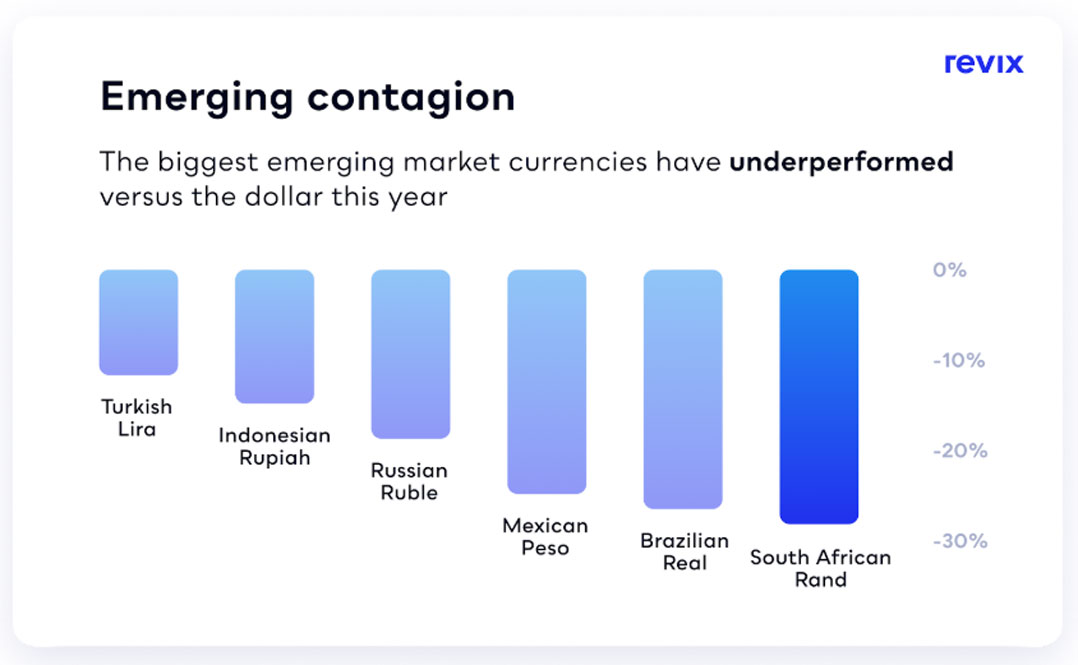

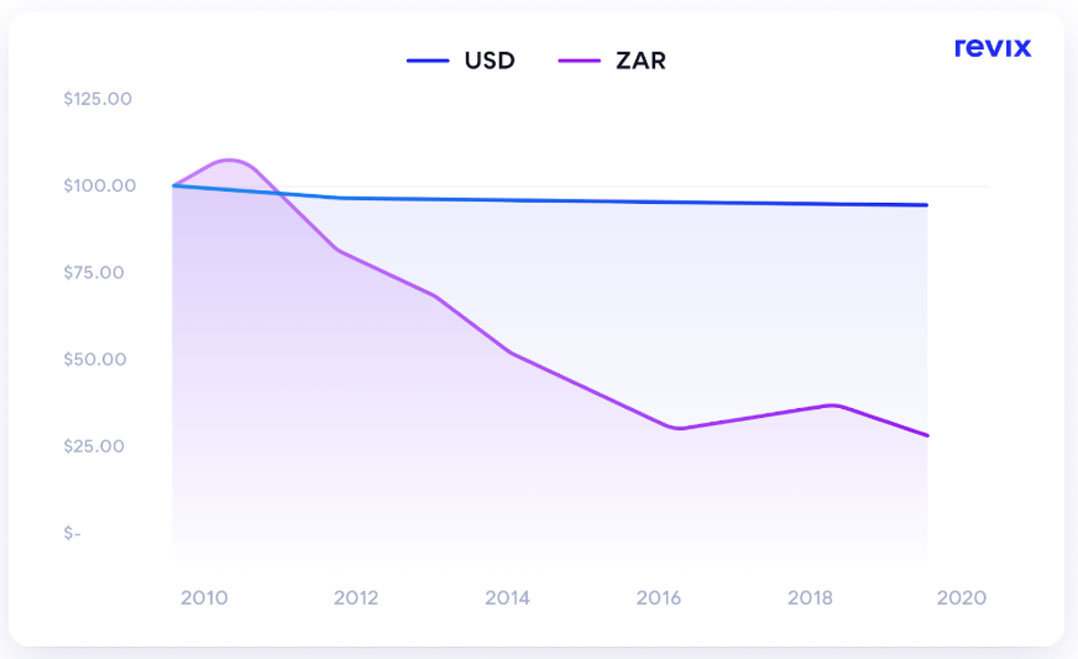

The rand has lost over 40% of its value to the US dollar since this time last year and is down 60% to the dollar over the last decade.

The rand has lost over 40% of its value to the US dollar since this time last year and is down 60% to the dollar over the last decade.

Globally, it has been the worst-performing currency over 12 months. If you factor in the inflation rate of South Africa, relative to the US, over the last 10 years, the picture gets even worse, with 90% of the rand’s “real” value lost to the dollar. (South African inflation has averaged 4.4%, according to the Reserve Bank, while the Federal Reserve reports an average US inflation rate of 1.8%. This 2.6% difference in inflation means the “real” value lost by the rand is 90%, relative to the dollar.)

To make matters worse, all three major credit rating agencies recently cut South Africa’s credit rating. These agencies now deem South African debt to be “junk”, with Fitch having the most pessimistic outlook with a rating two notches below “junk”. Collectively, these agencies estimate that South Africa’s debt burden will reach about 91% of GDP by 2023, up from 69% today.

To make matters worse, all three major credit rating agencies recently cut South Africa’s credit rating. These agencies now deem South African debt to be “junk”, with Fitch having the most pessimistic outlook with a rating two notches below “junk”. Collectively, these agencies estimate that South Africa’s debt burden will reach about 91% of GDP by 2023, up from 69% today.

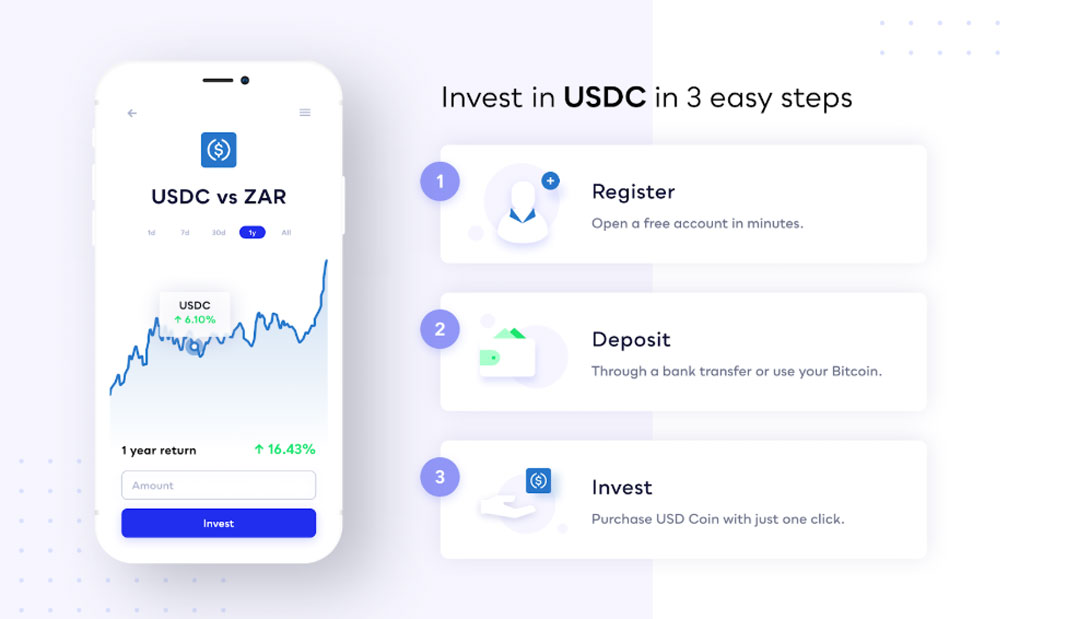

Sean Sanders, CFA Charterholder and CEO of investment platform Revix, believes South Africans should be protecting their wealth by holding hard currencies, like the US dollar and alternative assets including gold and cryptocurrencies. In response to the rapid depreciation of the rand, Revix — backed by JSE-listed Sabvest — has listed USD Coin, a dollar-backed crypto asset.

Click here to invest in USD Coin with Revix

Why invest in USD Coin?

Every central bank around the world has expanded its balance sheet and issued unprecedented sums of money. What we’re witnessing is a debasement of global currency values like we’ve never seen before. People are seeking safe harbours for their hard-earned money in these turbulent times and are turning to stablecoins like USD Coin.

The US dollar is the world’s most transacted currency and generally appreciates relative to other currencies when global risk levels increase. USD Coin, or USDC, is a crypto asset with a stable price — otherwise known as a stablecoin — which is backed one-to-one by US dollars held in reserve by regulated financial institutions. Every token can be redeemed for one dollar — providing a dollar-linked stable investment.

Click here to invest in USD Coin with Revix

Click here to invest in USD Coin with Revix

Sanders explains: “These are uncertain times. The coronavirus pandemic is far from over, jobless claims have soared and now South Africa will have higher borrowing costs thanks to the rating downgrades.

“At Revix, our mission is to provide a ladder of opportunity for wealth creation and, in times such as these, wealth preservation. We do this by making it possible to invest in alternative assets like USDC, a US dollar-backed crypto asset, PAXG, a gold-backed digital token, bitcoin, and a variety of diversified ready-made cryptocurrency “Bundles” for as little as R500.”

How to sign up to Revix

Sign up to Revix today for free

Sign up to Revix today for free

About Revix

Revix is an investment platform that allows anyone to create a diversified portfolio or “Bundle” of assets in just a few clicks. They bring simplicity, trust and great customer service to investing. Investing is as easy as signing up, choosing an asset, and then watching your portfolio grow. For more information, head to www.revix.com.

- This promoted content was paid for by the party concerned