The divide between emerging and developed markets in terms of smartphone penetration is set to grow wider, new research suggests.

Telecommunications equipment company Ericsson expects that by 2018, almost all handsets in Western Europe and North America will be smartphones compared to only a third in the Middle East, Africa and Asia-Pacific.

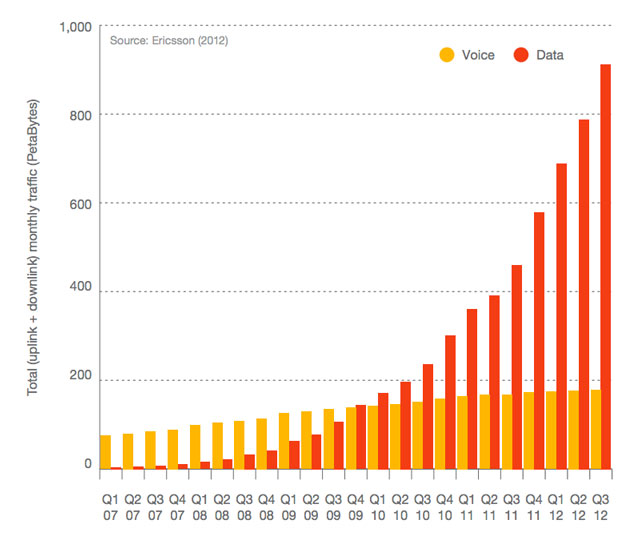

Ericsson’s latest annual Mobility Report finds that mobile traffic is expected to continue the current trend of doubling each year, driven by increased demand in developed markets and new users of mobile broadband in developing ones.

Moreover, mobile data traffic is predicted to grow far faster than fixed-line data between now and 2018, even though, cumulatively, fixed-line services will still carry greater volumes of data globally. Not surprisingly, mobile data is expected to continue to outstrip fixed-line services in Africa as the primary form of data connection for most people in the region.

Worldwide voice revenues are expected to flatten, with only marginal growth compared to the enormous increase in data consumption. However, as margins for data are far lower than those for voice, and because operators are under pressure to meet growing demand for data, infrastructure spending will continue to increase, potentially more rapidly than growth in revenue.

According to Ericsson, smartphones aren’t the only driver of the increasing demand for data. In emerging markets, particularly in Africa and Asia-Pacific, feature phone users are also using more data.

About 40% of all phones sold in the third quarter of 2012 were smartphones, up from around 30% for the full year in 2011. However, only 15% of mobile phone users globally have smartphones, which Ericsson says indicates that there remains huge potential for growth.

Mobile data traffic has doubled over the past year and, thanks to increasing demand for video — which Ericsson says is the biggest contributor to mobile data traffic — is expected to grow by 12 times by 2018.

Total mobile subscriptions are expected to reach 6,6bn before the end of this year — though the actual number of individual subscribers is estimated at closer to 4,3bn because many people have more than one subscription — and to grow to 9,3bn in 2018.

Uptake of fourth-generation (4G) broadband is expected to grow enormously across all markets, although African growth will be slower because fewer consumers will be able to afford either the fees associated with the technology or the devices needed to make use of it.

Ericsson says that by 2018, global 4G subscriptions will reach 1,6bn. By mid-2012, 4G coverage was provided for an estimated 455m people worldwide and, within five years, more than half of the world’s population will be covered.

According to the report, 4G long-term evolution (LTE) technology is the fastest-developing system in the history of mobile communications in terms of build-out and uptake, with more than 100 mobile operators globally now offering services.

However, older 3G networks already provide coverage to more than half the world’s population and continue to grow faster than LTE in terms of absolute numbers. — (c) 2012 NewsCentral Media