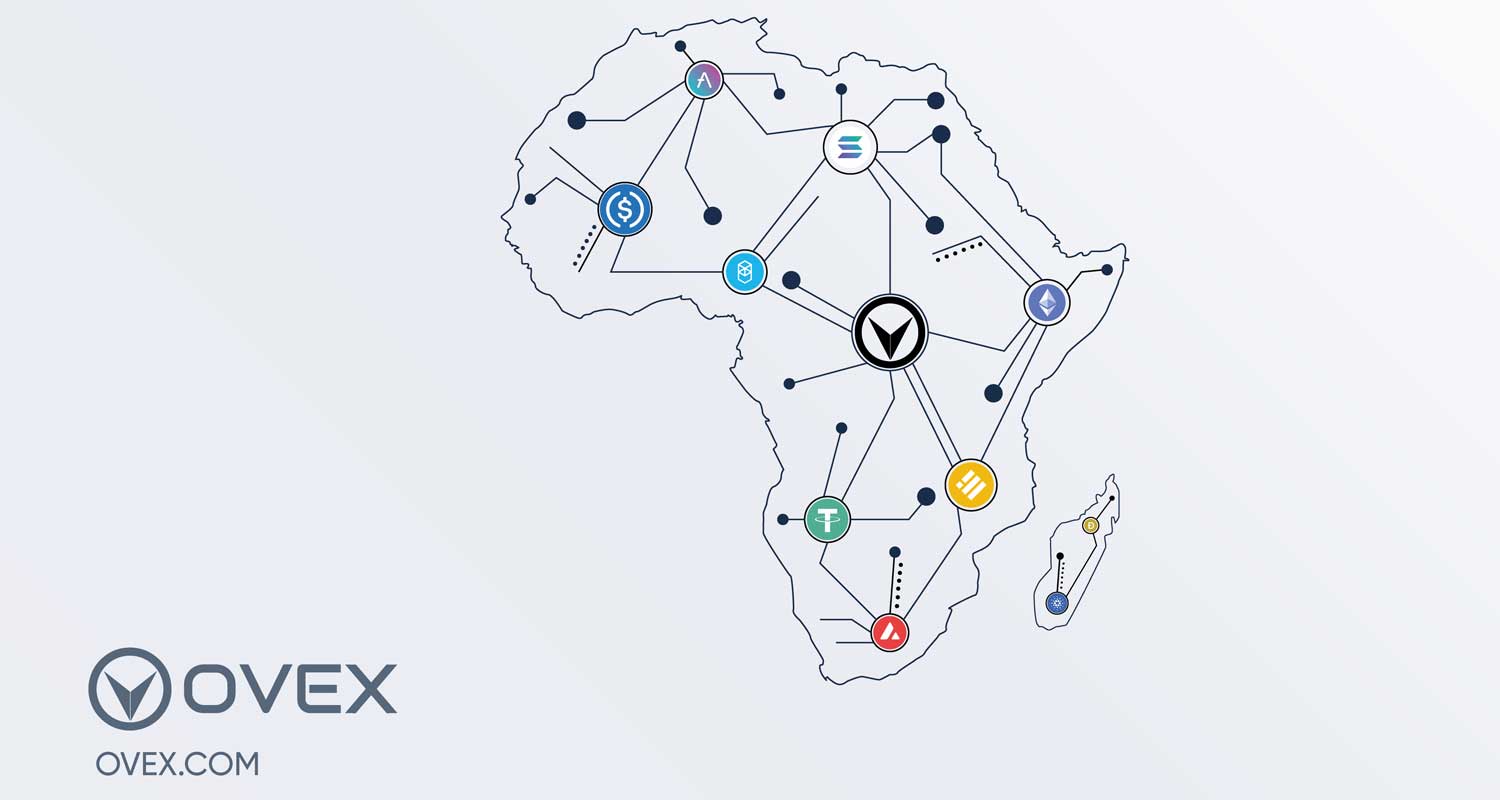

Africa is the next crypto frontier. The continent’s immense population (of over 1.3 billion people) stands to benefit the most from this nascent technology that is fast shaping the future of African finance.

Africa is the next crypto frontier. The continent’s immense population (of over 1.3 billion people) stands to benefit the most from this nascent technology that is fast shaping the future of African finance.

The African continent is plagued with high inflation, devalued local currencies and limited infrastructure for cross-border transactions (both internally and externally).

It is these very problems, however, that make Africa the perfect sandbox for crypto innovation – from solutions that facilitate cross-border flows, to greater financial inclusion and even as a store of value, mitigating the effects of currency fluctuations and inflation. The decentralised nature of digital assets means these transformative solutions can happen outside of Africa’s otherwise fragmented banking system.

Cryptocurrency has low barriers to entry when compared to its traditional finance (TradFi) counterpart. Advancements in KYC technology enable users with a basic Internet connection to have an exchange account up and running in hours. Institutional-grade African crypto exchange OVEX, for example, can have a user fully KYC’d minutes after they sign up.

Streamlining the verification of new accounts is just the tip of the iceberg. The staggering amount of Africans underserved by TradFi institutions is a cause for concern. According to the United Nations, there are only 4.5 commercial bank branches per 100 000 adults in sub-Saharan Africa. This is substantially lower than the global average of 10.8.

The typical barriers to entry plaguing TradFi access in Africa include the high fees waged by financial intermediaries; the distance to travel to financial institutions; financial illiteracy; the lack of necessary documentation; and collateral requirements.

Mobile

The high levels of mobile adoption in Africa over the past decade paved the way for cryptocurrency adoption on the continent. One can register a crypto account (custodial or non-custodial) in minutes via a mobile phone and start sending, receiving, spending and converting value at a fraction of the TradFi cost. There are also fewer requirements of documentation and collateral, regardless of the physical distance to financial service providers and/or the gender of account holders.

Many prominent African crypto firms hold workshops, webinars and share content, all with the intention of educating Africans about cryptocurrency and its potential as a vehicle for saving, lending and the transfer of value. Cryptocurrency exchange OVEX is a prime example of one of these firms. You can join the OVEX Telegram group or follow its social media channels and start learning with fellow crypto enthusiasts.

Beyond financial inclusion, cryptocurrency has vastly improved access to financing for some of Africa’s budding small, medium and micro enterprises (SMMEs). More often than not SMME financing comes from foreign interests and is often processed in dollars. This proves challenging given the difficulty African businesses face when opening dollar-denominated bank accounts and the high foreign exchange costs associated with cross-border transactions.

Sending value across borders, however, has vastly changed with the introduction of crypto stablecoins. Stablecoins are digital assets that are pegged to real-world assets. The most widely used stablecoins are collateralised dollar stablecoins like USDC. Every USDC minted on the blockchain is backed by a physical dollar in the real world. These can be bought and sent anywhere on the planet in seconds – a major feat over the otherwise archaic Swift network.

US dollar stablecoins provide a way to bypass the high costs and slow settlement times associated with legacy finance when sending and receiving money. Now African businesses have access to financing that can take minutes on the blockchain compared to the days in TradFi and at the same time circumvent the exorbitant fees waged by banks. These institutions need access to avenues capable of absorbing their large ticket sizes. That is why institutional-grade cryptocurrency exchanges like OVEX are well positioned as they can absorb these large orders off open order books and lock in competitive rates for these institutional players.

US dollar stablecoins provide a way to bypass the high costs and slow settlement times associated with legacy finance when sending and receiving money. Now African businesses have access to financing that can take minutes on the blockchain compared to the days in TradFi and at the same time circumvent the exorbitant fees waged by banks. These institutions need access to avenues capable of absorbing their large ticket sizes. That is why institutional-grade cryptocurrency exchanges like OVEX are well positioned as they can absorb these large orders off open order books and lock in competitive rates for these institutional players.

Beyond providing African businesses with much-needed liquidity, the implication of being able to buy and sell digital dollars that are both effortlessly available and interchangeable means payments can happen a lot more timeously. This enables the more rapid movement of money along the supply chain, among buyers, shipping companies and sellers. Trade financing made up 40% of the total African trade in the past decade. Vast improvements in this space through cryptocurrency will offer more flexible solutions to African businesses that need to accelerate cash flow and reduce exposure to trade risks. OVEX is an example of a custodial crypto exchange that enables large businesses in Africa to trade local fiat currencies by locking in exchange rates and offering upfront capital for processing trade payments.

Cryptocurrency is also being used as a store of value in Africa to hedge against hyperinflation and devalued local currencies. Stablecoins that are pegged to a stable fiat currency (like the dollar) and other cryptocurrencies (like bitcoin) that have digital scarcity based on disinflationary monetary models can offer some protective buffer against the negative effects of inflation. What is more – crypto exchanges like OVEX offer high-yielding crypto interest accounts so that users can earn a passive income on their idle crypto assets on OVEX.

The future of Africa is bright. Crypto firms must continue to work with regulators to ensure an environment is fostered which encourages innovation yet protects users from malicious actors.

- This promoted content was paid for by the party concerned