrencies to the masses.

Facebook, a centralised corporate giant with a history of customer data-use controversies, is an unlikely candidate for bringing cryptocurrencies to the masses.

Yet many digital assets enthusiasts are now hanging their hopes on the company’s new digital coin succeeding where Bitcoin has not. Facebook said on Tuesday it will launch the token, called Libra, next year in partnership with finance and technology heavyweights including Visa and Uber Technologies.

Facebook hopes its so-called stablecoin, which is designed to be less volatile than bitcoin, will be used for global money transfers and commerce. The coin could instead become a place to park funds during market stress. Either way, Libra’s biggest achievement could be ushering in mainstream usage of a plethora of virtual currencies.

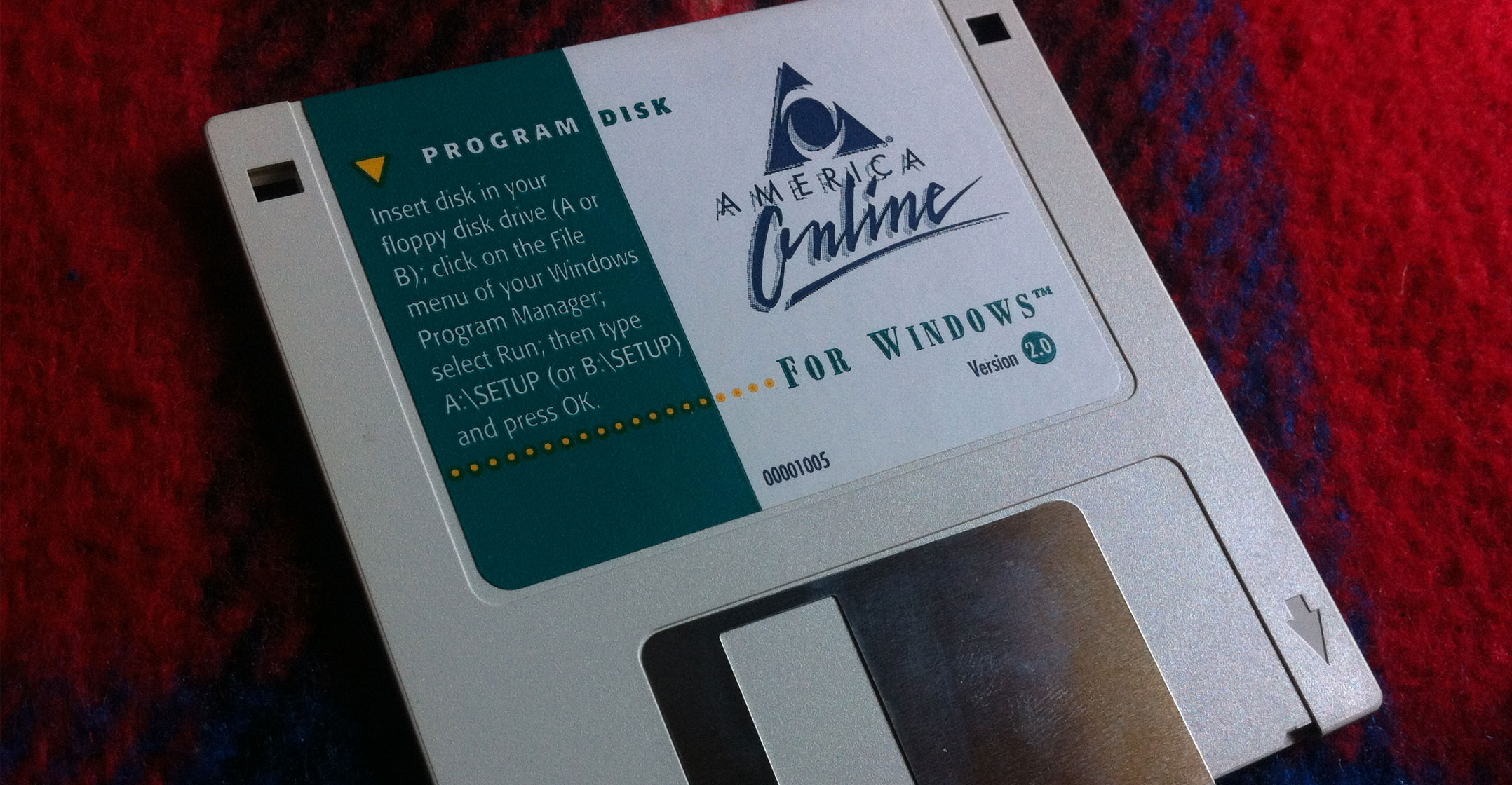

“It could be the America Online to the Internet,” Aaron Brown, an investor and a writer for Bloomberg Opinion, said in an e-mail referring to the US dial-up Web service pioneer better known as AOL. “America Online introduced 40 or 50 million people to the Internet in a simple, safe, inexpensive way.”

Only around 5% of Americans have owned bitcoin, according to a Federal Reserve survey. Facebook, with its 2.38 billion monthly users as of March, could open up cryptocurrencies to a much wider audience than the small circle of libertarians, computer geeks and day traders that have embraced digital currencies to date.

And Libra is only the beginning, according to Brown. In the same way that AOL was just the entry point to the Internet for many users, the Facebook venture could be a first step toward its customers seeing value in other crypto.

In other words, the coin could be “a gateway to bitcoin”, Travis Kling, founder of the Los Angeles-based crypto hedge fund Ikigai, said in an e-mail.

More bitcoin adoption

“In a roundabout way, Facebook competing with bitcoin and other digital assets will actually help spur more bitcoin adoption,” Jeff Dorman, chief investment officer at hedge fund Arca, said in an e-mail. “It doesn’t really matter what gets you into the ecosystem; once there, every blockchain app and every digital token becomes much more readily accessible.”

Libra should become available for purchase with cash at retail outlets, David Marcus, who leads the effort at Facebook, said in an interview. The coin’s path is being mapped out by Libra Association, of which Facebook is currently one of 28 members.

The token could find a receptive user base in developing countries such as Venezuela where skyrocketing inflation has already provided fertile ground for alternative non-state currencies like bitcoin.

“If you are talking about Venezuela or you are talking about Turkey, in those cases people may chose to hold it,” Diogo Monica, co-founder of Libra Association member Anchorage, said in a phone interview. “It’s one potential very good use case, but I think it will be in the minority.”

“If you are talking about Venezuela or you are talking about Turkey, in those cases people may chose to hold it,” Diogo Monica, co-founder of Libra Association member Anchorage, said in a phone interview. “It’s one potential very good use case, but I think it will be in the minority.”

Because Libra will offer lower transaction fees than mainstream payment methods, it also could become attractive for money transfers and merchant payments and compete with Western Union and Visa.

Libra could also become a favourite of crypto traders who until now have shown preference for another stablecoin called tether. However, unlike tether, which is only partly backed by cash and securities, Libra’s reserves, comprised of multiple fiat currencies and securities, will completely cover all coins in circulation, Marcus said. Also in contrast to tether, which is being investigated by the New York Attorney General over potentially misusing client funds, Libra will be regularly audited, Marcus said.

“If you are going to compare a stable coin that’s backed by an unknown entity and one backed by a large publicly traded company, all else being equal, there should be an advantage to the one backed by the large public company,” Gil Luria, MD for institutional equity research at DA Davidson & Co, said in a phone interview.

Tether, which holds the lion’s share of stablecoins today, isn’t worried about losing market share though.

“A mass brand like Facebook is likely to introduce a wider demographic into cryptocurrencies, which can only be beneficial,” Paolo Ardoino, Tether’s chief technology officer, said in an e-mailed statement. “The initial use cases of Facebook stablecoin will be largely different to the current adoption of tether, and therefore we do not anticipate much impact on tether other than bringing a new audience into the market.”

Very much in question

Whether Libra will be used in commerce is very much in question. For the last decade, multiple cryptocurrencies starting with bitcoin have tried and failed to penetrate coffee shops and retail stores. In the first four months of this year, only 1.3% of bitcoin economic transactions came from merchants, according to researcher Chainalysis. The majority of the rest related to trading.

“While Libra might be a big step in opening up a new wave of users to the benefits of asset-backed digital money, it comes with the risks of centralised pain points and vulnerabilities,” said Joseph Lubin, a co-creator of ethereum. “Data silos enable incumbents to maintain pricing power, and also come with the risks of data breaches, privacy, and security issues — problems that many have already begun to associate with Facebook.” — Reported by Olga Kharif and Alastair Marsh, with assistance from Kurt Wagner, (c) 2019 Bloomberg LP