[dropcap]T[/dropcap]he bitcoin market is “over-inflated” and “very frothy”, despite big risks looming on the horizon, South African Internet entrepreneur — and cybercurrency expert — Vinny Lingham warned on Tuesday.

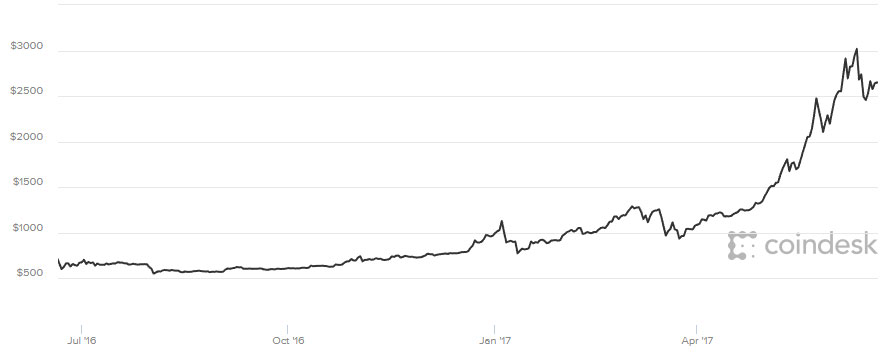

Lingham, who has been dubbed by some media outlets as the “Bitcoin Oracle” because of his successful predictions of the value of bitcoin — he correctly forecast that one bitcoin would be worth US$3 000 this year — warned in a podcast interview with TechCentral that the risks are high in the short term.

He also warned that people who don’t understand how bitcoin works probably shouldn’t be investing in it. “Don’t invest in things you don’t understand,” he said, adding that “bitcoin and the whole crypto space is a little bit over-inflated right now”.

Lingham, who now lives in San Francisco, founded Civic, his new start-up, in 2016. The company offers digital identity management and protection using the blockchain, the digital ledger that underpins bitcoin.

“There are some existential risks to the [bitcoin] ecosystem in the next month or so regarding the ‘hard fork’ vs ‘soft fork’ [debate]. It’s technical risk, which people don’t understand,” Lingham said. “These risks may play out okay, and bitcoin may go up to $4 000, but equally it could go down to $400. We just don’t know how it’s going to play out.”

As Business Insider explained in a recent article, there’s a long-running and heated debate going on in the bitcoin community about how best to scale the network. There are two camps offering two possible solutions, the article said. Both propose software updates to the bitcoin network that would change how it functions; both options can’t both coexist, and it’s far from clear what is going to transpire.

“Personally, I’m largely out of the market,” said Lingham. “I’m going to sit and wait. I don’t mind paying a premium once these issues are resolved, but I’d rather not be losing money.”

Risks ‘pretty high’

He said the risks right now at “pretty high”. In the short term, there’s “some risk” that could result in a “massive collapse or down cycle”.

Aside from this, Lingham is concerned that bitcoin has run too hard, too fast. “I predicted $3 000 this year. It got there a lot earlier than I thought, which makes me a little more concerned that there are a lot of people buying who don’t understand the technical risks. I’d rather sit in the background and wait it out and see what happens.

“There’s no guarantee that bitcoin will be around in five or 10 years. In a month’s time, there could be five bitcoins. That’s a big problem, because of the way things are playing out in the technical community right now.

“You might be losing some upside [by not investing now], but I personally don’t like the risks I’m seeing on the horizon. The downside is pretty heavy… After August, after this is resolved and there is a path to scaling bitcoin going forward, then I’ll be more open to jumping in and saying let’s get more aggressive on it.” — © 2017 NewsCentral Media