There are more than 5 000 cryptocurrencies in existence today, and 1 200 of these have market values of more than US$1-million. While bitcoin is the oldest and best-known cryptocurrency, an ecosystem of developers, traders, investors, miners and entrepreneurs have entered the crypto space.

There are more than 5 000 cryptocurrencies in existence today, and 1 200 of these have market values of more than US$1-million. While bitcoin is the oldest and best-known cryptocurrency, an ecosystem of developers, traders, investors, miners and entrepreneurs have entered the crypto space.

At this date, all these have brought the existence of thousands of new cryptocurrencies. Some compete with bitcoin, while others do something completely different. Some are wildly successful, while others are duds. This spectrum exists in crypto, too.

Some cryptocurrencies aim to offer cash-like anonymity, while others aim to tackle a specific industry, like supply chain management, cloud computing, file sharing and advertising – the list goes on.

Bitcoin has opened Pandora’s box with all the new crypto assets that have emerged. Now that the box is open, there’s no going back, and as cliche as it sounds, the future is here!

Sign up to Revix for free to invest in a Crypto Bundle

Over time, these cryptocurrencies have been challenging bitcoin’s market capitalisation. Bitcoin’s dominance, which is how valuable bitcoin is relative to the rest of the cryptocurrency market, has dropped to 61% from 90% just six years ago. Meanwhile, the cryptocurrency market has grown over 50 times over the same period.

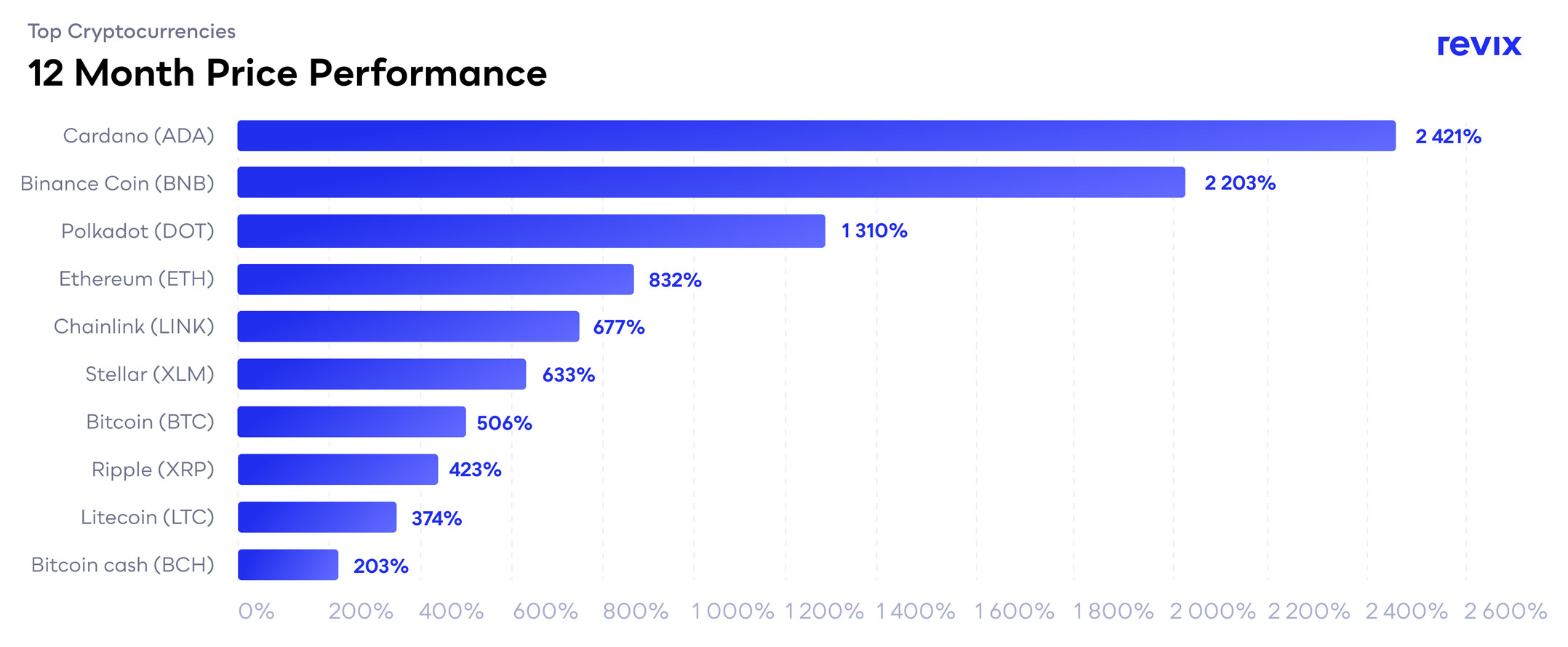

The following chart is an example of the cryptocurrencies that have succeeded in the last 12 months — the growth is real!

What does it mean for us as investors?

What does it mean for us as investors?

It means there may be multiple success stories in the crypto space. It also means there’s a possibility that a cryptocurrency that looks good today will soon be surpassed by another.

Picking long-term winners is challenging

If all these cryptocurrencies have different use cases and performance, why not just invest in the best few names?

Sean Sanders, CEO and founder of investment platform Revix, explains that it’s “almost impossible to predict which cryptocurrencies will be the success stories of tomorrow”.

“In January 2015, bitcoin had a market cap of nearly $4-billion, and ether hadn’t even launched yet. If you’d asked anyone in the crypto space whether they thought ether would be worth four times bitcoin’s current market cap in just two years, they would have laughed at you. But that’s exactly what happened.”

This year, ether is up over twofold versus bitcoin’s returns. “It’s not that ethereum is the new best crypto to own. The point is that, while it’s easy to identify the current winners, it’s hard to predict the future.”

So, what cryptocurrencies will be the top performers next week? In three years’ time, how many crypto winners will there be?

“No one knows,” Sanders explains. “And fortunately, you don’t have to as our Crypto-Bundles aim to deliver on one promise: to make sure that customers own the top cryptocurrencies, whatever they may be.”

How do I invest?

Picking one cryptocurrency to back — even if it is bitcoin — can be risky because you may have chosen the wrong horse to back regardless of your best analysis.

Even the professionals only get it right half the time. Many professional investors prefer a diversified approach, so you’re “not putting all your eggs in one basket”. Instead, you’re buying a basket of cryptocurrencies.

“Crypto investing can be complicated, time-consuming and quite intimidating, so we created an ultra-simple investment platform that allows you to own a diversified bundle of the top cryptocurrencies for as little as R500,” says Sanders. “And what’s great is that you can sell out of your Bundle and withdraw your funds at any time.”

Sign up to Revix for free to invest in a Crypto Bundle

Revix’s Bundles are ready-made investments that provide you with direct exposure to the underlying cryptocurrencies within each Bundle. This means that you don’t have to guess which cryptocurrencies to own.

Investing is as easy as signing up and buying a Bundle.

The greatest component of Revix’s Bundles is their “invest and leave it” functionality. Its Crypto-Bundles automatically update your holdings every month so that you always stay up to date with the fast-paced crypto market.

“Our Crypto-Bundles let the most successful cryptocurrencies come to you, and this puts your whole investing experience on autopilot — making your money work harder for you”, explains Sanders.

Sign up to Revix for free to invest in a Crypto Bundle

Revix offers three crypto bundles on its platform, all of which track the crypto market and are known as passive investments as there isn’t a fund manager picking which cryptocurrencies anyone should own. Instead, Revix’s Bundles provide investors exposure to the largest and most established cryptocurrencies.

The Top 10 Bundle is like the JSE Top 40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 85% of the crypto market.

The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies looking to make payments cheaper, faster and more global. These cryptos include the likes of bitcoin, ripple, bitcoin cash, stellar and litecoin.

The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like ether, EOS and tron, which allow developers to build applications on top of their blockchains, similar to how Apple builds apps on top of iOS.

Revix’s Bundles have outperformed an investment in bitcoin alone over a one-, three- and five-year period.

Sanders explains: “The alternative cryptocurrencies, called altcoins, have outperformed bitcoin, and this is why our Bundles have performed so well: We equally weight each of the cryptocurrencies within the Bundles, which diversifies your crypto portfolio.”

What fees does Revix charge?

Revix doesn’t charge monthly subscription fees but rather a simple 1% transaction fee for both buys and sells and a 0.17%/month rebalancing fee (which amounts to 2.04%/year only) on the total Bundle value held.

So, whether you want to invest in a slice of the entire crypto market or a specific niche sector in the crypto space, Revix has a low-cost and easy to use investment option to suit your needs.

About Revix

At Revix, we’re driven to empower everyday people to become their own wealth managers. Cryptocurrencies have been our first investable category. We offer bitcoin, a regulated gold tokenised commodity called Paxos Gold, and three ready-made crypto Bundles. These Bundles are like the S&P 500 for crypto and offer passive, diversified exposure to the crypto asset class. Investing is as easy as signing up, choosing an asset, and then watching your portfolio grow.

We have some exciting new products on the way. Soon you’ll be able to invest in emerging themes, sectors and asset classes in an effortless way. Sign up to learn more.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned