Chip makers from Taiwan to the US are cranking up production to address shortages that have hammered car manufacturers and other customers as they try to emerge from the coronavirus pandemic.

Now that unprecedented surge investment is fuelling fears the industry will overshoot, adding so much capacity in the years ahead as demand subsides that profits will take a hit.

In the latest sign of concern over demand, Texas Instruments, one of the largest makers of chips, warned that revenue for the third quarter could fall short of some analysts’ estimates. Sales will be US$4.4-billion to $4.76-billion in the period ending in September, the company said, compared to analysts’ prediction of $4.59-billion. Shares fell about 4% in extended trading.

The forecast was particularly puzzling because it came after the largest maker of analogue and embedded processors reported a 41% surge in second quarter revenue. It led to a barrage of questions from analysts on why the company isn’t more optimistic and whether we’re seeing the first signs of a slowdown in the notoriously cyclical industry.

Management cautioned that it couldn’t anticipate whether demand is peaking or whether growth at the current levels is sustainable.

‘Dangerous argument’

“Our job isn’t to predict the future, it’s to prepare the company so we can handle anything and we’ve done that,” chief financial officer Rafael Lizardi said in an interview. “Some would argue that this time it’s different, but that’s a dangerous argument.”

Like other chip makers, Texas Instruments has posted multiple quarters of double-digit percentage revenue growth, boosted by demand for a wide variety of devices that contain its tiny electronic components. The rapid run-up has caused speculation among analysts and investors that some of the orders reflect panic buying by customers who have grown anxious they won’t be able get enough supply. Such behavior in the past has caused crashes.

“TI posted yet another puzzling earnings report. Revenue for the quarter significantly beat guidance, but it guided revenue flat, without much explanation for the conservative guidance,” said Raymond James analyst Chris Caso in a note after the report. “Our view is that management likely suffers from a lack of confidence at the macro level, despite what clearly continues to be tight supply conditions at both TI and the semi industry at large.”

Lead times, the gap between ordering a semiconductor and taking delivery, increased to 19.3 weeks in June, a week and a half longer than in May, according to research from Susquehanna Financial Group. That gap, already the longest wait time since the firm began tracking the data in 2017, is now more than five weeks longer than the previous peak in 2018.

Texas instruments itself said the amount of in-house inventory fell to 111 days in the quarter, well short of the 130 to 190 days the company likes to have on hand. The company’s lead times have stretched for an increasing number of products.

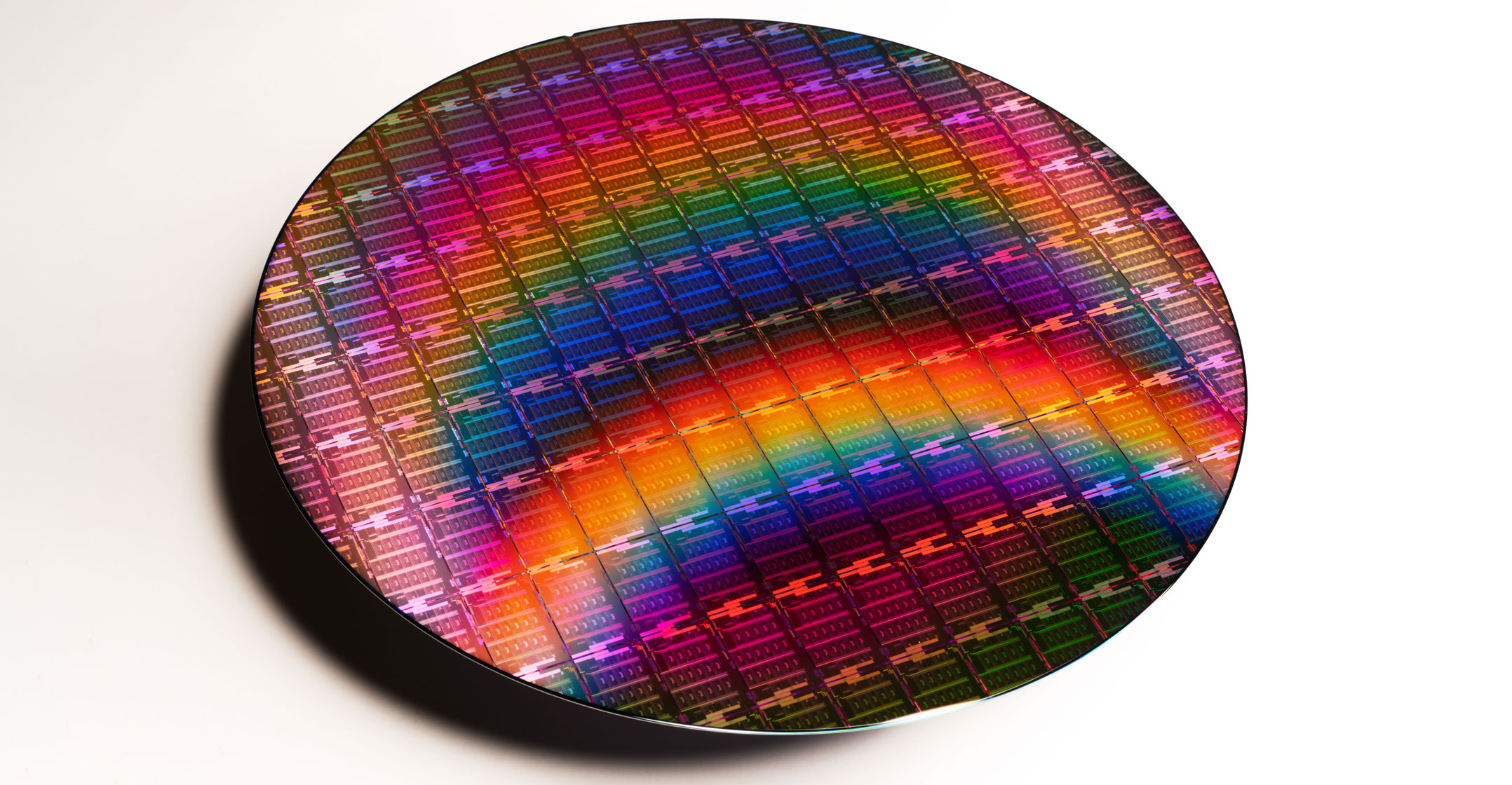

The entire chip industry is cranking up investments to meet the surging demand. Taiwan’s TSMC., the world’s top chip maker, has pledged to invest $100-billion over three years, including in a new fab in the US. South Korea’s Samsung Electronics and SK Hynix will lead more than ₩510-trillion ($442-billion) of investment in semiconductor research and production in the years to 2030 under a national blueprint devised by President Moon Jae-in’s administration.

Executives such as Intel CEO Pat Gelsinger have predicted long-term growth for the industry at well above historical levels. They argue that chips are simply in more and more devices that never needed them and that’ll mitigate some of the historical slumps when the industry primarily supplied the computer and phone industries.

This week, ASML Holding, the leading provider of equipment to make chips, said orders for machines that make high-end semiconductors rose to a record as TSMC and Samsung get in line for key machinery. That gear, however, won’t be producing chips until next year, at the earliest.

Boost orders

ASML CEO Peter Wennink said the ongoing efforts by several governments to build chip capacity at home will boost orders for semiconductor equipment. The company has historically underestimated how quickly the industry would grow in the past 15 years and Wennink said it’s working to boost manufacturing to keep up.

TSMC CEO CC Wei said in an earnings call last week that he expects the company’s capacity to remain tight throughout this year and into 2022.

There are signs the shortages are easing. This year, US commerce secretary Gina Raimondo brokered meetings between semiconductor manufacturers, their suppliers and their customers, including car makers. She said this week there are improvements and companies such as Ford and General Motors are getting “a bit more of what they need”. — Reported by Ian King and Debby Wu, (c) 2021 Bloomberg LP