Intel has agreed to sell its NAND memory chip business to SK Hynix for US$9-billion in an all-cash deal that would propel the South Korean chip maker to second in the global rankings.

Intel has agreed to sell its NAND memory chip business to SK Hynix for US$9-billion in an all-cash deal that would propel the South Korean chip maker to second in the global rankings.

The move marks the latest effort by the US chip giant to divest its non-core businesses, move away from the volatile commodity NAND chip industry and focus on its remaining Optane memory business, which is smaller but more lucrative because it taps more advanced technology.

It is the biggest acquisition to date for SK Hynix and follows its $3.7-billion investment in Japanese rival Kioxia in 2017, as the Korean firm tries to boost its capacity to build NAND chips — used to store data in smartphones and data centre servers — and beef up its pricing power.

The deal will help SK Hynix overtake Kioxia in the NAND memory market while narrowing the gap with market leader Samsung Electronics.

SK Hynix shares jumped immediately after the news before valuation concerns saw them reverse gear to fall 2%, while the wider market was down 0.7%. Samsung gained 1%.

“Shareholders are negative about the deal because they believe the price is too expensive. It’s good news for other memory chip makers, because the move would lead to industry consolidation,” said Lee Seung-woo, an analyst at Eugene Investment & Securities.

All sold

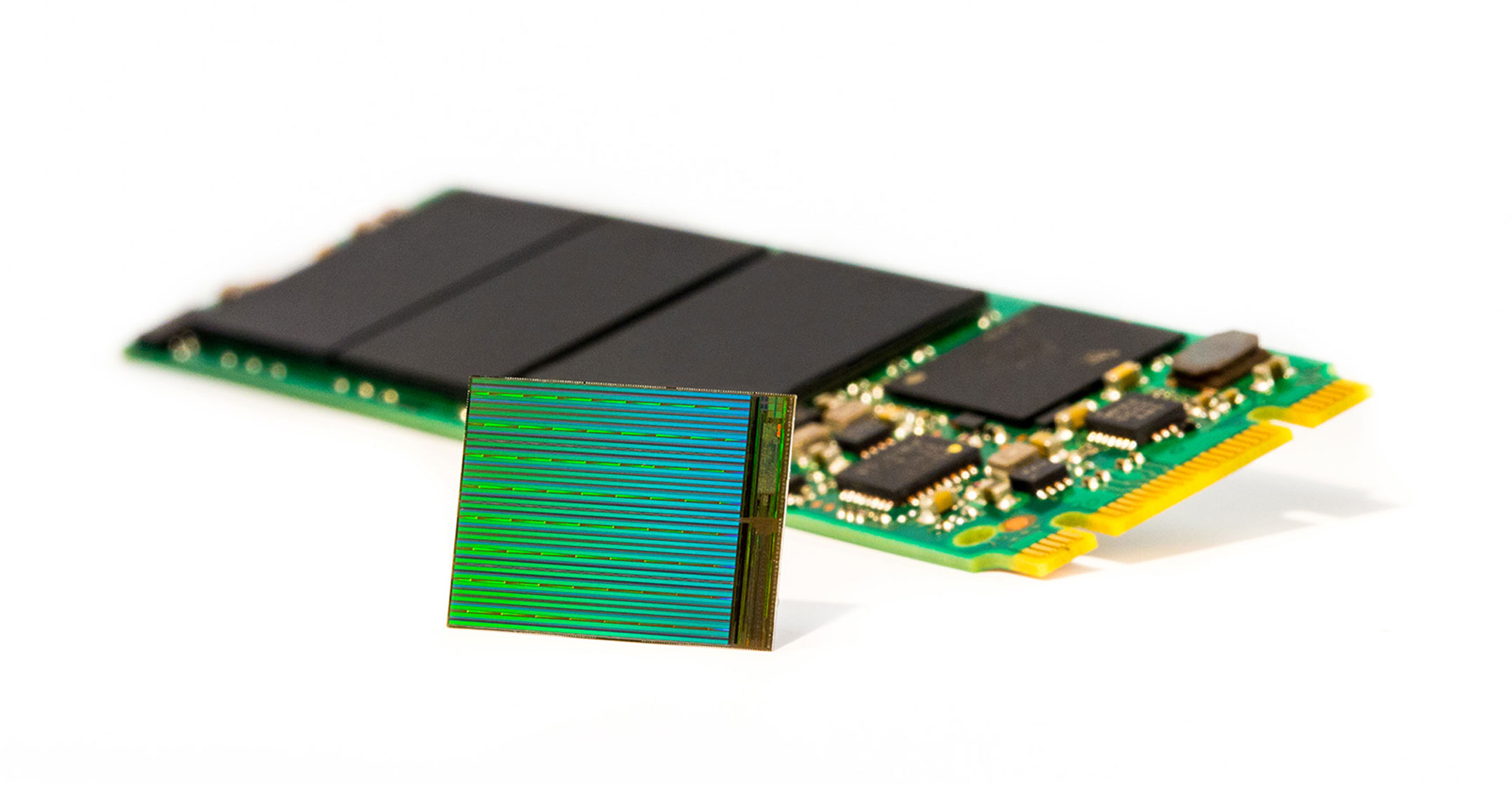

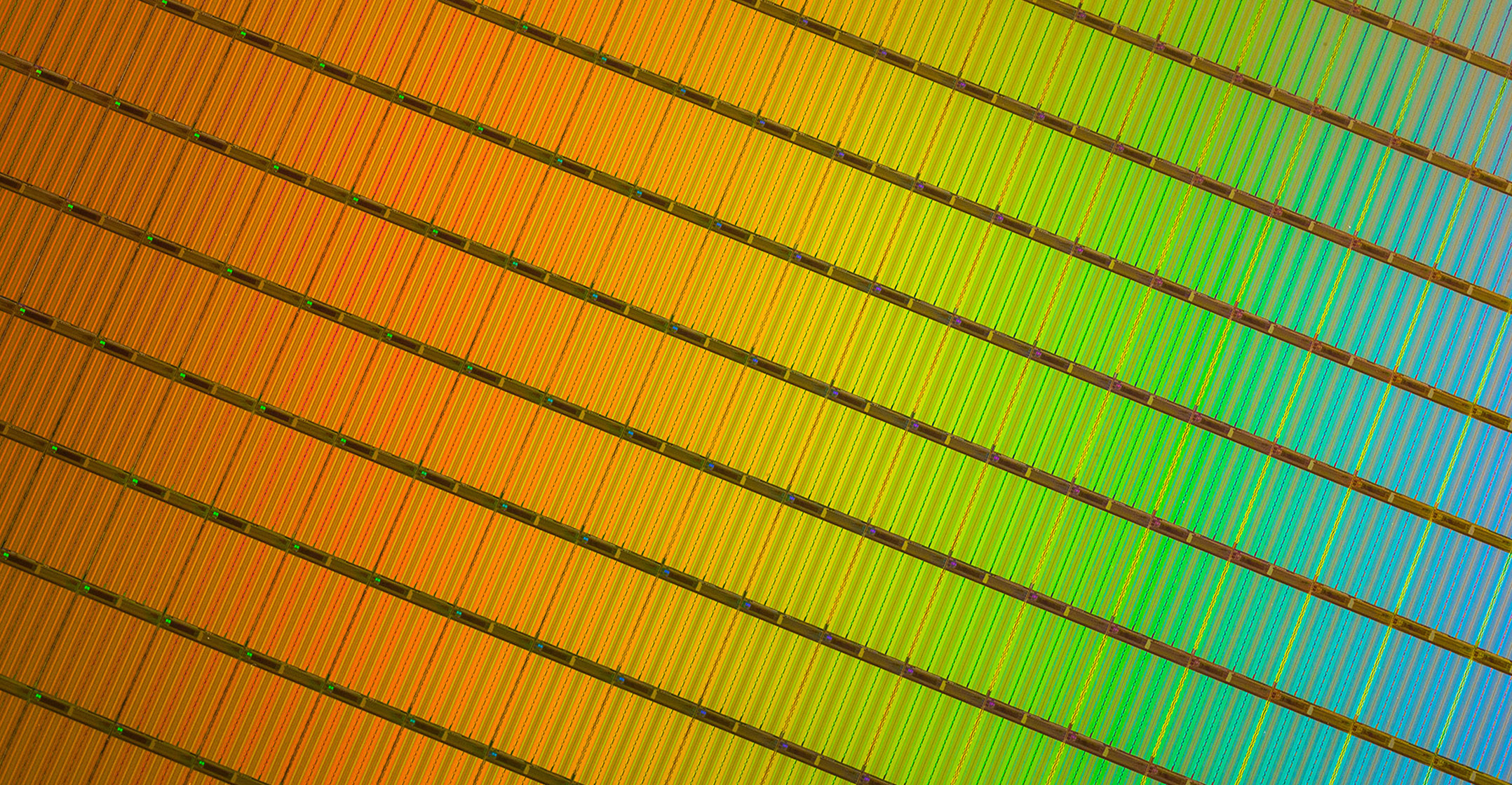

SK Hynix said Intel would sell all of its NAND business including its solid-state drive business, NAND component and wafer operation, and its factory in Dalian, China.

Intel would keep its advanced Optane memory technology, developed in partnership with Micron Technology, which makes the Optane chips for Intel under a supply agreement.

The Intel division which includes its NAND and Optane businesses posted a fourth consecutive annual loss in 2019, although it swung to a profit in the first half of this year. SK Hynix has also posted losses in its NAND business.

Analysts said US-China tensions may have influenced Intel’s decision to sell its NAND flash memory factory in China. The moves comes a month after Kioxia cancelled a planned initial public offering amid market uncertainty.

Analysts said US-China tensions may have influenced Intel’s decision to sell its NAND flash memory factory in China. The moves comes a month after Kioxia cancelled a planned initial public offering amid market uncertainty.

Intel’s Dalian factory makes chips that compete in the cut-throat commodity memory business where prices cycle through booms and bust that can eat profits.

“This transaction will allow us to further prioritise our investments in differentiated technology,” Intel CEO Bob Swan said in a statement. Swan has told investors he plans to divest non-core businesses. The company earlier sold its 5G modem business to Apple. — Reported by Hyunjoo Jin and Stephen Nellis, with additional reporting by Krystal Hu, Ayanti Bera and Joyce Lee, (c) 2020 Reuters