South Africa is falling behind its African peers in the blockchain investment race, but the country is making solid progress in creating a regulatory framework to govern the sector.

The inaugural African Blockchain Report, published by CV VC in collaboration with Standard Bank, has revealed that South Africa placed fifth in a list of African countries for new blockchain ventures in Africa in 2021.

The inaugural report, released this week, provides a structural overview of the emerging blockchain sector and insights regarding funding in Africa.

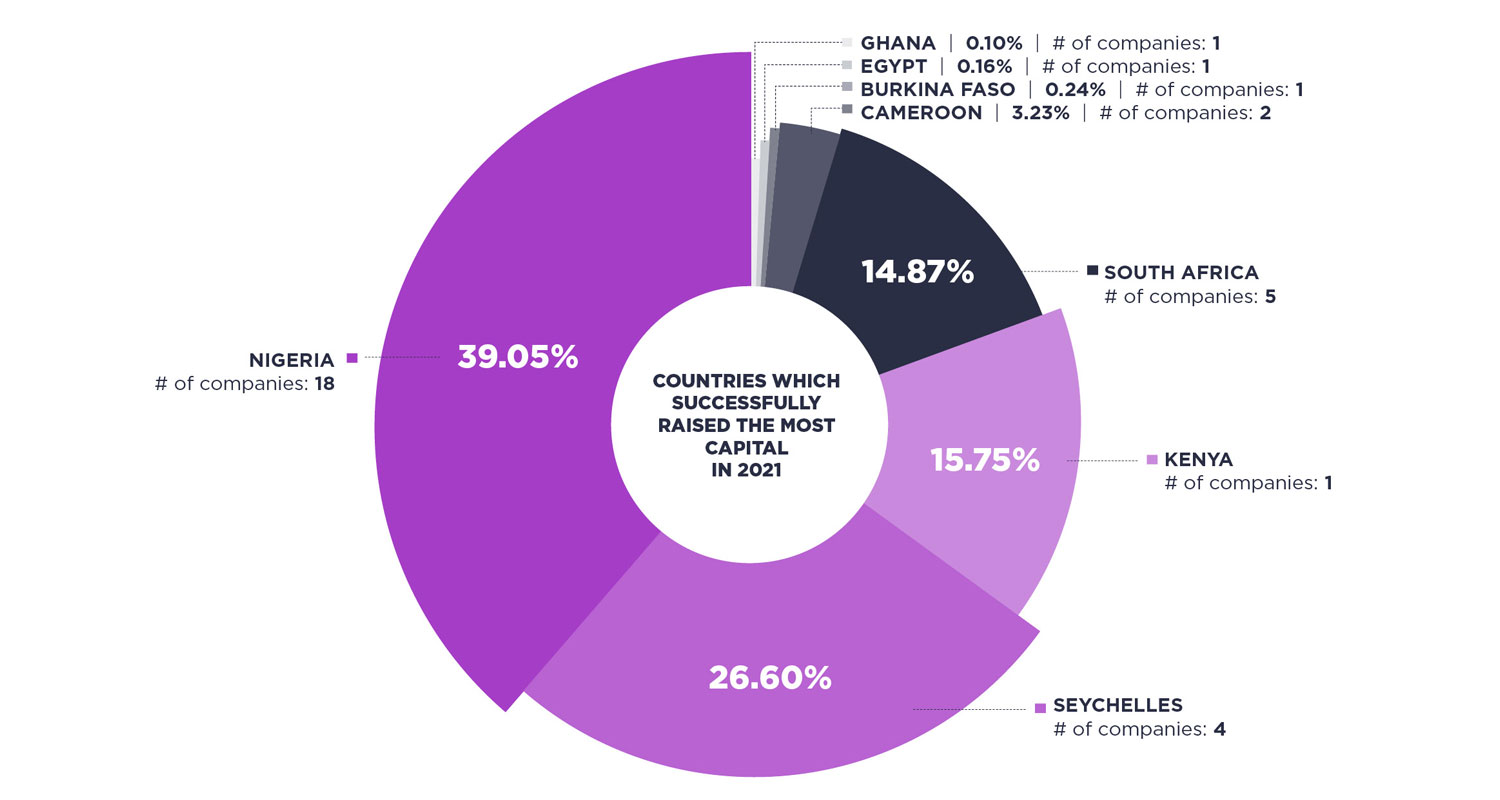

In 2021, US$18.9-million was raised to fund five blockchain and cryptocurrency companies in South Africa.

This was well behind Nigeria, where $49.6-million was raised for 18 companies. This was followed by the Seychelles ($33.8-million for four companies) and Kenya, with $20-million for one enterprise.

Companies in Africa raised a further $91-million in the first quarter of 2022, a staggering 1 668% year-on-year increase from the first quarter of 2021.

The fintech industry dominates the African blockchain industry. South African companies such as Sun Exchange, Revix and Ovex are some of the fintech companies featured in the report.

South Africa is home to one of Africa’s most sophisticated financial sectors, the report said. Local regulators have been working hard to embrace new-age technologies and create a transparent regulatory environment that will further encourage blockchain and cryptocurrency adoption, it added.

Regulatory framework

The South African Reserve Bank is crafting regulatory frameworks, developing a central bank digital currency (digital rand) and actively participating in the blockchain community.

So, although South Africa is not leading the race in blockchain investment, it is making leaps and bounds with cryptocurrency regulations.

Ian Putter, Standard Bank’s head of blockchain, said: “South Africa has the most sophisticated financial sector on the African continent. Although some may believe the country is in a state of regulatory uncertainty, this is by no means the case.”

Although some may believe South Africa is in a state of regulatory uncertainty, this is by no means the case

Africa is adopting crypto at a faster pace than any other market, yet has only a 0.5% share of total global blockchain venture funding, which stood at $25.2-billion in 2021, the report said.

African blockchain funding of $127-million in all of 2021 is similar in size to a single blockchain “mega-deal”, of which there were 59 globally last year. Africa is yet to see a blockchain “mega-deal”, but South African crypto exchange company VALR.com came closest after closing a $50-million funding deal in a recent series-B round, the continent’s largest-ever crypto-related funding round. — (c) 2022 NewsCentral Media