Cryptocurrencies, like bitcoin and ethereum, have stolen the spotlight again after another year of phenomenal returns for investors.

Cryptocurrencies, like bitcoin and ethereum, have stolen the spotlight again after another year of phenomenal returns for investors.

- Many investors are in awe with how well bitcoin has performed as it shot past US$19 000 earlier this week, rising to levels not seen in three years, with prices up more than 150% year to date. This price boom pushes crypto’s returns well ahead of traditional assets like gold (up 24%) and the S&P 500 (up 12%).

- Germany’s biggest bank, Deutsche Bank, says more people now prefer bitcoin over gold and expects its value to continue to rise in 2021.

- Bitcoin now has a greater market value than Mastercard and, if the leading cryptocurrency were a company, it would be the 16th largest in the world.

- While bitcoin’s returns have been nothing short of remarkable for the past two years (it produced a 94% return in 2019), there are other cryptocurrencies that have done even better. In fact, the “altcoins” (every cryptocurrency other than bitcoin) have cumulatively returned more than bitcoin this year. Ethereum, polkadot, litecoin and chainlink are all up over 300% since the start of January.

Sean Sanders, the founder of investment platform Revix, which is backed by JSE-listed Sabvest, explains: “To say that the past month has been one of the most important in crypto’s history would be an understatement.”

What’s been happening?

- PayPal: One of the world’s largest digital payment firms announced that it would offer all 200 million-plus US users the ability to buy and sell five of the largest cryptocurrencies by the end of the year.

- Square: The payments platform headed by Twitter CEO Jack Dorsey announced it had invested 1% of its total assets in bitcoin.

- JP Morgan: The bank’s CEO called bitcoin a fraud just three years ago, published an in-depth feature in its flagship research series comparing bitcoin to gold, and saying its price could double or triple if current trends continue.

- Other well-known Wall Street names: Fidelity Investments, Paul Tudor Jones, Stanley Druckenmiller and recently the $7-trillion money manager BlackRock have touted bitcoin’s potential as the future of money, a hedge against inflation and a peer-to-payment system, an alternative to the US dollar.

Revix | One-click diversified crypto investing

Buying the JSE Top 40 index is a well-known way to spread risk through diversification and profit from the returns of the 40 largest companies listed on Africa’s largest stock exchange. Revix offers this same effortless approach in the crypto space.

“Buying a single cryptocurrency exposes you to something called concentration risk, which is the risk that something negative happens specifically to the cryptocurrency that you bought, causing its value to decline,” explains Sanders.

Revix’s Bundles lower the concentration risk and remove the guesswork from crypto investing as you own a basket of cryptocurrencies instead of just one or two. This means that if one cryptocurrency’s value declines, you have others that can make up the loss.

Revix offers everyday people the ability to buy bitcoin, a USD stablecoin, a 1:1 gold-backed cryptoasset called PAX Gold and three ready-made crypto Bundles. Bundles achieve a similar outcome to that of passive index funds and provide low-cost diversified crypto exposure to several of the largest cryptocurrencies in one investment.

You purchase a Revix Bundle as a single transaction, and you can sell your crypto investment at any time and withdraw your funds – there are no lock-up periods like there are with other investment funds.

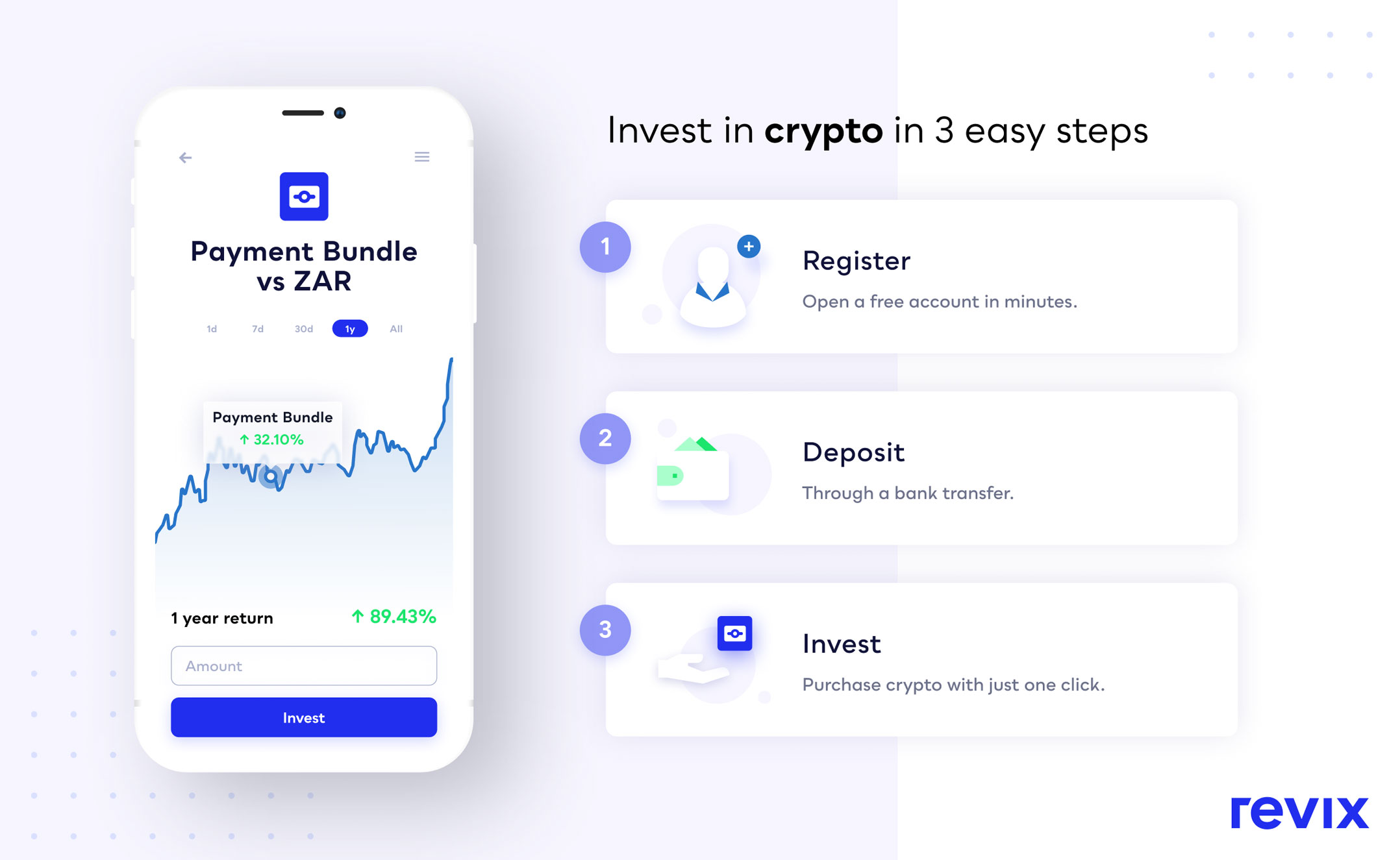

Sign-up is free – head over to www.revix.com. The verification process is effortless, the minimum investment is less than R500, and there are no monthly account fees.

How to sign up to Revix

Sign up for free with Revix today

Sign up for free with Revix today

Revix is accessible to everyone and the online platform is ideal for people who want to get started in crypto but are unsure how or where to start. “Our main focus at Revix is to make investing easier so that many more people have access and can take advantage of the big growth opportunity of this new investment category,” says Sanders.

“Crypto is revolutionising the way value is transferred throughout the world. It’s no mystery that crypto itself is very difficult to understand, not to mention the underlying blockchain technology that it operates on. The early adopters have included crypto as a key element in their investment portfolio for many years and reaped a remarkable reward for doing so,” Sanders says.

What’s great is that Revix secures your cryptocurrencies so you don’t have to, and the company’s algorithms automatically find you the best available prices when you buy or sell on the platform. Additionally, it automatically reweights your Bundle holdings on the 1st of every month so that you stay up to date with the fast-moving crypto market.

More on Revix’s products

Revix’s Bundles aims to deliver on one promise: to make sure that customers own the largest, and by default the biggest, success stories in the crypto space, whatever they might be.

- The Top 10 Bundle is like the S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies, making up more than 85% of the crypto market.

- The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies including the likes of bitcoin, XRP and litecoin. These cryptos aim to make payments cheaper, faster and more global. This is suitable for those who believe crypto as a means of payment will eventually become universal.

- The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like ethereum. Smart contracts have additional functionality built into them, to facilitate payments when certain predefined conditions are met.

Revix also offers three standalone cryptocurrencies

- Bitcoin is the largest and most well-known cryptocurrency.

- Pax Gold is a 1:1 gold bar-backed crypto commodity where investors can take legal ownership of a fraction of a physical gold bar. The physical gold is securely in Brinks vaults in London.

- USDC is a dollar-backed stablecoin that can be redeemed on a 1:1 basis for US dollars.

You can sign up for a free account with Revix at www.revix.com.

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform allows anyone to securely own the world’s top investments in just a few clicks. Revix guides new clients through the sign-up process, to their first deposit and first investment. Once set up, most customers manage their own portfolios, but can access support from the Revix team at any time. For more information, please visit www.revix.com.

- This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose and before investing, please take into consideration your level of experience, investment objectives, and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned