Facebook and its partners are considering redesigning the libra cryptocurrency project so that the network accepts multiple coins, including those issued by central banks, in an effort to woo reluctant global regulators and rebuild momentum for the plan.

Facebook and its partners are considering redesigning the libra cryptocurrency project so that the network accepts multiple coins, including those issued by central banks, in an effort to woo reluctant global regulators and rebuild momentum for the plan.

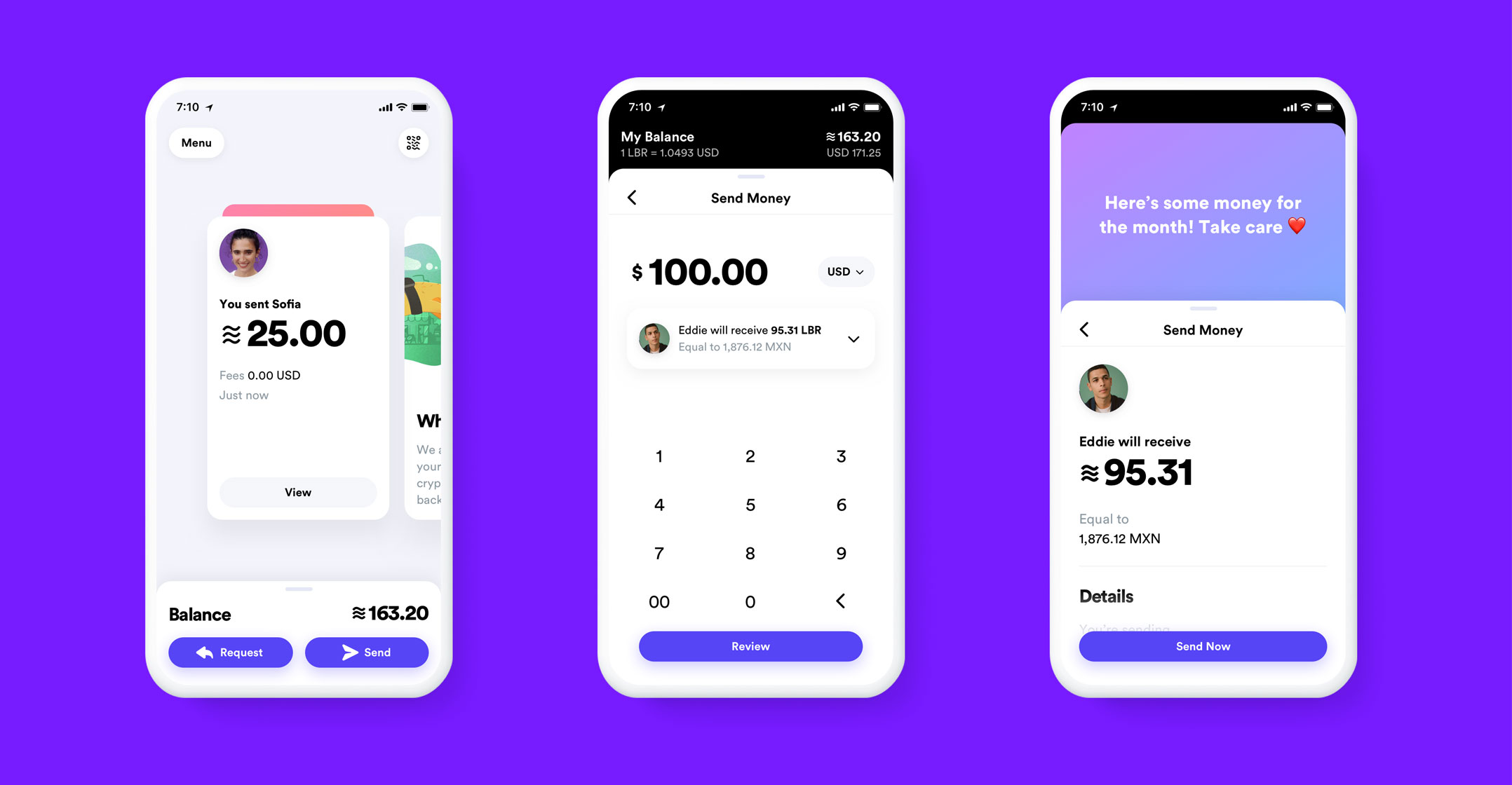

When Facebook unveiled libra, it said it intended to create a single global digital currency. Anyone, especially the 1.7 billion people who have no bank account, could send money anywhere in the world at little cost, as easily as sending a text.

Eight months later, after the idea ran into a wall of opposition, Facebook and the Libra Association, the consortium behind the digital currency, are looking at a revamp, said three people familiar with the matter. They are weighing a recast of libra as mostly a payments network that could operate with multiple coins, two of the people said.

The coins could include those issued by central banks and backed by the US dollar, the euro or other currencies, the people said. The association will re-introduce libra soon, said the people, who asked not to be named because the redesign remains in flux and the plan could change.

The dream of a single global coin isn’t dead, said one of the people familiar with the overhaul. The new plan could expand, not pull back from, the original vision, that person said.

But if the revamped libra becomes more of a payments network than a single, global cryptocurrency, the average US consumer might not see much difference between it and existing payments systems run by PayPal or numerous fintech startups that aim to seamlessly move funds around the globe.

‘Fully committed’

“The Libra Association has not altered its goal of building a regulatory compliant global payment network, and the basic design principles that support that goal have not been changed,” said Dante Disparte, head of policy and communications for the Libra Association, in a statement.

Facebook said it “remains fully committed to the project”.

What happened to libra since its June 2019 unveiling is a story of hubris, wary lawmakers, protective regulators and partners fearful of the risks involved. Facebook and 27 other companies announced the project as a way to connect the globe — while also circumventing the financial system — and reduce the cost of sending money, especially for unbanked populations. The project’s members included Visa, Mastercard and other large companies that would be Facebook’s partners in governing the system.

As originally envisioned, the libra coin would be created from a basket of relatively stable assets, such as US dollars and government bonds, euros, Singapore dollars, UK pounds and Japanese yen. A libra reserve made up of those currencies and debt instruments would support the token, whose value would adjust along with the underlying assets’ market value.

As originally envisioned, the libra coin would be created from a basket of relatively stable assets, such as US dollars and government bonds, euros, Singapore dollars, UK pounds and Japanese yen. A libra reserve made up of those currencies and debt instruments would support the token, whose value would adjust along with the underlying assets’ market value.

But the plan almost immediately ran aground. US lawmakers said they didn’t trust Facebook to manage a financial network after the company’s high-profile missteps in other areas, especially its repeated failures to protect user data.

Officials at some central banks said the new digital coin could undermine the sovereignty of their own currencies, while finance ministers worried that it could enable money laundering. Some European regulators vowed the project would never win approval.

As the Geneva-based Libra Association tried to formalise its membership in October, many of its most prominent members, including Visa and Mastercard, dropped out. The project now has 20 of the original 28 members, though it recently added two others — cloud-based commerce company Shopify and cryptocurrency trading platform Tagomi Trading.

Even as some left the project for dead, representatives of Facebook and the association have continued to meet with officials at the treasury department, the Securities and Exchange Commission and other US regulators to address their criticisms, the people familiar with the matter said.

Treasury officials, in particular, have continued to focus on how the project will ensure the payments network isn’t used for money laundering, one of the people said.

A security

Some people connected to the libra project worry that the SEC could rule that a coin backed by a basket of currencies is a security, which is a tradeable financial asset like a stock or a bond. Such a determination would subject the libra to a slew of disclosure requirements and impose the same tight restrictions that the regulator places on stock offerings, undermining the coin’s usability.

Central bank officials have also said that if Libra issues a coin backed by multiple currencies, it would undermine their ability to manage their own currencies.

Since Facebook announced the libra project, several central banks, including the Bank of England and the European Central Bank, have said they are exploring their own digital currencies. The overhaul is intended to ensure that the new payments network would be compatible, rather than in competition, with those projects, the people said.

Libra and Facebook officials have spent the past few months traveling the world to speak at conferences, making the case that a payments network such as libra could lower the cost of money transfers.

Libra and Facebook officials have spent the past few months traveling the world to speak at conferences, making the case that a payments network such as libra could lower the cost of money transfers.

At the World Economic Forum in Davos, Switzerland, in January, Facebook executive and libra co-founder David Marcus emphasised that the libra network wouldn’t preclude central bank projects.

“I want to really make that distinction between the network and the assets that are running on top of the network, which I think could be issued by many different entities whether it’s central banks or the private sector,” Marcus said, signalling that Libra’s new form could host multiple digital coins.

“We think there’s a lot of momentum building,” said Jennifer Campbell, the founder of Tagomi, one of the new members of the consortium. She said libra “is definitely first and foremost a payment system. Within that there’s definitely also a coin that’s part of that strategy.”

Libra could still face hurdles. Congressional staff and officials associated with libra have said the project might be defined as systemically important, people familiar with the matter said. Should that happen, libra could get yet another layer of regulation by the US Federal Reserve, which would mean following its rules on equity capital and stress testing.

The Libra Association originally planned to launch its cryptocurrency this year, and Campbell said the technology is already being tested. But solving the regulatory challenges could take much longer, and Facebook has vowed that it won’t stay in the project without US approval. — Reported by Joe Light, Ben Bain and Olga Kharif, (c) 2020 Bloomberg LP