Telkom paid its former group CEO, Sipho Maseko, R20-million in retention bonuses in the past two years plus a R32-million restraint to prevent him being poached by competitors.

This comes on top of a R10-million retention fee paid to Maseko in the previous financial year.

Maseko resigned last year, stepping down as CEO on 31 December, though he remained available to his successor Serame Taukobong as an adviser for a further period.

Telkom said in the annual report that shareholders had questioned last year’s R10-million retention bonus paid to Maseko.

Specifically, they were concerned about the value of the award and the “lack of rationale for such a large sum being paid to the group CEO”. They were also worried that Telkom did not deliver the retention payment as equity but that it was in addition to other variable pay he was eligible to receive.

“The combination of a constrained market that drove tough trading conditions with regulatory events pointed to an even tougher outlook for Telkom in 2020 and 2021. The board considered it to be strategically important to retain Mr Maseko’s services for a minimum period of two years,” the annual report said.

The decision to make the payments was based, among other things, on the timing of Telkom’s value-unlock strategy and restructuring, together with “significant shifts taking place in the telecoms space”. Also considered were the implementation status of key strategic issues, such as the spectrum auction and optimisation of business units.

R32-million restraint payment

“The board remains of the opinion that the right decision was taken to retain Mr Maseko’s service for two years. He remains in an advisory capacity from 1 January to 30 June 2022 to assist with completing selected strategic matters.”

That’s not where the story ends, though. Telkom’s annual report reveals that the board also agreed to pay Maseko R32-million to restrain him from joining a competitor until at least mid-2023.

Astonishingly, there was no restraint agreement in his original employment contract when he joined Telkom in 2013.

“In the absence of a restraint of trade being concluded when Mr Maseko joined Telkom in 2013, and given the significant influence that he had as group CEO of Telkom over eight years, the board agreed that it was in the best interests of the business to engage with Mr Maseko and agree on terms of a restraint.”

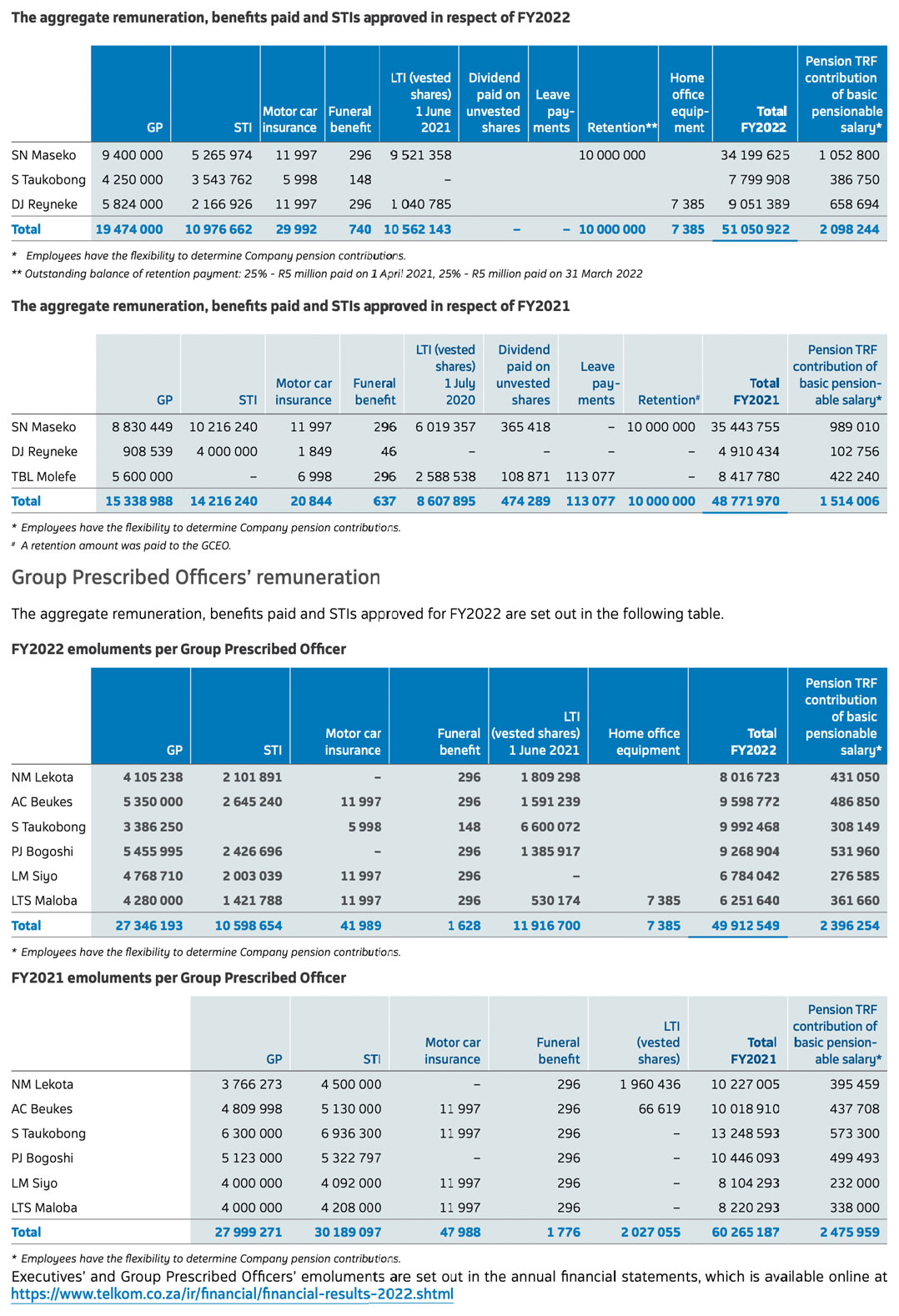

In the 2022 financial year, which ended in March, Maseko’s total remuneration was R34.2-million for nine months of service. This included the second R10-million retention bonus and long-term incentives (vested shares) worth R9.5-million.

Telkom’s annual report shows Maseko was paid a guaranteed package of R9.4-million, up from R8.3-million in the 2021 financial year. He also received short-term incentives valued at R5.3-million. Maseko’s total remuneration of R34.2-million is a slight decline from the R35.4-million he earned in 2021.

More details about the Maseko’s pay, as well as the remuneration of other Telkom directors and prescribed officers, are included in the tables above from the group’s annual report. – © 2022 NewsCentral Media