AMD forecast third quarter revenue slightly below Wall Street estimates, a signal of uncertainty that concerned some investors after the company stock made huge gains in July.

AMD said on Tuesday that it continued to show strong growth in the data centre business, at the expense of its rival Intel, but the company cut its market forecast for PC sales and shares fell more than 5% after hours.

“After the surprisingly challenging quarter that Intel had, a lot of eyes were closely watching to see what AMD did and, overall, the numbers were solid,” said Bob O’Donnell, chief analyst at TECHnalysis Research. “The issue is the market was looking for a better forecast, but it’s clear that the company sees a challenging market going forward.”

Runaway inflation and the reopening of offices and schools have led people to spend less on PCs than they did during lockdowns, hurting companies like AMD, which is among the largest suppliers of CPUs and GPU chipsets.

Chip makers also are under pressure from a spate of Covid curbs in China, an important PC market, and the Ukraine war, which have worsened supply-chain snarls and dragged demand further. Global shipments of PCs are expected to drop 9.5% this year, according to IT research firm Gartner.

Those pressures led to lower-than-expected earnings and forecasts from Intel last week. Analysts had worried that Intel’s sales from its Datacenter and AI Group falling 16% last quarter could also spell out a slowdown in the cloud business which has been booming.

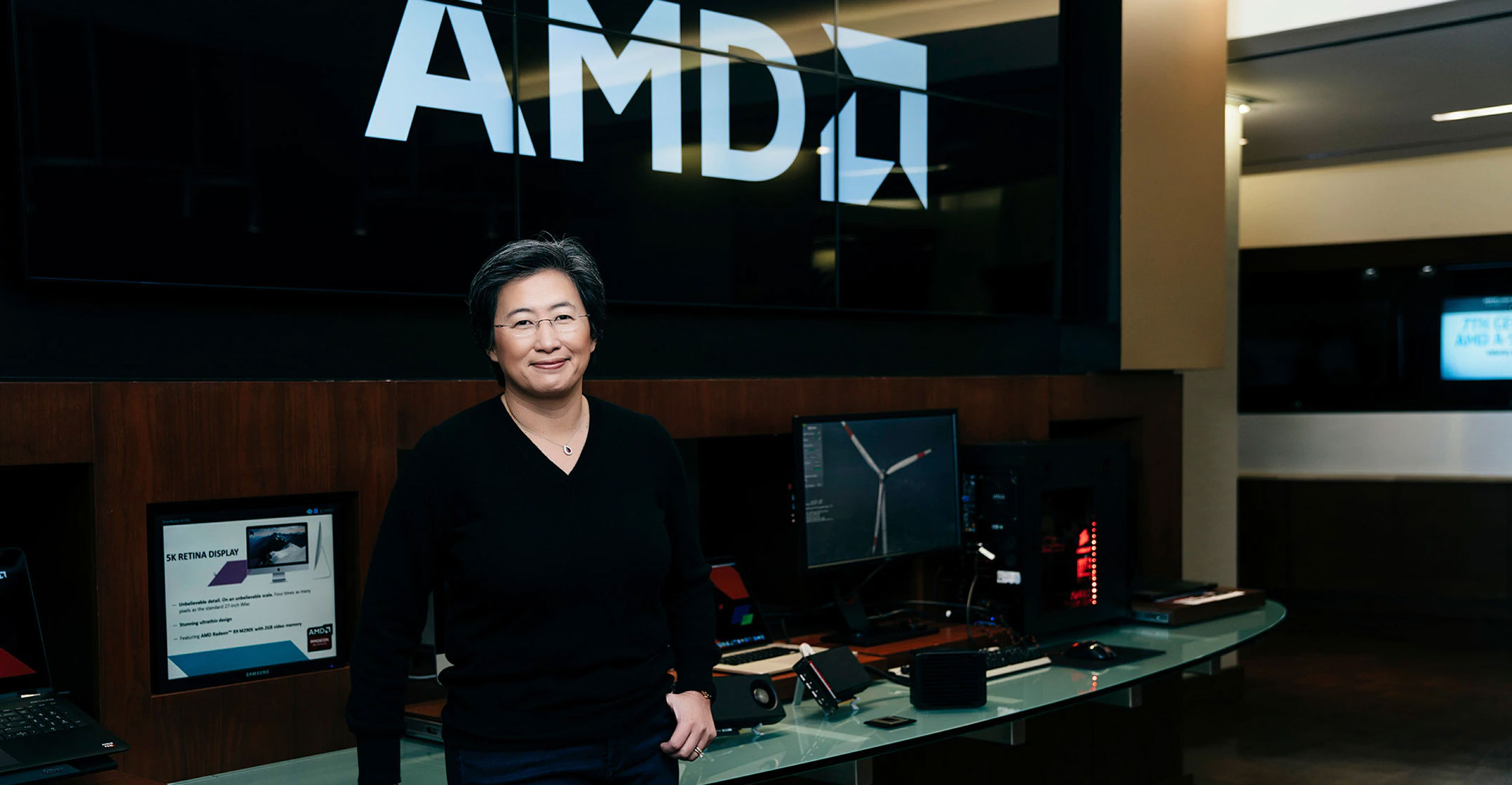

But AMD CEO Lisa Su told analysts on earnings calls that in her interactions with customers, the cloud business continued to be strong. “We’re continuing to ramp new cloud instances … we see that continuing into the second half of the year.”

Su said AMD continued to gain market share in the data centre business.

Gaining on Intel

YipitData research director Nathaniel Harmon said AMD has been gaining market share in the data centre and cloud market at Intel’s expense, while Intel has been losing between one and two percentage points of share each quarter since the first quarter of 2019.

Still, AMD is coping with a slowing PC market. Su told analysts that AMD revised its outlook on the PC market for this year to drop by the mid-teens percent from previous projections of a high single digit percent drop. Su said AMD was focusing on the higher-end PC market.

The company expects revenue of US$6.7-billion, plus or minus $200-million, for the current quarter compared to analysts’ estimate of $6.82-billion, according to IBES data from Refinitiv. AMD expanded its full-year forecast to a range of $26-billion to $26.6-billion, compared to about $26.3-billion earlier. Analysts had forecast $26.18-billion.

Second quarter revenue jumped 70% to $6.55-billion, inching past analysts’ estimate of $6.53-billion. Adjusted earnings for the second quarter were $1.05/share, topping analysts’ estimates by $0.02. — Yuvraj Malik, (c) 2022 Reuters