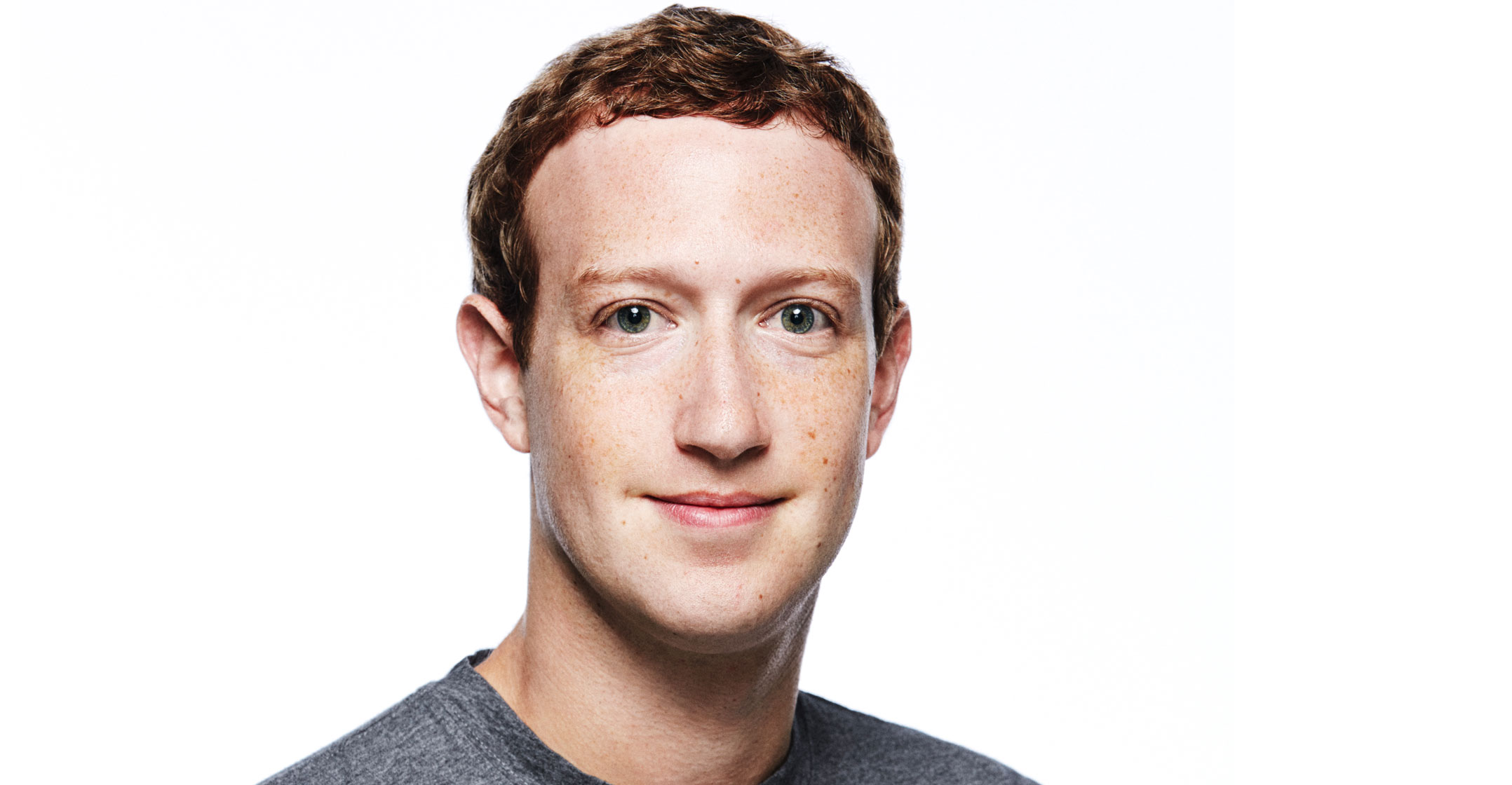

Sometimes even bitter billionaire rivals need each other. Mark Zuckerberg and the Winklevoss twins fell out over the founding of Facebook but they appear to have buried the hatchet over the blockchain.

According to the Financial Times, Gemini, the crypto exchange founded by the “Winklevii”, has held talks with Facebook over the social network’s plans to roll out its own cryptocurrency, which would probably be used to make payments and purchases across Zuckerberg’s empire. The talks suggest something “bigger and more open” than previously imagined by the company, according to the FT: a liquid, tradeable currency that’s used far and wide.

How far, and how wide? Well, in terms of ambition, it’s not far off something Dr Evil from the Austin Powers movies might come up with. According to the BBC, Facebook’s crypto-based system — humbly labelled “GlobalCoin” — will be rolled out next year across about a dozen countries. That’s more than the euro zone started with.

Unlike bitcoin, Facebook’s aim is not to bring down the established financial system, but to co-opt it. The social network is said to be seeking the blessing of governments, central banks and regulators. It also wants to partner with brokers and money-transfer firms, and to strike deals with online merchants.

Zuckerberg will obviously do his best to make his new project sound as trustworthy and above-board as possible when it’s finally launched. GlobalCoin is said to be a so-called “stablecoin”, which are usually pegged to a major currency like the US dollar to minimise volatility. So, in theory, one of Facebook’s tokens would never be more valuable than the dollar that backs it — unlike the boom-and-bust prices of bitcoin. Presumably, Facebook would also keep things plain-vanilla at first in terms of the digital currency’s uses, offering simple retail deals or money transfers to minimise the risk of loss for its more than two billion users.

No dummies

Regulators and politicians are no dummies, though. This is the kind of move that would turn Facebook from an incredibly powerful centralised network tracking its users’ behaviour for the benefit of advertisers into one that also knows where and how they spend their money. Transaction data is a powerful tool, one that’s key to a lot of fintech companies’ bubbly valuations. In the hands of a business with Facebook’s reach, the unintended consequences could be huge. US senators are right to be asking tough questions already about the implications for privacy, potential data breaches and credit scoring. If Facebook starts gauging its users’ creditworthiness, it will need tough regulation.

Ironically, there seems to be nothing of bitcoin’s decentralised libertarian principles in this currency for billions that would ultimately be controlled by one company — and one man. Facebook’s co-founder Chris Hughes this month accused Zuckerberg of having “near-unilateral” power over the social network through his ownership of 60% of the voting rights, suggesting the company board is accountable to him rather than the reverse. Calls to break up Facebook, or at least take another look at the monopoly power of the firm, will only get louder if GlobalCoin becomes reality.

Judging by early reports, then, this project looks like a dream for an over-mighty corporation, and a nightmare for the crypto true believers. We’ve had companies issue their own currency in the past — think of the East India Company under the British Empire — but nothing quite like this. Whether the US government views it as a rival to or extension of the US dollar’s global dominance will be crucial. The relationship status between Big Tech and politics is about to get even more complicated. — By Lionel Laurent, (c) 2019 Bloomberg LP