Businesses countrywide will from 1 February pay up to 1 700% more for unrest insurance after the South African Special Risk Insurance Association (Sasria) adjusted its premiums following the destructive unrest in July that cost the country around R50-billion.

Mike Schüssler, economist from economists.co.za, says everyone in the economy will now pay the price for government’s inability to prevent and contain the unrest. He says this cost will now be a permanent burden on the economy.

Several structural changes have also been made to reflect the changes in risk exposure.

There are no increases in Sasria cover for individuals and vehicles for personal use. Tertiary institutions have also been spared the increases.

The sociopolitical unrest that followed the incarceration of former President Jacob Zuma targeted businesses in KwaZulu-Natal and Gauteng.

Government had to come to Sasria’s assistance with an allocation of R11-billion in the October adjustment budget after the claims it received depleted its coffers (and more will follow); R3.9-billion of this was to be disbursed in the current financial year.

The police service was widely criticised for its failure to protect businesses, owners and staff against the violent looters.

Sasria is a state-owned company that provides cover against damage caused by special risks such as politically motivated malicious acts, riots, strikes, terrorism and public disorder. It stated in November that it had received 14 051 claims, valued at R32-billion.

Commenting on the claims, Sasria previously said “the most in number and rand value came in the following order: fire commercial, heavy commercial vehicles, light commercial vehicles and business interruption”.

Drastic increases

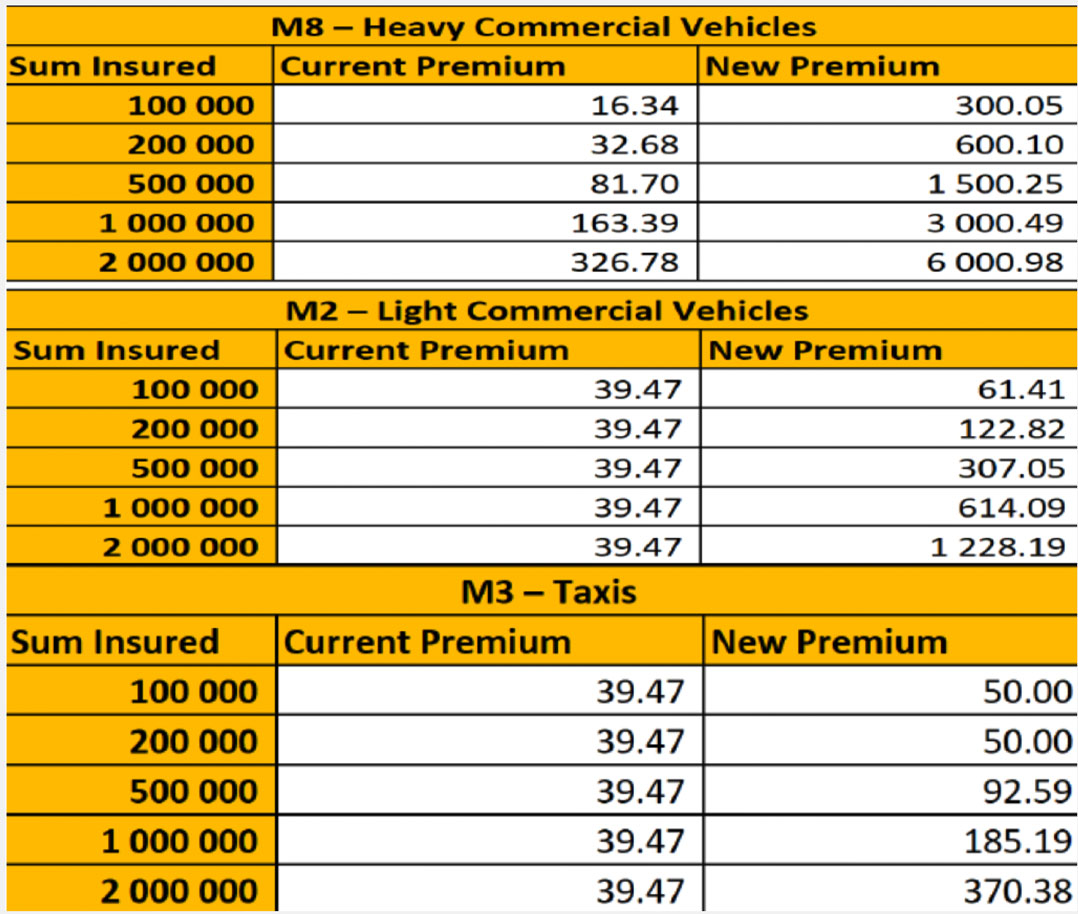

Accordingly, the premiums on cover for heavy and light commercial vehicles as well as taxis and goods in transit have been drastically increased.

Light commercial vehicles and taxis used to pay a fixed rate, but this will no longer be the case.

A circular sent by Sasria to its agents and intermediaries shows the impact on annual premiums (excluding value-added tax):

For the purposes of cover against fire damage, commercial office property has been delinked from other commercial property such as shopping malls, due to a “different risk profile”.

According to Sasria, commercial property excluding office “is amongst the hardest hit in terms of severity of claims”.

According to a letter from Versaflex Insurance Brokers, which specialises in insurance for heavy commercial vehicles, the Sasria insurance on goods in transit will increase from 1.476% of the insured value to 1.7712%.

The monthly premium for goods with an insured value of R3 500 will therefore increase from R51.66 to R61.99.

A minimum premium of R50 will however be applicable, which means insuring an item with an insured value of R500 against unrest will increase sharply from the current premium of R8.86.

We are introducing a new rating class ‘MUN’ specifically for all municipal-related risks to be added with its own risk profile

Schüssler says this will hurt the developing e-commerce sector – “typically the kind of goods sold by Takealot”.

Sasria has further created a new category for “all municipal related risks”. These premiums will be calculated at a rate of 0.02958% of the insured value, which is comparable to the new rate for fire insurance for commercial property, offices excluded.

Sasria says the claims volatility on municipalities has warranted a review on the rating structure for this risk.

“We are therefore introducing a new rating class ‘MUN’ specifically for all municipal-related risks to be added with its own risk profile.”

Gavin Kelly, CEO of the Road Freight Association, says it is unfair that the logistics industry must bear the brunt of the increased risk.

“Why must we – the victims here – suddenly have to bail out Sasria in terms of this. We are the ones attacked – this is not an insurance risk where a behaviour change on the part of the insured (like accidents/driver behaviour, etc) can be implemented,” he says.

Where’s the money?

He asks what happened to the billions of rand that was collected by Sasria over all the years? “Where has that money gone into state coffers – but now disappeared/not available to cover these costs?

“These costs should be borne by the state. They did not react. They did not prevent the damage – no matter how many times we called for assistance, for action and for investigation and follow-up to deal with those responsible.”

Kelly says businesses cannot go to insurance companies and get this sort of cover. “It’s the domain of the state. Specifically, so [as] to keep premiums down and [as] an incentive for the state to ensure political riots and protests are dealt with.

“Companies will now have to choose whether to take out this optional cover, and to carry the risk. Obviously – this will mean more companies will be vulnerable and face total destruction and closure. More job losses.”

Kelly says the Road Freight Association – together with its insurance associate members – is looking for a way to ensure its members are provided with some sort of cover at affordable rates. The association has had interaction with Sasria but these have not managed to resolve the matter of the huge increases.

The organisation also met with transport minister Fikile Mbalula last week in an effort to find a lasting solution to the conflict in the road freight industry between local drivers and the foreign counterparts, which is believed to be the root cause of much of the violence in the industry. Local drivers object to employers giving jobs to foreign drivers instead of South Africans, allegedly at less than minimum wages.

The organisation also met with transport minister Fikile Mbalula last week in an effort to find a lasting solution to the conflict in the road freight industry between local drivers and the foreign counterparts, which is believed to be the root cause of much of the violence in the industry. Local drivers object to employers giving jobs to foreign drivers instead of South Africans, allegedly at less than minimum wages.

Schüssler says clients regularly require service providers in the logistics industry to take out insurance and it would be difficult for them to avoid the increased premiums.

The increases will however be passed on to the end users of the relevant goods and services, which means “everybody” will be paying the price for the July riots and looting.

- This article was originally published by Moneyweb and is republished by TechCentral with permission