We may have entered another high-growth period for the crypto market, with its total value hitting US$2-trillion for the first time since April 2022. That’s about R38-trillion at today’s rand/dollar exchange rate.

We may have entered another high-growth period for the crypto market, with its total value hitting US$2-trillion for the first time since April 2022. That’s about R38-trillion at today’s rand/dollar exchange rate.

Bitcoin, or BTC, accounts for just over half of the total crypto market value. This means that the world’s largest cryptocurrency is now by itself more valuable than the combined worth of all companies listed on the JSE.

How has the market performed in the last 12 months?

The crypto market soared by 76.1% over the past year, far outpacing the JSE Top 40 Index’s negative return of 12.9% as well as the S&P 500 index’s AI-fuelled return of 18.9%.

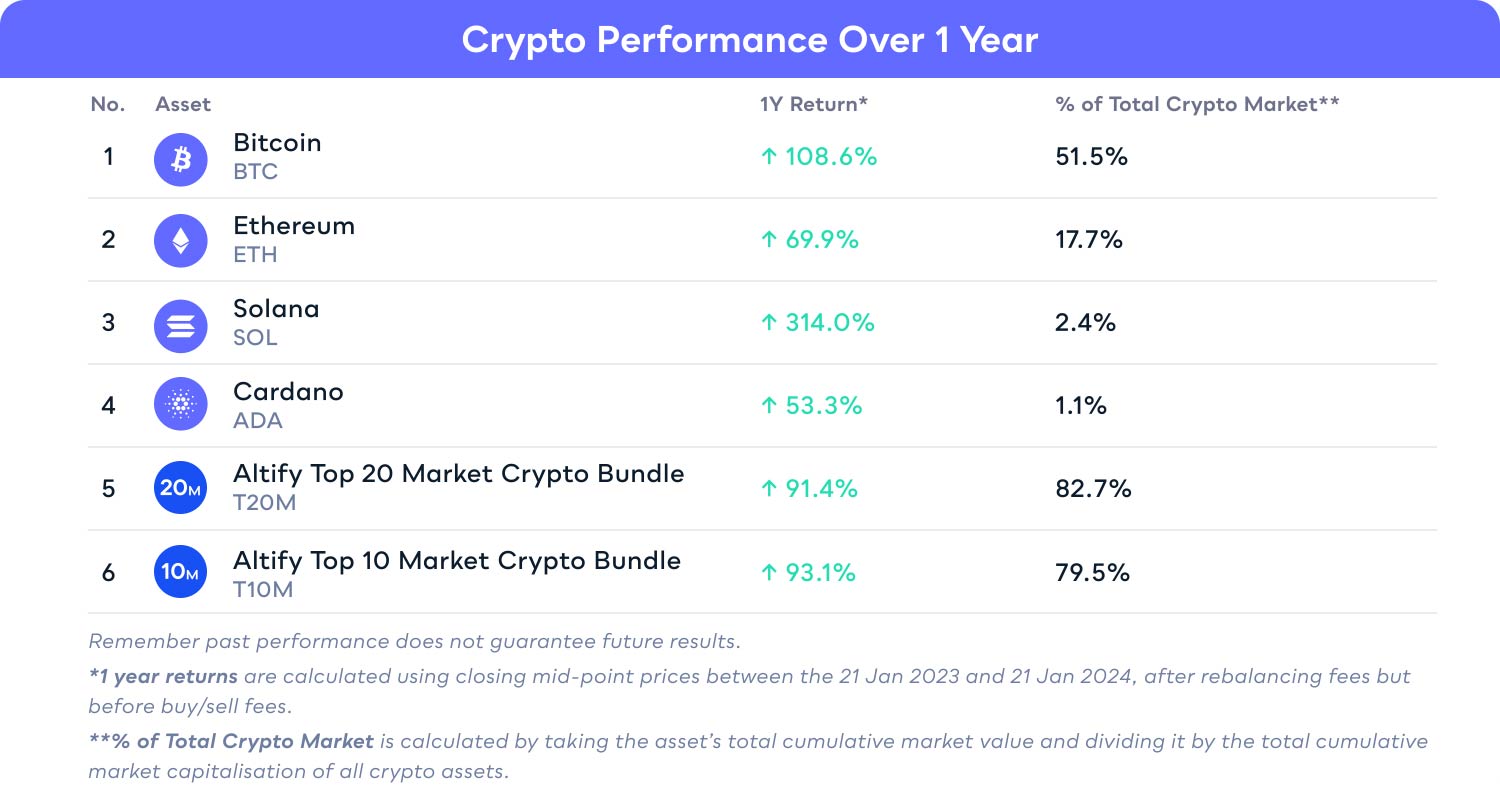

Notably, the crypto space had standout performers apart from bitcoin. Ethereum (ETH), the second-largest cryptocurrency, saw its value jump by 69.9%, while solana (SOL), now ranking fourth, surged an astonishing 314% over the year.

Altify’s leading ETF-style Crypto Bundles, the Top 20 Market (T20M) and Top 10 Market (T10M), saw significant gains, thanks in part to the outstanding performances of bitcoin and solana. Both Crypto Bundles recorded gains of over 90%, showcasing one of the key advantages of diversification in the dynamic crypto market. This strategy highlights how investing in smaller emerging crypto assets, or “altcoins”, can yield impressive returns.

If you’re interested in a Crypto Bundle, explore Altify’s fee-free investing promotion below.

Click here to sign up with Altify for free

What has led to crypto’s revival?

Sean Sanders, CFA charterholder and the CEO of Altify, leads the Cape Town-based investment platform that offers an easy-to-use mobile app to its 80 000 users and is backed by notable investors, including Sabvest, a specialty investment group listed on the JSE. Sanders shares the three main factors fuelling the growth of the crypto market.

1. Bitcoin ETF approval

The SEC approved the first Bitcoin ETFs on 11 January, attracting $3.9-billion in net inflows. Sanders calls this “a monumental step forward for cryptocurrency, enhancing its legitimacy after years of scepticism”.

2. Bitcoin halving

Set for this April, the bitcoin halving cuts new bitcoin creation by 50%, reducing its inflation rate. This event, which boosts media attention, historically leads to higher crypto prices.

3. Shifting inflation expectations

Improved investor sentiment towards lower inflation could decrease interest rates soon. This makes high-risk investments, including cryptocurrencies and tech stocks, more appealing for growth.

Click here to sign up with Altify for free

Which cryptocurrencies will be the winners in 2024?

“It’s impossible to know for sure which cryptocurrencies will be the star performers of the upcoming year,” Sanders said. “Trying to pick individual winners in the crypto market is more akin to gambling than investing.

“It carries a high level of risk due to the market’s inherent volatility and the early-stage nature of this evolving industry. This is exactly why we at Altify created our Crypto Bundles — to offer a smarter investing approach where you can invest in the future of crypto, or a crypto sector, rather than just a specific coin.

Like an exchange-traded fund (ETF) or index fund, Altify’s Crypto Bundles allow you to easily and cost effectively diversify across the entire crypto market, or into a more focused crypto sector like DeFi (decentralised finance), the metaverse or web 3.0 with just one investment.

You can think of a Crypto Bundle like buying the JSE Top 40 or S&P 500 index, but for crypto.

For a limited time, until 8 March 2024, Altify is waiving all buy fees on its Crypto Bundles. Discover more about this offer here.

Each of Altify’s 13 Crypto Bundles automatically updates every month. This ensures that you own the largest, and by default the biggest, success stories in the crypto space, with the underperformers being automatically removed.

This approach offers a hassle-free method to secure widespread exposure in the rapidly evolving crypto landscape, without the need for continuous management or extensive research.

Explore Altify’s Crypto Bundles

Low fees and starting amounts

Low fees and starting amounts

Altify has no sign-up, no deposit and no monthly subscription fees. You can begin investing with as little as R150.

There are also no lock-up periods like with other investment funds, which means you can sell your investment at any time and withdraw your returns.

Altify charges a 0.50% transaction fee for both buys and sells and a 0.17%/month rebalancing fee (only for Crypto Bundles).

Fee-free investing promotion

For a limited time, Altify is offering zero buy fees across all the Crypto Bundles for 10 days, until 8 March 2024.

- You can learn more about the promotion here.

- You can download Altify’s mobile app from the Apple App or Google Play store today.

Disclaimer

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. Altify provides a reception and transmission brokerage service for crypto asset orders without giving any investment advice or personalised recommendations.

While we believe in crypto accessibility for all, we also know that it might not be appropriate for everyone. Before investing, please take into consideration your level of experience and investment objectives, and seek independent financial advice if necessary. You are encouraged to conduct thorough research into cryptocurrencies before making any investment.

As an investor, you are responsible for making decisions regarding your investments. Please consider your personal circumstances when buying or selling crypto as the price can be very volatile. Remember, investing in cryptocurrencies is considered a high-risk investment as the value of cryptocurrencies is subject to extreme price fluctuations and may both appreciate and depreciate over time. Investing in crypto assets may result in the loss of capital.

Remember, too, that past performance does not guarantee future results and we can’t guarantee returns since asset prices move based on supply and demand, so never trade with funds you can’t afford to lose. You should seek professional advice if you’re uncertain about the suitability or appropriateness of any investment for your specific circumstances or needs.

Further information can be found in the General Risk Disclosures and Crypto Risk Disclosures on our website. Investments should only be made by investors who understand these risks.

For more information, please visit www.altify.app.

About Altify

Altify is headquartered in London, with satellite offices in Cape Town and Vienna. The fintech business is backed by notable investors Sabvest, High-Tech Gründerfonds, CVVC, Emurgo and Calm Storm Ventures, to name a few. Altify’s desktop and mobile platforms provide a user-friendly, low-cost way for over 80 000 users to invest beyond the stock market — offering access to more than 15 individual crypto assets, including bitcoin and ethereum, as well as the world’s largest range of ETF-style Crypto Bundles and gold.

- Read more articles by Altify on TechCentral

- This promoted content was paid for by the party concerned