Shareholders in MultiChoice, which was unbundled from Naspers on 4 March, rejected the group’s executive pay at Thursday’s AGM.

Shareholders in MultiChoice, which was unbundled from Naspers on 4 March, rejected the group’s executive pay at Thursday’s AGM.

Only 50.3% of shareholders voted for the remuneration policy, while its implementation attained only 44.7% of shareholder support. More than half — 55.3% — voted against it, with around 2% abstaining. These are non-binding votes put to shareholders as part of the JSE’s listing requirements.

This is the third time shareholders have shot down a JSE Top 40 company’s remuneration. In May, 69% of Old Mutual shareholders rejected the implementation of its remuneration policy.

In April, it was revealed that 73% of ordinary shareholders voted against Shoprite Holdings’ remuneration policy last October, and 69% against its implementation. Because of Shoprite’s deferred share structure, both those resolutions passed.

In MultiChoice’s integrated annual report, remuneration committee chair advocate Kgomotso Moroka notes three issues that were raised by shareholders during engagement in the listing process:

- Does management have equity participation to align with shareholder interests?

- Are there performance metrics in the share scheme?

- Why were executive long-term incentives not included in the pre-listing statement?

The committee provides responses to each of these.

It is the reply to the last of these that shareholders may not be content with: “At the time of the pre-listing statement, the new MCG (MultiChoice Group) Trust Deed had not been registered to approve new awards.”

The group’s three largest shareholders are the Public Investment Corp (PIC), which holds 13.8%, Allan Gray, which holds 8.6%, and Prudential Investment Management, with 5.3%. Given the large number of votes against both resolutions, it is highly likely that the PIC voted against them.

Warranted

Old Mutual Investment Group, a shareholder with a smaller holding, voted against the remuneration policy, but for its implementation. It says a vote against MultiChoice’s policy is warranted as “a significant portion of awards under the new LTIP (long-term incentive plan) are not performance related, and all awards vest as early as two years from the date of grant”. It adds that “the total number of shares reserved for the new scheme exceeds the recommended limit”.

Regarding the implementation of the remuneration policy, it says “upon engagement with the company, we have been given sufficient detail on the reasons for the sign-on and discretionary bonuses this year which as a result do not warrant a vote against this resolution”.

Chief financial officer Tim Jacobs was paid a sign-on bonus of R3.8-million during the year.

The group’s remuneration committee says a R556 000 discretionary bonus paid to Jacobs was due to him being “instrumental in the successful listing of MCG since joining MCG in November 2018”.

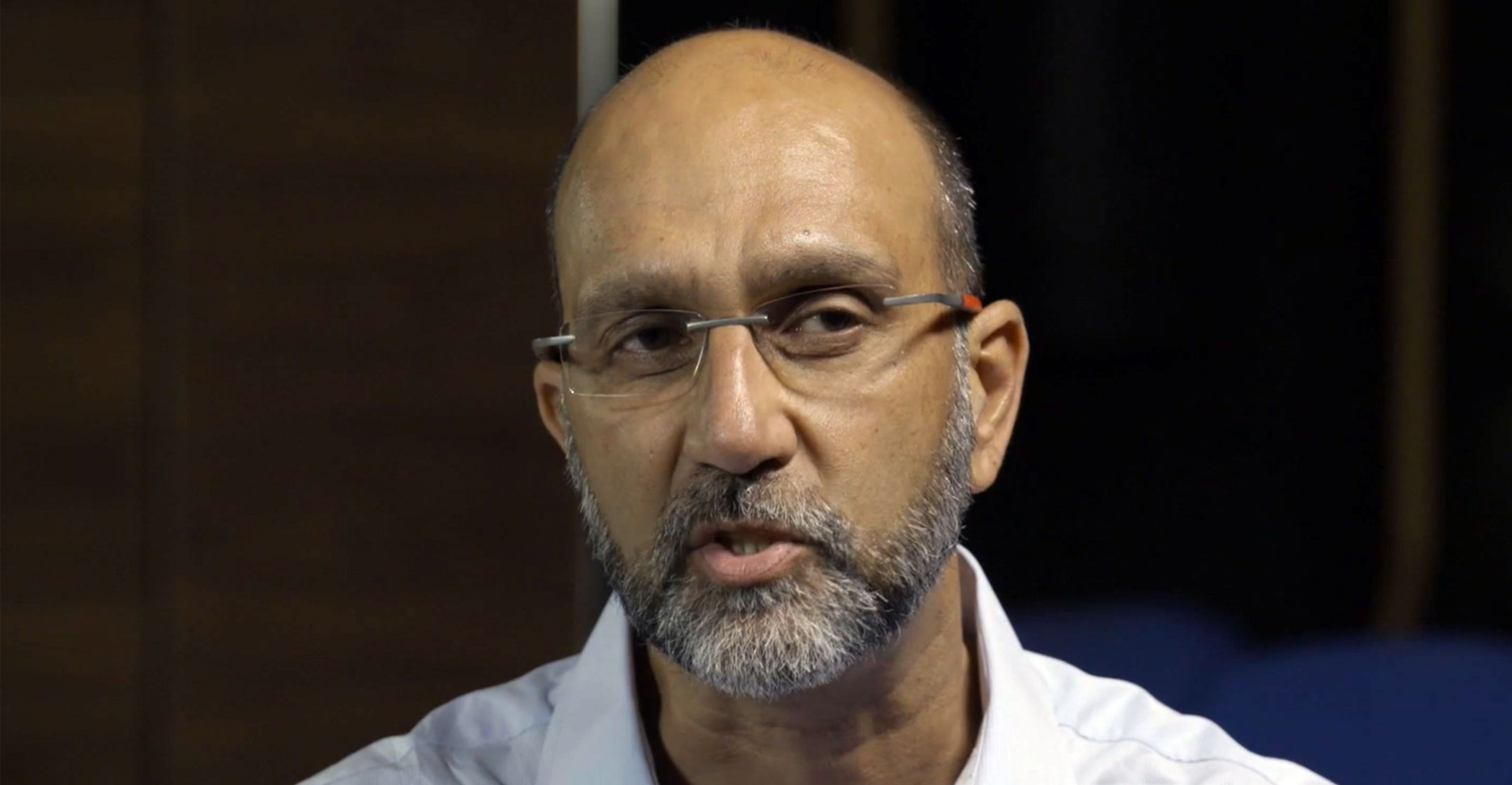

Further discretionary bonuses were paid to executive chair Imtiaz Patel (US$22 000) and chief operating officer Brand de Villiers ($31 000). These were “to recognise Imtiaz’s role in leading the successful listing of MCG and the Naspers unbundling” and “to recognise a significant increase in Brand’s portfolio and change in role during the year”.

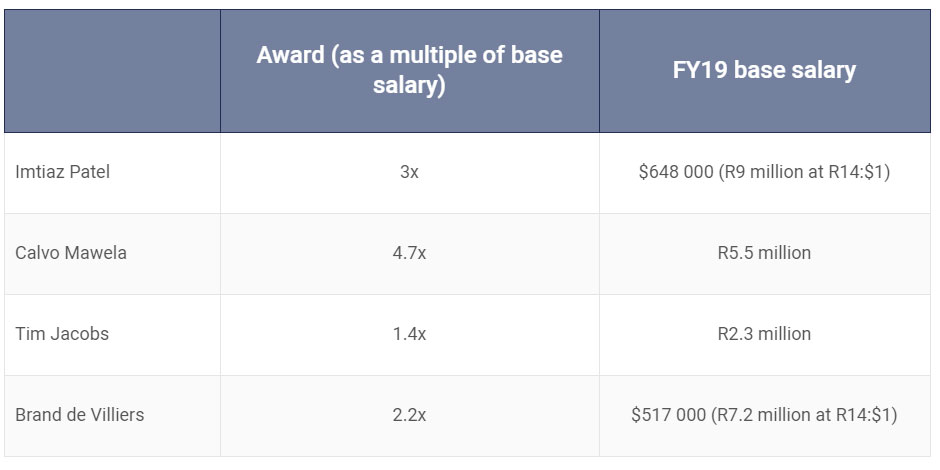

During its 2020 financial year, the group has committed to awarding long-term incentives to its executives as follows:

During its 2020 financial year, the group has committed to awarding long-term incentives to its executives as follows:

Separately, senior employees participated in the option share schemes while MCG was part of the Naspers group. “Following the unbundling, the vesting dates for the Naspers option awards were accelerated in line with the rules to the date of the MCG listing on 27 February 2019.”

Separately, senior employees participated in the option share schemes while MCG was part of the Naspers group. “Following the unbundling, the vesting dates for the Naspers option awards were accelerated in line with the rules to the date of the MCG listing on 27 February 2019.”

Patel made a gain of R14.5-million on his options, De Villiers a gain of R4.8-million, and Mawela a gain of R2.4-million.

The board and the remuneration committee of MultiChoice have invited “those dissenting shareholders to engage with the company by forwarding their concerns/questions on the remuneration policy and the implementation thereof to the company secretary in writing”. It undertakes to “respond … to those that have made submissions”.

One (binding) resolution that failed to pass was the general authority for the company to issue shares for cash. Only 61.65% of shareholders voted in favour.

- This article was originally published on Moneyweb and is used here with permission