Let’s get something clear upfront: Microsoft’s purchase of TikTok isn’t worth US$50-billion.

That’s my opinion¹. But then again, it’s not my money. Some investors in its parent company, ByteDance, think it’s worth that much, according to a Reuters report last week. Good for them. We’ll soon find out its true value, and more importantly, that of Microsoft’s CEO.

After a weekend of speculation, the American software giant came out on Monday morning, Beijing time, to confirm talks to buy the short-video sensation that boasts more than 100 million users in the US alone.

The opening line of the blog statement notably said: “Following a conversation between Microsoft CEO Satya Nadella and President Donald J Trump.” This came after after Trump had suggested that he may ban TikTok from the US altogether.

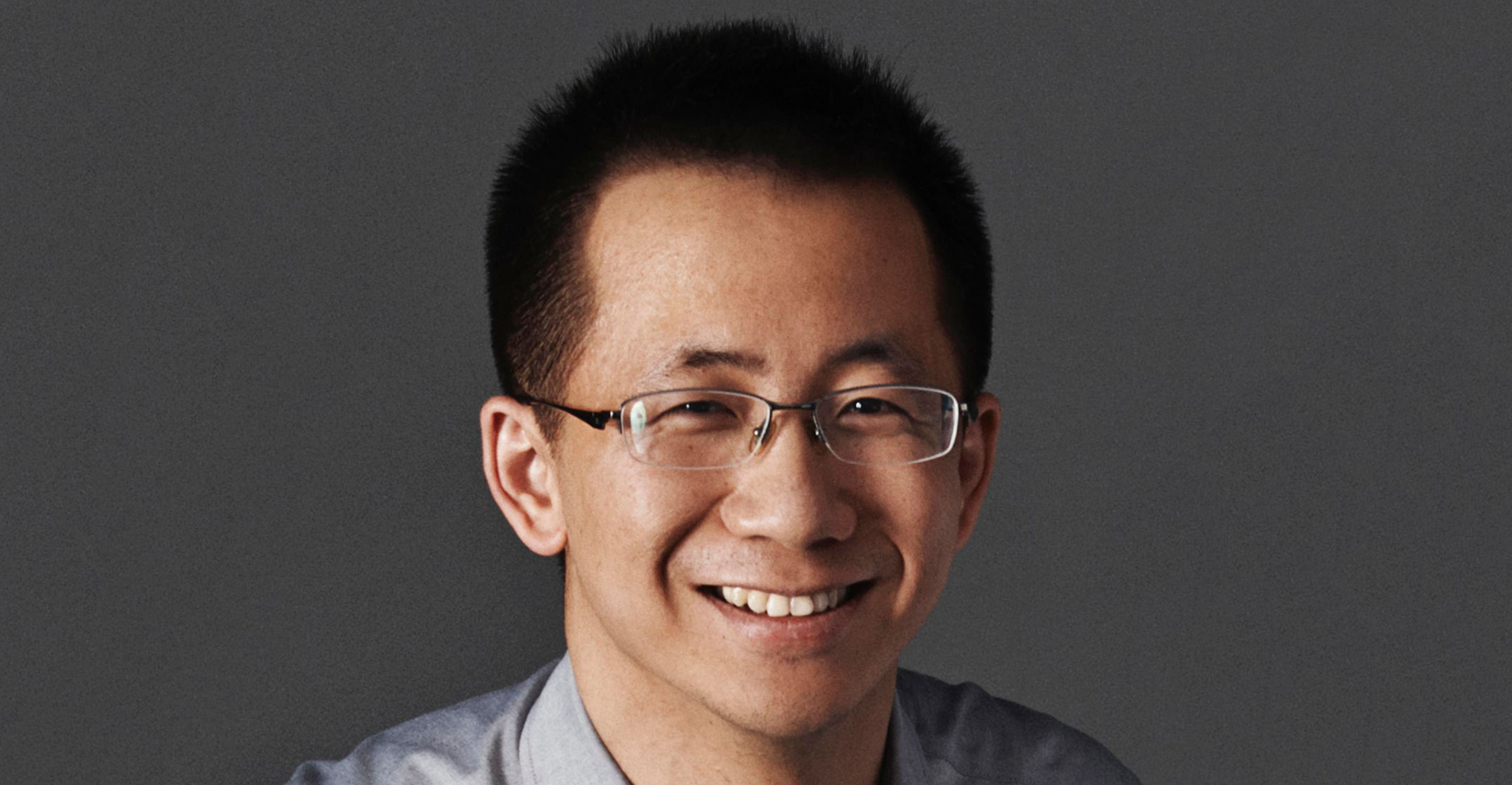

ByteDance, TikTok’s Beijing-based owner, wasn’t mentioned until the third paragraph. I don’t want to downplay the importance of founder Zhang Yiming or his executive team, who have done a fabulous job of building a powerhouse of an Internet company, but this deal already transcends them.

Nadella is the kingmaker now.

The architect of Microsoft’s transformation from PC operating systems to cloud computing, he’s already overseen some big deals. Within a year of taking over as CEO in 2014, he bought the Swedish games company behind Minecraft; later, he closed the $24-billion purchase of professional network site LinkedIn.

An earlier idea to have TikTok, or at least the US operations, spun off and bought by existing ByteDance investors looked good on paper. But it likely wouldn’t have allayed US concerns about data privacy and Chinese control given how opaque the ownership structure would be afterward.

Data transparency

As my colleague Tae Kim wrote, a TikTok-Microsoft deal makes sense because it could allay antitrust concerns just days after four other tech CEOs were grilled by members of the US congress. I also think it might solve the issue of data transparency by putting the US operations of TikTok in the hands of a trusted, publicly listed American company.

Microsoft thinks so, too, outlining how it would transfer and protect user data. The company “would ensure that all private data of TikTok’s American users is transferred to and remains in the US”, it said. Any such data currently stored outside the US would be deleted from servers overseas, it continued.

But first, Microsoft will need to convince the US administration. The company indicated which buttons it’s pushing, mentioning in its statement — before it even named ByteDance — both the US treasury department and the Committee on Foreign Investment in the United States.

Some US lawmakers are already on board. “Win-win,” senator Lindsey Graham wrote on Twitter. His fellow Republican John Cornyn and others looked ready to sign off, too.

It’s not really up to congress, but their support adds important political momentum to the deal. Democrat senator Richard Blumenthal is among those more cautious, noting that such a transaction “should not distract us from the need to crack down on insidious spying and surveillance” by Chinese companies.

It’s quite likely other names will pop up as potential suitors, leaked by bankers or ByteDance insiders in the hope of building the illusion of a bidding war. But Microsoft has the credibility and strategy to get a deal past the real gatekeepers in Washington, leaving ByteDance with few other options.

The onus is on Nadella to get it done, and quickly. Microsoft said it will complete discussions by 15 September.

Now let’s look at what’s for sale.

ByteDance itself had revenue of $17-billion last year with profits of $3-billion. But that’s the entire company, with a stable of at least 20 apps — including Douyin (the local version of TikTok) and news feed Toutiao. According to The Information, TikTok’s revenue last year was around $300-million globally — that’s less than 2% of an entire company which CB Insights lists as the world’s top unicorn at $140-billion in value. This year, TikTok is aiming for $500-million in sales in the US, The Information reports.

According to Microsoft, it’s looking to buy operations in the US, Canada, Australia and New Zealand. Throw in a little extra for the three smaller markets and some upside, and we’re looking at maybe $700-million in annual revenue this year, $1-billion if we’re lucky. India and the UK were not mentioned. These are crucial omissions, given that Britain is also a key Five Eyes security partner and far larger than both New Zealand and Australia, while India is TikTok’s largest potential market but was banned after a recent border clash.

Nadella knows it

Facebook shares trade at 9.6 times sales and Twitter at 8.5 times sales. Sure, TikTok is growing more quickly, but so was Snap, that once-hip social media app which had an initial public offering in 2017 and posted 590% revenue growth the year before it listed. Snap now trades at 16.5 times sales, and has yet to post an annual profit.

The idea that TikTok — without the UK, India or dozens of other emerging markets — is worth $50-billion today is fanciful. ByteDance’s leadership can be sure that Nadella knows it, too. He has a fiduciary duty to his own shareholders to squeeze TikTok’s owners as hard as possible.

After finessing regulators and stroking egos to get this deal done, Microsoft will rightfully expect a big discount. The size of that discount will prove Nadella’s worth and make this the deal of the decade. — By Tim Culpan, (c) 2020 Bloomberg LP

¹For the record: I think the business Microsoft is bidding for is worth closer to $20 billion. That’s not to say this will be the transaction price, though.