US President Donald Trump is injecting nearly US$9-billion into Intel in exchange for a 9.9% equity stake. But the money — which the struggling chip maker was slated to receive anyway under a federal funding act — will not be enough for its contract chip-making business to flourish, analysts said.

What Intel needs is external customers for its so-called cutting-edge 14A manufacturing process — a tough ask, at least in the short term.

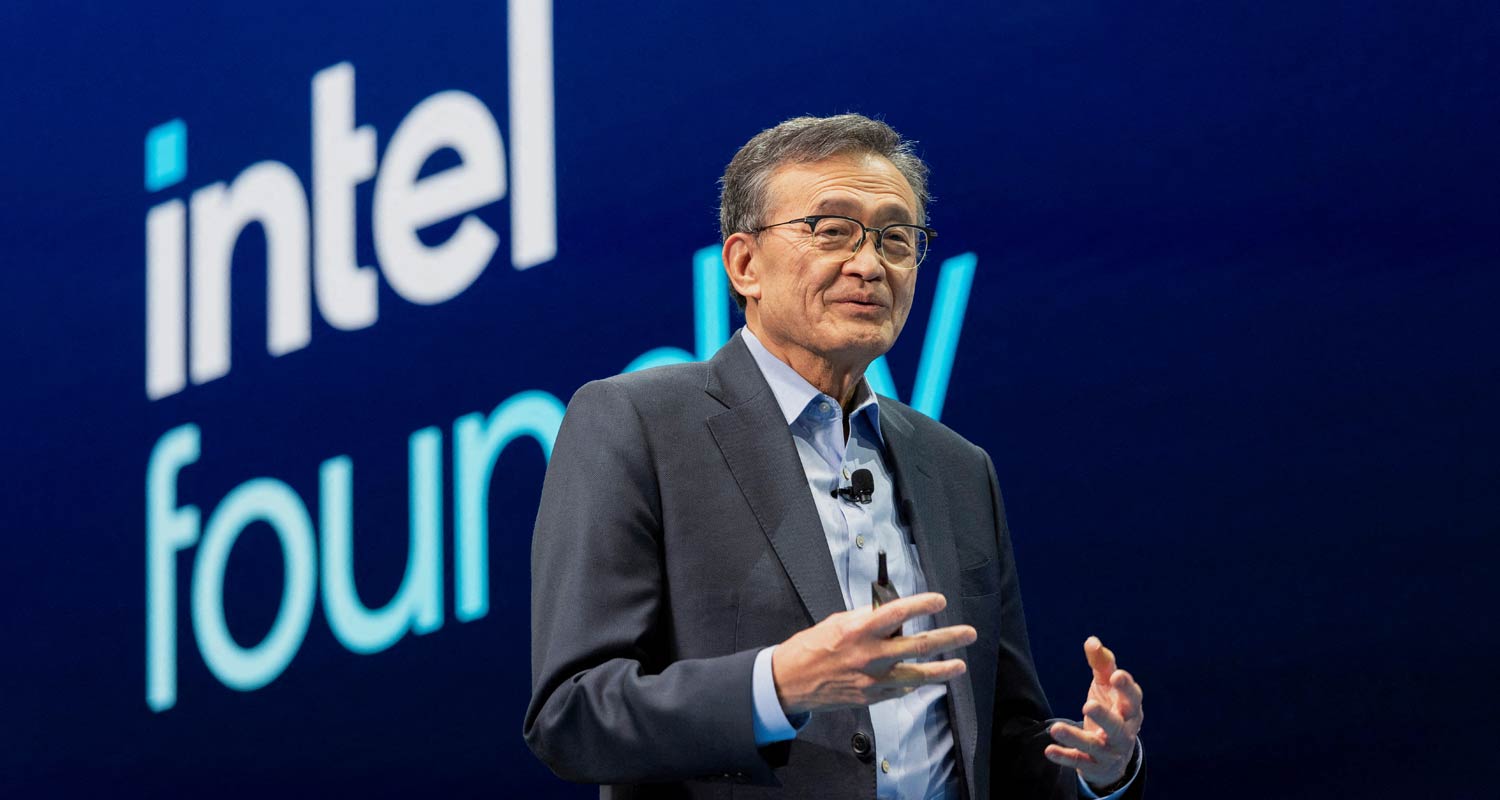

CEO Lip-Bu Tan, who took the top job in March, warned last month that the company may have to quit the chip contracting business if it does not land any big clients. “Going forward, our investment in Intel 14A will be based on confirmed customer commitments,” he said.

Kinngai Chan, analyst at Summit Insights, underlined the economic rationale of Tan’s message. “Intel must secure enough customers’ volume to go to production for its 18A and 14A nodes to make its foundry arm economically viable,” he said, referring to Intel’s manufacturing processes.

“We don’t think any government investment will change the fate of its foundry arm if they cannot secure enough customers.”

The chip maker, once synonymous with American chip-making prowess, has stumbled due to years of management missteps, ceding its manufacturing lead to Taiwan’s TSMC and losing out on the race for artificial intelligence chips to Nvidia.

Now, at an impasse, Intel needs to prove it is capable of making advanced chips to attract customers. Reuters has reported that Intel’s current 18A process — less advanced than 14A — is facing problems with yield, the measure of how many chips printed are good enough to make available to customers.

Net negative

Large chip factories including TSMC swallow the cost of poor yields during the first iterations of the process when working with customers like Apple. For Intel, which reported net losses for six straight quarters, that’s hard to do and still turn a profit.

“If the yield is bad then new customers won’t use Intel Foundry, so it really won’t fix the technical aspect of the company,” said Ryuta Makino, analyst at Gabelli Funds, which holds Intel stock.

Makino, who believes that Intel can ultimately produce chips at optimal yields, views the deal as a net negative for Intel compared with just receiving the funding under the Chips Act as originally promised under the Biden administration. “This isn’t free money,” he said.

Read: Intel’s big bet on 18A runs into trouble

The federal government will not take a seat on Intel’s board and has agreed to vote with the company’s board on matters that need shareholder approval, Intel said. But this voting agreement comes with “limited exceptions” and the government is getting Intel’s shares at a 17.5% discount to their closing price on Friday.

The stake will make the US government Intel’s biggest shareholder, though neither Trump nor Intel disclosed when the transaction would happen.

Intel’s shares closed up 5.5% on Friday on news of the government’s equity stake, but fell 1% in post-market trading after the chip maker detailed the terms of the deal. They have risen 23% so far this year as Tan has announced huge job cuts.

The investment, the latest extraordinary intervention by the White House in corporate America, is consistent with the president’s desire to boost domestic production and bring back jobs. It follows comments from Trump earlier this month calling Tan “highly conflicted” due to his ties to Chinese firms and demanding Tan’s resignation. However, Trump soon changed his mind about Tan.

Some analysts say Intel could benefit from the government’s support, including in building out factories.

Intel has said it is investing more than US$100-billion to expand its US factories and expects to begin high-volume chip production later this year at its Arizona plant.

“To have access to capital and a new partial owner that wants to see you succeed are both important,” said Peter Tuz, president of Chase Investment Counsel.

The government’s $8.9-billion investment is in addition to the $2.2-billion in grants Intel has received to date, making for a total investment of $11.1-billion, Intel said in a statement.

The government will also receive a five-year warrant, at $20/share, for an additional 5% of Intel stock, exercisable if Intel ceases to own at least 51% of the foundry business.

‘Fundamental to the future’

“On one hand, a government stake could be viewed as a strong signal that Intel is ‘too big to fail’. On the other hand, people are concerned about potential governance implications and how that may impact the company’s ability to act in the best interest of shareholders,” Andy Li, a senior analyst at CreditSights.

“The company is not receiving incremental government funding … that indicates a marginally weaker appetite of the US government to provide support.”

The investment follows a $2-billion infusion from SoftBank announced earlier this week.

Read: Honey, I shrunk the chips – inside TSMC’s 2nm breakthrough

“This is a great deal for America and, also, a great deal for Intel. Building leading edge semiconductors and chips, which is what Intel does, is fundamental to the future of our nation,” Trump said on Friday. — Jaspreet Singh, Max Cherney and Sayantani Ghosh, with Juby Babu, Lewis S Krauskopf and Shankar Ramakrishnan, (c) 2025 Reuters

Get breaking news from TechCentral on WhatsApp. Sign up here.