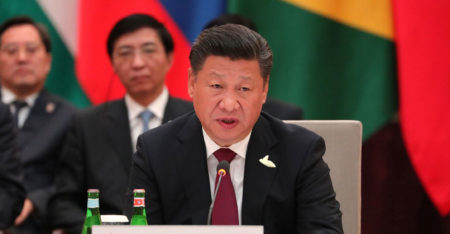

Chinese gaming and media stocks including Tencent and NetEase fell on Thursday, a day after authorities summoned them to ensure they implemented new rules for the sector.

Browsing: Investment

4AX, a rival stock exchange to the JSE launched in 2017, is relocating from Johannesburg to Cape Town, will be rebranded as the Cape Town Stock Exchange, and will position itself as the “Nasdaq of Africa”.

JSE-listed technology group Mustek has built on the blowout results it reported in the six months to 31 March 2021 and has said the full-year number will be even more impressive.

Blue Label Telecoms has suspended two senior executives pending an investigation into possible irregularities, details of which the JSE-listed group has declined to disclose at this stage.

Naspers’s high-voting A shares once again ensured that all of the resolutions at Wednesday’s AGM were passed, despite hefty opposition from the N shareholders.

Tim Cook is poised to hit pay dirt – again. This week, the Apple CEO will collect the 10th and final tranche of the pay deal he received a decade ago after he took over the top job from co-founder Steve Jobs.

President Xi Jinping has increasingly emphasised the idea of “common prosperity” as the Communist Party tries to address the country’s wealth gap.

South Africa’s economy is 11% bigger than previously estimated, after statistics authorities changed the way they calculate GDP.

Chinese technology shares rallied in Hong Kong on Monday as bargain hunters pounced in the wake of the sector’s worst rout in months.

Even a $1.5-trillion selloff may not provide an attractive entry point for equity investors as they grapple with cascading risks in China’s technology sector.