Let’s face it: we all have to find somewhere to keep our money safe. To some, that’s under a mattress. To others, it’s in a bank account. To the financially savvy, it’s in a diverse portfolio of investments that includes shares, property, gold and cryptocurrencies.

Let’s face it: we all have to find somewhere to keep our money safe. To some, that’s under a mattress. To others, it’s in a bank account. To the financially savvy, it’s in a diverse portfolio of investments that includes shares, property, gold and cryptocurrencies.

The reason that most people choose not to build an investment portfolio is because they think they need to be wealthy to do so, but that’s not true. “You begin with as little R500 to start building your diversified portfolio. You just have to know where to start,” explains Chris Beamish, investment manager at Cape Town-based Revix.

Investing during times of conflict adds its own layer of risk and makes conservative investing more important than ever. With the world uncertain of what will happen next, your investment strategy could use its own line of defence.

No matter where you are in the world, the Russia-Ukraine conflict is going to affect your investments. But this isn’t the time to be hiding your money under the mattress. Uncertain times bring opportunity; being savvy with your money now will help you weather the storm and gain security during uncertain times.

Luckily, there are safe-haven investments that are able to fortify your wealth. Investing in gold during times like these offers more than just positive returns in the long term, it solves unexpected issues that arise in times of crisis.

What does war mean for your finances?

Investing during volatile times can be difficult because of the increased unpredictability.

Firstly, conflict causes disruptions to a country’s ability to produce goods and services.

These disruptions generally cause a knock-on effect that leads to goods and services becoming more expensive — this is known as inflation.

Secondly, conflict is expensive. Billions get spent on funding the military with weapons and machinery. A government will risk debt over defeat so it’s the taxpayers who shoulder the cost.

It’s not time to panic; it’s time to be a smart investor. You can use this knowledge to position your portfolio in a way that protects you from harm but also helps you benefit from any potential upside.

So, where should you be investing?

The answer to that question is, in safe havens.

Safe havens are investments that maintain or increase in value during times of market uncertainty. Even during turbulent times in the world, these assets hold strong and provide the security your portfolio needs to weather the storm. Gold is one of the most favoured choices because of its proven credentials as a wealth protector.

Throughout history, few investments have rivalled gold in popularity as a hedge against almost any kind of trouble, from inflation and economic upheaval to currency fluctuations and war. Gold has historically been seen by investors as the “go-to” in terms of safe-haven assets.

There’s an old saying in investing: “Own gold and hope it doesn’t go up.” When gold’s on the rise, everything else (like stocks, property, etc) is most likely going down. The precious metal has not just survived bear markets, after all, it has thrived in them.

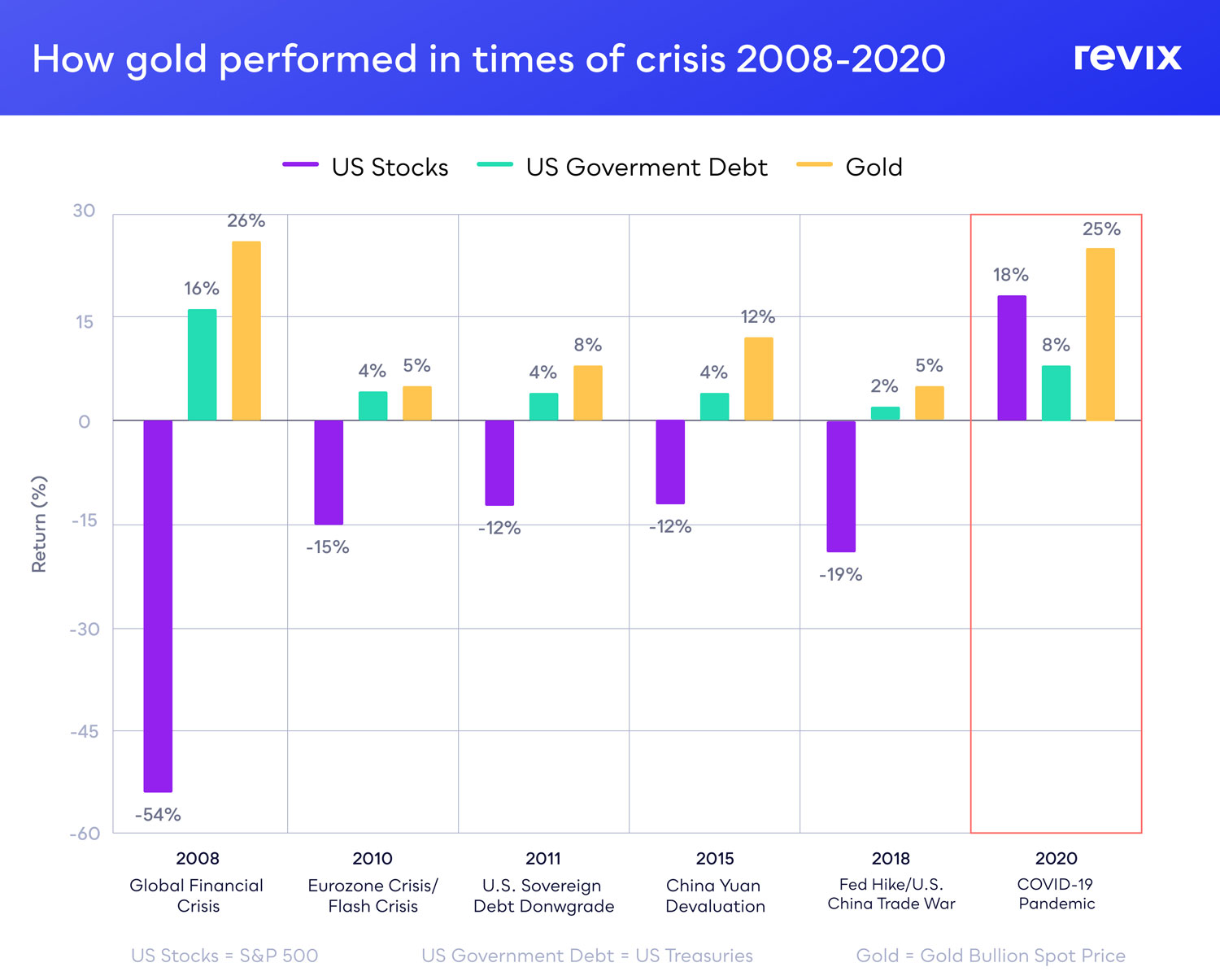

As shown below, gold has outperformed most traditional assets in times of uncertainty. This was most noticeable during the Covid-19 pandemic of 2020 when gold shot up 25%, against 18% for the S&P 500 (a gauge of the US stock market) and 8% for US treasuries (debt that the US government has and is viewed as generally very low risk).

With the uncertainty over Russia and Ukraine, this time is no different. We have already seen gold up over 10% this year, while the S&P 500 is currently down 11%.

Simply put, investing in a safe-haven asset like gold is the safe choice when there is conflict in the world.

How can you invest in gold?

The drawback of investing in physical gold bars is that they are expensive to store, secure and insure against loss. Plus, unless you are paying the tab with a gold bar, they aren’t exactly mobile. Luckily this centuries-old investment has gone through a contemporary evolution with Paxos Gold (PAXG).

You can invest in gold through Paxos Gold (PAXG), a US-regulated and insured ounce of physical gold that sits on a blockchain. PAX Gold is for anyone looking to invest directly in gold without the custody and insurance burdens of physical ownership. One PAXG token is backed by one fine troy ounce of the highest-quality gold stored in high-security, fully insured vaults.

When you buy one whole PAXG token or a fraction of a PAXG token, you’re buying the legal ownership right to an ounce, or a fraction of an ounce, of a physical gold bar. It’s like buying a stock where you have legal ownership even though you don’t physically hold or look after the company itself. It’s one of the benefits that blockchains bring to investing — lower costs, greater efficiency and more security.

Invest in PAXG

You can effortlessly invest in PAXG with Revix, a Cape Town-based investment platform backed by JSE-listed Sabvest. With all Revix’s investments, there are no lockup periods, meaning that you can withdraw your funds at any time. There are no monthly subscription fees, and you can get started with as little as R500.

Revix’s website can be found at www.revix.com. There you can reach out to the company’s live customer support team, who can guide you through the sign-up process to your first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

How to sign up to Revix

Sign up for free with Revix today

Revix is accessible to everyone, the online platform is ideal for people who want to get started in investing but are unsure how or where to start. The company’s focus is to make investing easier so that many more people have access to investing in this new investment category of tokenised commodities (like PAXG), cryptocurrencies and other emerging investment categories.

What else does Revix offer?

What else does Revix offer?

With Revix, you can also invest in another set of alternative investments: cryptocurrencies.

You can invest in bitcoin, ethereum and loads of other cryptocurrencies. Revix also offers three ready-made crypto bundles that are like the S&P 500 for crypto. Investors gain diversified exposure to the top-performing crypto assets in just a few clicks.

- The Top 10 Bundle provides equally weighted exposure to the top 10 cryptocurrencies making up more than 85% of the crypto market.

- The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies, including bitcoin, XRP and litecoin. These cryptos aim to make payments cheaper, faster and more global, and are aimed at those who believe making payments with cryptos will become as easy as sending an e-mail.

- The Smart Contract Bundle provides equally weighted exposure to the top five cryptocurrencies built around smart contracts and includes the likes of ether, EOS and tron. Smart contract cryptocurrencies sit on the blockchain rather like mobile apps rest on Android or iOS. These cryptocurrencies aim to revolutionise how supply chains and trading networks operate through smart contracts. This is Revix’s top-performing bundle as it has benefited from the explosive growth in the decentralised finance (or DeFi) space in 2021.

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform enables anyone to securely own the world’s top investments in just a few clicks.

Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

For more information, please visit www.revix.com.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned