Shares of Nvidia surged over 9% on Thursday, building on a stunning rally as its bumper revenue forecast reinforced investor confidence in the AI-driven boom in chip demand.

Shares of Nvidia surged over 9% on Thursday, building on a stunning rally as its bumper revenue forecast reinforced investor confidence in the AI-driven boom in chip demand.

The semiconductor bellwether’s surge translated to an addition of around US$218-billion in market value on the day, according to LSEG data, the second-largest single-day market cap gain in history on Wall Street.

The big stock move came even as expectations were high for Nvidia with its shares trading near record peaks in the run-up to earnings. The results also capped a strong quarter for US technology giants, including Microsoft, with AI emerging as a major growth driver.

“Companies are continuing to increase their capital expenditures, particularly Big Tech, to keep up with this revolutionary technology, and Nvidia is by far the biggest beneficiary,” said Josh Gilbert, market analyst at eToro.

Nvidia also unveiled a 10-for-one stock split on Wednesday and lifted its quarterly dividend by 150% as demand continues to exceed supply for its high-end chips that power virtually all AI applications, including OpenAI’s ChatGPT.

Already the world’s third-most valuable firm, Nvidia’s market cap gain on Thursday was roughly equivalent to the full value of Adobe. The increase was second only to its own $277-billion jump on the day following its previous earnings report in February.

Nvidia’s market cap of $2.55-trillion also was closing in on Apple, the second-largest US company by market value at $2.87-trillion. Microsoft is the largest company by market value, at $3.17-trillion.

$1 200 price target

Nvidia’s shares closed at $1 037.99, ending above the $1 000 level. Its shares are up nearly 110% so far in 2024 after more than tripling last year.

Nvidia’s gains on Thursday bucked a broader downswing in the overall stock market. The S&P 500 fell 0.7% on the day, while the other six of the Magnificent Seven tech and growth megacap stocks ended negative.

Thursday’s jump also followed a prediction from Taiwanese contract chip maker TSMC, a major supplier to Nvidia, of 10% annual growth in the global semiconductor industry, excluding memory chips.

Read next: Nvidia B200 promises to extend chip maker’s AI dominance

TSMC’s US-listed shares ended up 0.6%. However, other AI-focused names were mixed after an initial rally following Nvidia’s results. ARM Holdings and Broadcom both rose about 0.1%, while AMD and Super Micro Computer both dropped about 3%.

Analysts cheered remarks from Nvidia executives that its new Blackwell AI chips would start shipping in the current quarter and demand for the processors might exceed supply “well into next year”.

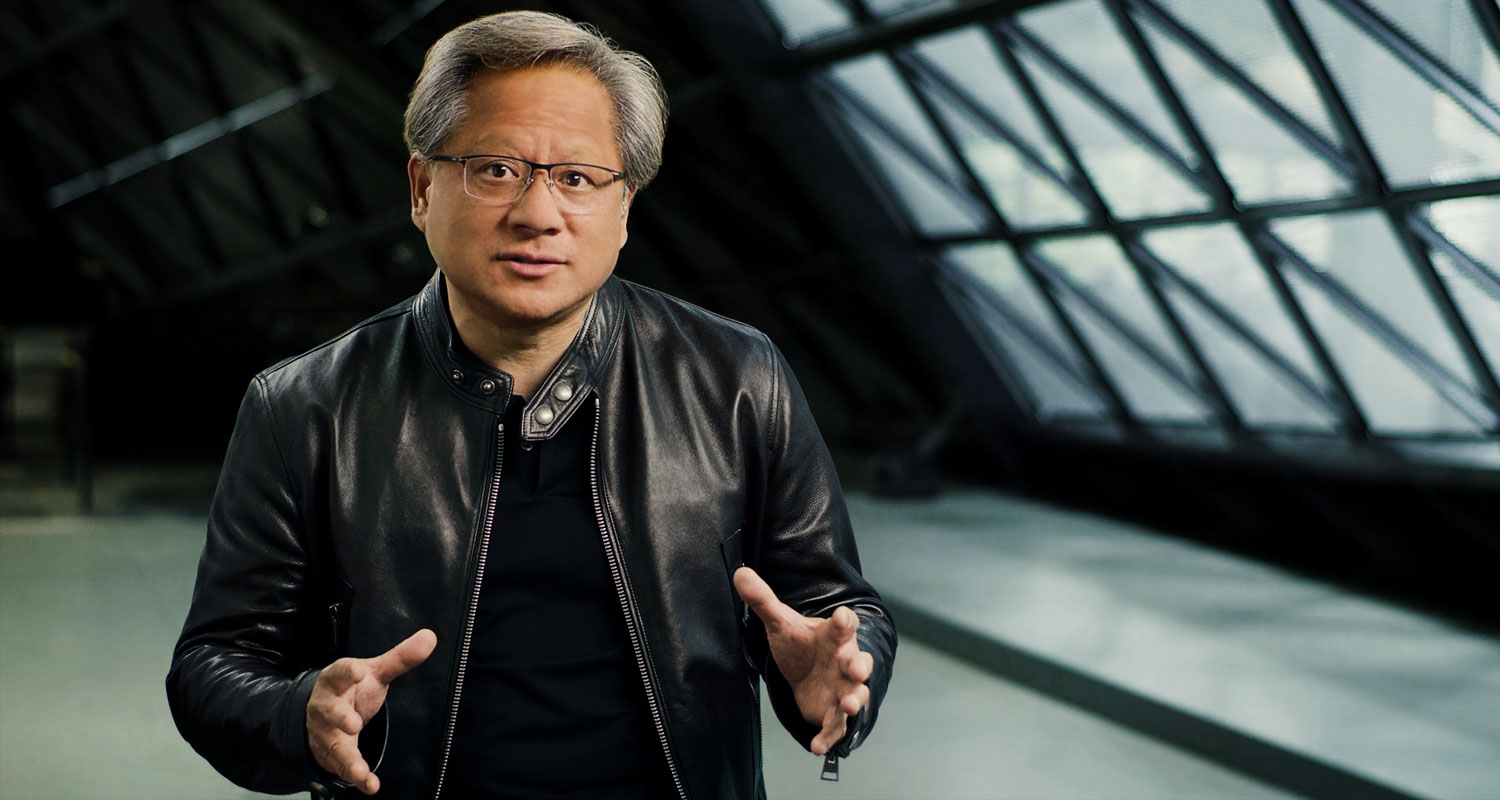

CEO Jensen Huang said in an interview that he expected new AI models that are capable of creating video and engaging in human-like voice interactions to spur more orders for Nvidia’s processors.

“With competition years behind, we believe Nvidia can comfortably defend and maintain its market share,” said Ido Caspi, research analyst at Global X, which invests in Nvidia. “The ongoing Hopper (Nvidia’s current chips) demand should help alleviate investor concerns about customers potentially delaying purchases in anticipation of the Blackwell transition.”

Analysts also said the stock split could make Nvidia more appealing to retail investors after a decline in interest this year.

At least 28 of the 58 brokerages raised their price targets on the stock, pushing up the median view to $1 200, according to LSEG data. Nvidia has a 12-month forward price-to-earnings ratio of about 34, compared with AMD’s 38 and Super Micro Computer’s 26. — Aditya Soni, Gokul Pisharody and Lewis Krauskopf, with Siddarth S, Shubham Batra, Noel Randewich and Danilo Masoni, (c) 2024 Reuters