The introduction of the smartphone a decade ago has changed many things. It’s changed the way you find things in the dark; it’s changed the way you wake up; it’s changed the way you communicate; it may even have changed the amount of time you spend in the loo. What it hasn’t changed, however, is investing.

Opening a new investment remains a complex, forms-based process requiring, among other things, multiple ID verification.

“It’s not hard to see why young people don’t invest,” says Juan Labuschagne, an actuary with long-term insurer Liberty and head of development at Stash. “Look at these forms — they are a barrier — and that’s before you start selecting from one of 50 unit trust options.”

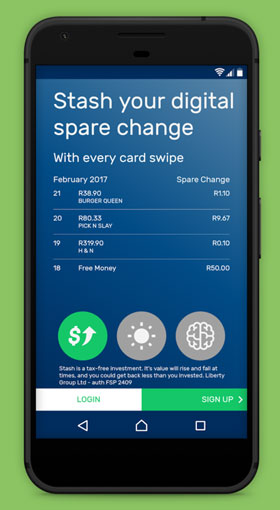

What if you could pay for your cappuccino using a credit, debit or cheque card and automatically the balance — rounded up to the nearest R10, R20 or R50 — was invested in the JSE’s top 100 companies?

Liberty has developed an app, called Stash — as in, “stash your cash” — that allows savers to do exactly that.

Users decide how much they want to stash. The app rounds up the amount of every transaction. If a user decides that their Stash limit per transaction is R10 and they make a transaction for R45, this would be rounded up to R50. The R5 in change is stashed.

Users decide how much they want to stash. The app rounds up the amount of every transaction. If a user decides that their Stash limit per transaction is R10 and they make a transaction for R45, this would be rounded up to R50. The R5 in change is stashed.

Labuschagne explains: “All this spare change accumulates without interfering with your day-to-day life. Stash checks your daily bank balance and never transfers more than you can afford, so you don’t have to worry about going into overdraft. Before you know it you’ll have a significant Stash balance. Your Stash grows as fast as South Africa’s biggest companies do because your spare change is invested in South Africa’s top 100 listed companies.”

There are several interesting features to the product. The first is that users are automatically invested in a tax-free savings account. The second is that the app takes less than a minute to download and activate. Lastly, there are no fees on the investment.

“We have designed it to encourage people — particularly first-time savers — to invest,” says Labuschagne. “The irony of tax-free savings accounts is that only 21% of the tax-free accounts opened to date have been opened by first-time savers.”

The reason the Stash sign-on process is so fast is because verification has been simplified. All that is required is your name, ID and cellphone number — and this information is transferred via the smartphone. Your bank card (not account) details are also required, but they are not stored by Stash. Rather, they’re kept by a Standard Bank subsidiary, which also manages encryption for SnapScan. These are also transferred via the phone.

So, what is not required is complex scanning and sending of documents required by most financial institutions in the name of the Fica legislation.

“We use other measures to test that you are who you say you are,” Labuschagne says. Fica verification is triggered in one of two ways: if a user decides to withdraw their cash — which they can at any time and at no cost — the system will request a photo of your ID or driver’s licence and your rates bill. (If the bill is not in your name the system will e-mail the home owner requesting confirmation of your residence at that address.)

The other trigger, Labuschagne says, is if you start to stash more than R2 500/month. “Long-term insurance regulations require that anyone saving more than this amount a month is Fica’d (not before).”

As a sweetener, Liberty is offering R50 to anyone who downloads the app and starts to save and R10 per friend referral. It is also funding the costs of managing the accounts and the Top 100 Index investment off its own balance sheet –hence, no fees.

One negative is that the app runs only on Android phones, not on Apple’s iOS.

Of course, nothing is ever for nothing — what’s in it for Liberty? Simply, it’s the window into your spending habits. The Economist noted in a recent cover story, that “the world’s most valuable resource is no longer oil, but data”.

“Stash knows what you are spending your cash on and we hope to make use of that data,” says Labuschagne. For instance, research shows that people who top up with airtime regularly make better life insurance candidates than those who let their airtime run out.

Does this mean users need to brace themselves for a host of Liberty salespeople breathing down their necks? “No, we are not using this for sales. What keeps us honest are the reviews on Google Play. Negative comments on that forum will mean no one will download our app.”

- This article was originally published on Moneyweb and is used here with permission