JSE-listed Homechoice International’s pivot from its legacy retail business towards fintech through its Finchoice and PayJustNow offerings has helped the group deliver a solid set of results despite economic headwinds constraining its retail customer base.

While group revenue for the year ending 31 December 2023 was flat at R3.7-billion, operating profit grew by 28% year on year to R619-million. The group’s fintech arm, Weaver Fintech, houses the Finchoice and PayJustNow businesses, and contributed 92% to profits before group costs, despite retail sales being down 24% year on year.

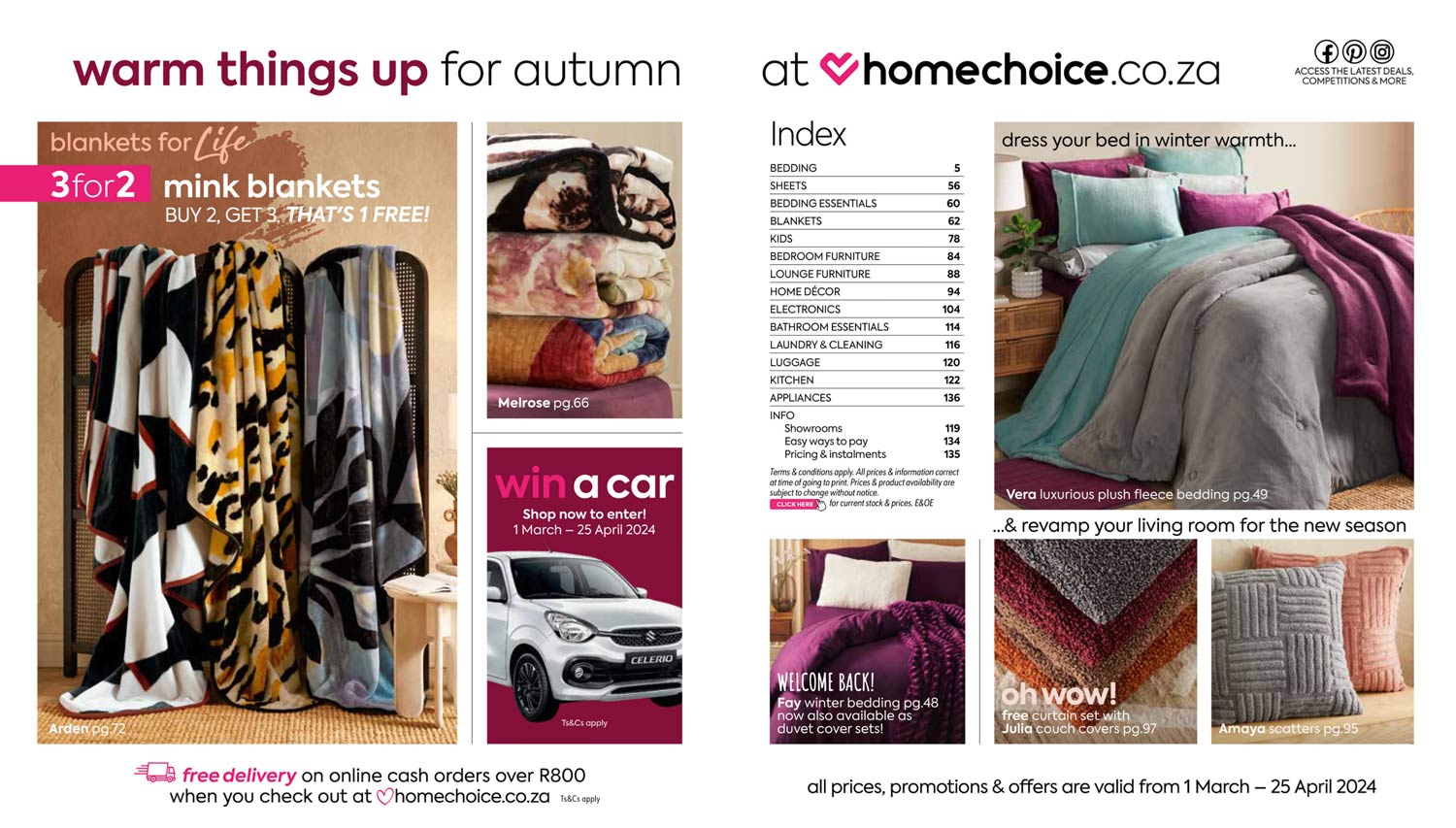

The HomeChoice brand, which was established in 1985, was built on a mail order retail business that focused on supplying household goods and consumer electronics marketed through its popular seasonal catalogues. The company’s pivot into fintech began in 2007 with the launch of Finchoice.

“We have transitioned from being purely a retailer, augmenting into a financial services business, Finchoice, and now into more diversified fintech being the Weaver business,” says Sean Wibberley, group CEO at Homechoice International.

“We started by taking the customers who bought from Homechoice and repaid for the goods they bought over time, analysed their payment performance, and offered them financial products appropriate to their needs because we knew more about them than the market did.”

“We were able to use data cleverly to serve the customer by offering them products like lending, insurance and now the BuyNowPayLater product.”

BuyNowPayLater is an interest-free digital lending product that allows customers to pay for items over three months. When a customer uses the service, HomeChoice pays for the item minus a service fee that is charged to the merchant, with the benefit being that customers are able to “buy upwards”, only paying a third upfront and getting their purchase items immediately.

Digital first

The group’s digital-first, data-driven strategy is beginning to yield results by opening up avenues for the cross-selling of products to customers within the group, regardless of the channel they used first to enter the Homechoice ecosystem. Data profiling is used to ensure that customers are only offered products they need and can afford, which improves the quality of the group’s debt by keeping repayments high.

Wibberley does admit, however, that a 2023 decision to tighten lending criteria in the Finchoice business helped manage credit risk in a high inflation environment, but in hindsight the company did “leave some opportunity behind” by being too conservative at the time.

Wibberley hopes that forecasts of interest rate cuts later in the year are accurate as decreased pressure on consumers will drive sales not only in retail but in the fintech businesses as well, which the group wants to drive in an effort to swap a portion of its credit income for more fee-based revenue over time.

“Our insurance portfolio, which is highly cash generative, draws fees from trades in the BuyNowPayLater network. We are looking at augmenting this with other fee-generating products and other networks and really driving the volume of insurance into the PayJustNow database so we can upweight the fee distribution in the [revenue] mix,” says Wibberley.

“Our insurance portfolio, which is highly cash generative, draws fees from trades in the BuyNowPayLater network. We are looking at augmenting this with other fee-generating products and other networks and really driving the volume of insurance into the PayJustNow database so we can upweight the fee distribution in the [revenue] mix,” says Wibberley.

The group’s retail business is least reliant on digital touchpoints. According to Wibberley, the bulk of Homechoice retail sales, about 60%, are call centre driven. The rest are split between its online channels and the retail showrooms spread across the country. The showrooms are a recent addition to the group’s retail strategy, but as Wibberley says, they have helped drive sales by giving those customers who want a tactile experience with their products the opportunity to engage with the brand in that way, while also serving as a collection point for those customers who need it.

The Finchoice and PayJustNow businesses are far more digitally driven, each executing 95% and 100% of their sales though online channels, respectively.

Read: PayJustNow: Pick n Pay to let consumers buy smartphones and TVs on credit

“Our retail business has reset its structures completely and is now set for growth. The Weaver business is also only getting started, the ecosystem is now digitally integrated and it’s exciting to see that we are going to be able to cross-sell products that consumers like that are fairly priced and conveniently accessible digitally,” says Wibberley. – © 2024 NewsCentral Media