It was chip makers’ turn behind the tech woodshed last week as investors punished shares of the leading producers of computer hardware.

Semiconductor stocks sank a third day on Friday, with losses spilling over to Apple as concerns mounted that smartphone demand would derail earnings growth at the same time China and the US skirmish on the trade front. Meanwhile, the Fang cohort of megacaps, outside of Apple, pushed higher after weeks of struggles. Even Microsoft, a sometimes member of the acronym, rose.

“That’s the flavour of the moment in terms of the pain in tech land — it gets to software versus hardware,” Mike Bailey, director of research at FBB Capital Partners in Bethesda, Maryland said by phone. “The advertising-linked companies, they took a big hit and now we’re off of that. Now we’ve gone from a software problem to a hardware problem.”

Apple sank 4.1%, its steepest rout since early February. The Philadelphia Stock Exchange Semiconductor Index retreated for a third day, losing 1.2% to bring its loss in the week to 4.4%. Facebook, Netflix and Amazon.com were all up at least 1% in the five days.

Here’s a rundown of down of what’s been ailing semiconductor stocks.

Lower growth forecast

Taiwan Semiconductor Manufacturing, Apple’s main chip supplier and often considered an industry bellwether, on Thursday predicted current-quarter sales of about US$1bn less than analysts had projected. The major whiff renewed concerns over iPhone X demand and triggered a selloff in chipmakers around the globe.

It didn’t help that the worrisome growth forecast came on the heels of a report by the International Monetary Fund earlier in the week that smartphone shipments declined for the first time. Apple investors weren’t calmed, either.

“Apple, they’re not a semiconductor company, but they’re obviously a big smartphone hardware company, and if there’s a near-term problem in that hardware space, they are going to take a hit,” Bailey said.

Applied Materials, which sells TSMC production machinery, fell nearly 9% last week. Broadcom, another TSMC customer and a major supplier of phone parts, declined 4%. European chip stocks also weakened, with Dialog Semiconductor and STMicroelectronics both dropping at least 2.9% in the five days through to Friday.

The semi industry is “getting ‘fugly’”, Neil Campling, an analyst at Mirabaud Securities, wrote in a note to investors, adding that “the iPhone X is dead”.

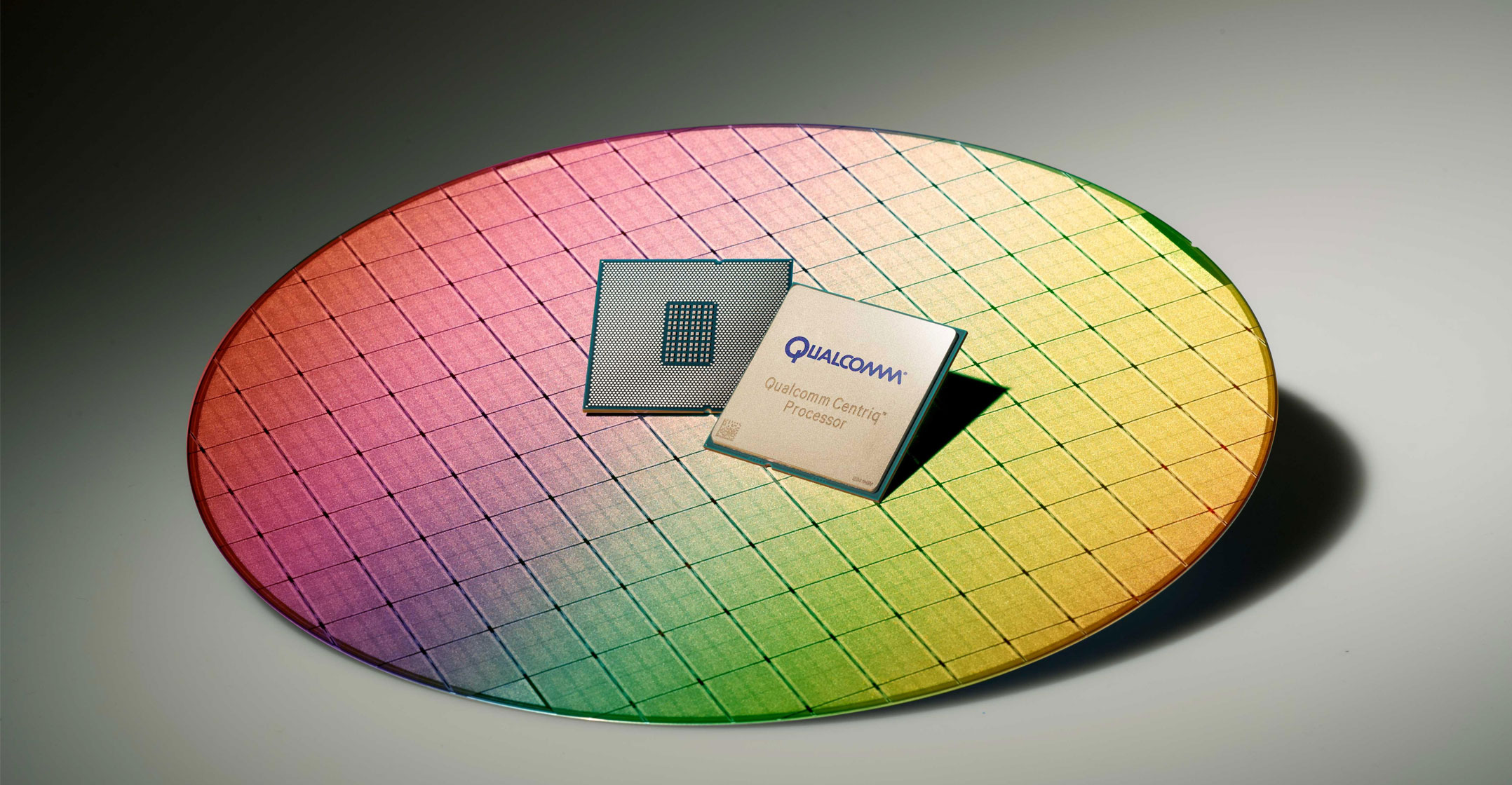

The US took fresh steps in its trade spat with China this week, prohibiting ZTE for seven years from buying any American technology. China hit back on Thursday, with its ministry of commerce dealing a blow to Qualcomm as the chip maker was forced to reapply for approval for its acquisition of NXP Semiconductors.

Speculation raged that the ministry might delay approval for multiple pending acquisitions. Those include Cavium/Marvell Technology Group, Microsemi/Microchip Technology and Orbotech/KLA-Tencor.

After the ZTE ban, “uncertainty will impact the optical and semi supply chain and could also freeze any US potential M&A activities,” Rosenblatt analyst Jun Zhang wrote in a note.

Aside from the trade spats and sobering news out of TSMC, other semiconductor stocks have simply reported disappointing earnings. Europe chip stock ASML Holding reported underwhelming numbers on Wednesday. Lam Research forecast that shipments may decline later this year, overshadowing better-than-expected revenue and profit views, potentially signalling a peak in the semiconductor business.

Poor results from Taiwan Semi and ASM International followed.

And the pain may not be over. Bank of America Merill Lynch sees potential for the Philadelphia Semiconductor Index to fall another 4-7%. As always, Apple’s results could provide some stability if it shows solid demand prospects when it reports on 1 May. — Reported by Sarah Ponczek, with assistance from Brad Olesen, Joshua Fineman and Ian King, (c) 2018 Bloomberg LP