Stellenbosch’s SnapScan, whose smartphone application won MTN Business’s 2013 App of the Year award this week, is betting that consumers will take to the idea of making in-store payments using their mobile phones instead of credit or debit cards.

SnapScan falls under FireID, the company that now houses six start-up technology businesses, SnapScan being the most recently launched.

FireID started life as an information security company specialising in “two-factor authentication” technology for mobile phones. It was funded by billionaire Johann Rupert, through Reinet. Justin Stanford, one of FireID’s co-founders, was instrumental in securing the initial capital injection. However, Stanford was unable to convince Reinet’s investment committee to continue investing and in 2011 it pulled its funding of FireID, forcing the company to lay off its 40 employees.

Shortly thereafter, one of FireID’s co-founders, Malan Joubert, negotiated a management buyout and repositioned the company as an incubator for technology companies with its security business being spun off as FireID Security.

To use SnapScan, consumers download the app for Apple, Android or BlackBerry, and add their credit card details by taking a picture of their card and creating a Pin. They can then use the app to scan a QR (quick response) code — a type of barcode — in a store and can make payments.

SnapScan co-founder, 28-year-old Kobus Ehlers, says there are a number of benefits to this approach for retailers. “It takes about 30 seconds to sign up. We issue a QR code, which you print, and you’re done.”

Merchants without bank accounts can cash out their takings at the end of the day. “Customers can pay with the app, the retailer can then get a voucher code at the end of the day that they can punch in at a Standard Bank ATM — or hand over at a Spar — and get cash.”

If customers don’t have the app installed, scanning the QR code will take them to the relevant app store where they can download it.

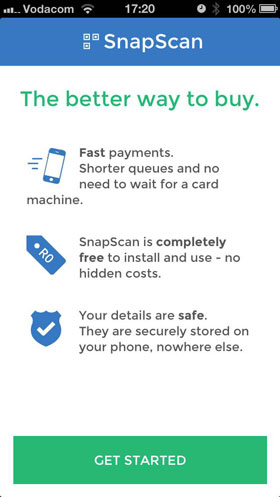

“Payment information sits securely in the app,” Ehler says. “So, your card details only have to be put into the app once and thereafter all you have to do is enter your Pin. This means we never transmit your card details to the merchant.”

SnapScan works with debit cards and credit cards, and there are no sign-up, setup or installation fees. There is also no monthly fee payable.

SnapScan works with debit cards and credit cards, and there are no sign-up, setup or installation fees. There is also no monthly fee payable.

The company makes its money by charging a small transaction fee to the retailer on each purchase. This fee varies. “We take a small transaction fee, much like the acquiring component to merchant transactions,” Ehlers says. SnapScan has a partnership with Standard Bank, which means it can process transactions at “competitive rates”, he adds.

In addition to transaction fees, SnapScan offers its customers the option of accessing analytics or running loyalty programmes, both of which are billed as add-ons.

The company offers three products. The first is an “instant merchant product” aimed at informal retailers who want their takings in cash. The second is the “standard” product that settles into a bank account like a traditional point-of-sale (POS) unit. The third is an “enterprise solution” designed to integrate with existing POS systems.

SnapScan started out operating in a number of stores around Stellenbosch. Ehlers was surprised by the good response and the company is now planning to expand to Cape Town and Johannesburg. However, the timing isn’t confirmed yet. Expansion will be gradual and carefully monitored, he says.

“We work very iteratively. We want to understand the market really well. We’ve been really impressed with amount of repeat purchases we’ve seen in Stellenbosch along with the low rate of people abandoning it. To maintain that momentum we need to do a controlled roll-out.”

Part of that means making sure SnapScan is accepted in multiple stores. “No one’s going to commit to an app if they can only use it in one store.”

SnapScan’s win at the MTN app awards this week includes a budget for marketing, which Ehlers says should help the company expand to new regions more quickly. — (c) 2013 NewsCentral Media

- Read more articles on South African technology start-ups