Microsoft’s first quarter sales and earnings topped analysts’ estimates, buoyed by growing demand for cloud-based software and services.

Profit excluding certain items was US$0,76/share on adjusted sales of $22,3bn. Analysts on average estimated profit in the period ended 30 September would be $0,68 on revenue of $21,7bn, according to data compiled by Bloomberg.

Shares surged to a record in extended trading.

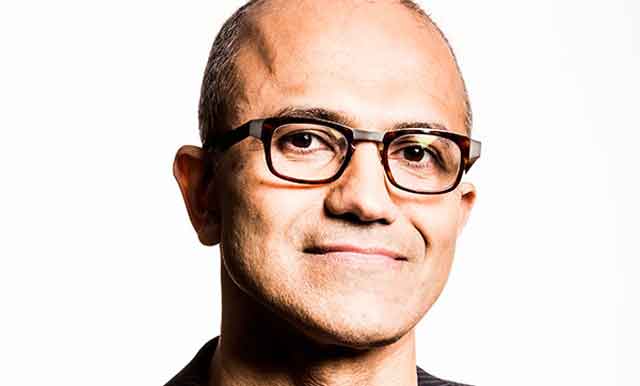

CEO Satya Nadella has been investing in data centres and striking partnerships to bolster sales of Microsoft’s main corporate cloud products, Azure and Office 365 — Internet-based versions of the popular productivity apps, e-mail and collaboration tools. Revenue from Azure cloud services more than doubled, helping Microsoft outperform even as demand for PCs remained in the doldrums and its mobile phone efforts collapsed.

“Cloud is growing significantly and Azure represents incremental new revenue,” said Mark Moerdler, an analyst at Sanford C Bernstein & Co, who rates the shares outperform. “Commercial cloud is driving revenue growth, which is somewhat hidden by the fact that Nokia is going to zero.”

Microsoft shares jumped as much as 6,2% in extended trading following the report, after losing less than 1% to $57,25 at the close in New York. If the gains hold when US trading opens tomorrow, the stock will top its all-time high — reached in 1999.

“This transition to the cloud represents the single largest addressable market opportunity we’ve all seen in many, many years,” chief financial officer Amy Hood said after the report. “There is such an opportunity to grow our overall revenue and do it profitably.”

Hood said half of the earnings-per-share estimate beat was because of strong sales, and half was related to a lower-than-expected tax rate and other income. Net income in the recent period declined to $4,69bn, or $0,60/share.

Earlier this month, on a swing through Europe, Nadella said the company has spent $3bn — $1bn in the past year alone — on data centres on the continent to expand cloud services. He promised continued investments there, including new sites in France next year.

Hood said in July that gross margins for commercial cloud would “materially improve” in the current year. That’s because previous years of investment are starting to pay off as those data centres support more customers. Commercial cloud gross margin in the recent period was 49%, seven points wider than in the prior quarter.

Microsoft has pledged to reach annualised revenue of $20bn in its corporate cloud business by the fiscal year that ends in June 2018. That metric stood at more than $13bn at the end of the fiscal first quarter. The company has been adding customers and workloads for its Azure services, which let clients run and store applications in Microsoft’s data centres.

Elsewhere in the cloud business, paid users for the company’s Salesforce.com rival, called Dynamics CRM Online, grew more than 2,5 times. Overall, Dynamics product revenue rose 11%. The two companies’ rivalry has intensified in recent months after Microsoft beat Salesforce in bidding for LinkedIn. Since then, Salesforce has asked European regulators to scrutinise the $26,2bn deal. Hood reiterated on Thursday that Microsoft expects the acquisition to close in the December quarter.

PC sales

Worldwide PC shipments in the September quarter were a smidgen better than expected — a decline of 3,9%, compared with a 4,1% drop in the prior period, researcher International Data Corp said. Still, chip maker Intel saw its shares plummet by the most in nine months after a disappointing fourth quarter sales forecast signalled lacklustre demand for PCs heading into the holiday shopping season.

Microsoft in July admitted it won’t meet its goal of getting the Windows 10 operating system on a billion devices within two to three years of the 2015 release of the software. The company blamed the shortfall on the decision to all but exit the phone hardware business and insisted this year would be a good one for corporate adoption of the system. Analysts are waiting to see evidence.

“I’m not yet ready to call success, but we are seeing enough people doing enough prep work for it that it’s quite possible we could see a jump in adoption on the corporate side,” Moerdler said.

Windows, gaming

Sales in the company’s More Personal Computing business, including Windows and Xbox, slipped 1,8% from a year ago to $9,3bn. That compares with the $8,9bn average estimate of five analysts polled by Bloomberg. Microsoft also reported a new metric for gaming revenue for Xbox and PC, saying it was $1,9bn last quarter.

In the Intelligent Cloud unit, comprised of Azure and server software deployed in customers’ own data centres, sales rose 8,3% to $6,4bn, compared with the $6,3bn average analyst estimate. Productivity revenue climbed 5,6% $6,7bn. Analysts had estimated $6,6bn.

For the fiscal second quarter, the company said Productivity revenue will be as much as $7,1bn, while Intelligent Cloud sales will be $6,6bn to $6,8bn. More Personal Computing, the unit most impacted by holiday sales of computers and videogames, will be $11,2bn to $11,6bn, Hood said on a conference call. — (c) 2016 Bloomberg LP