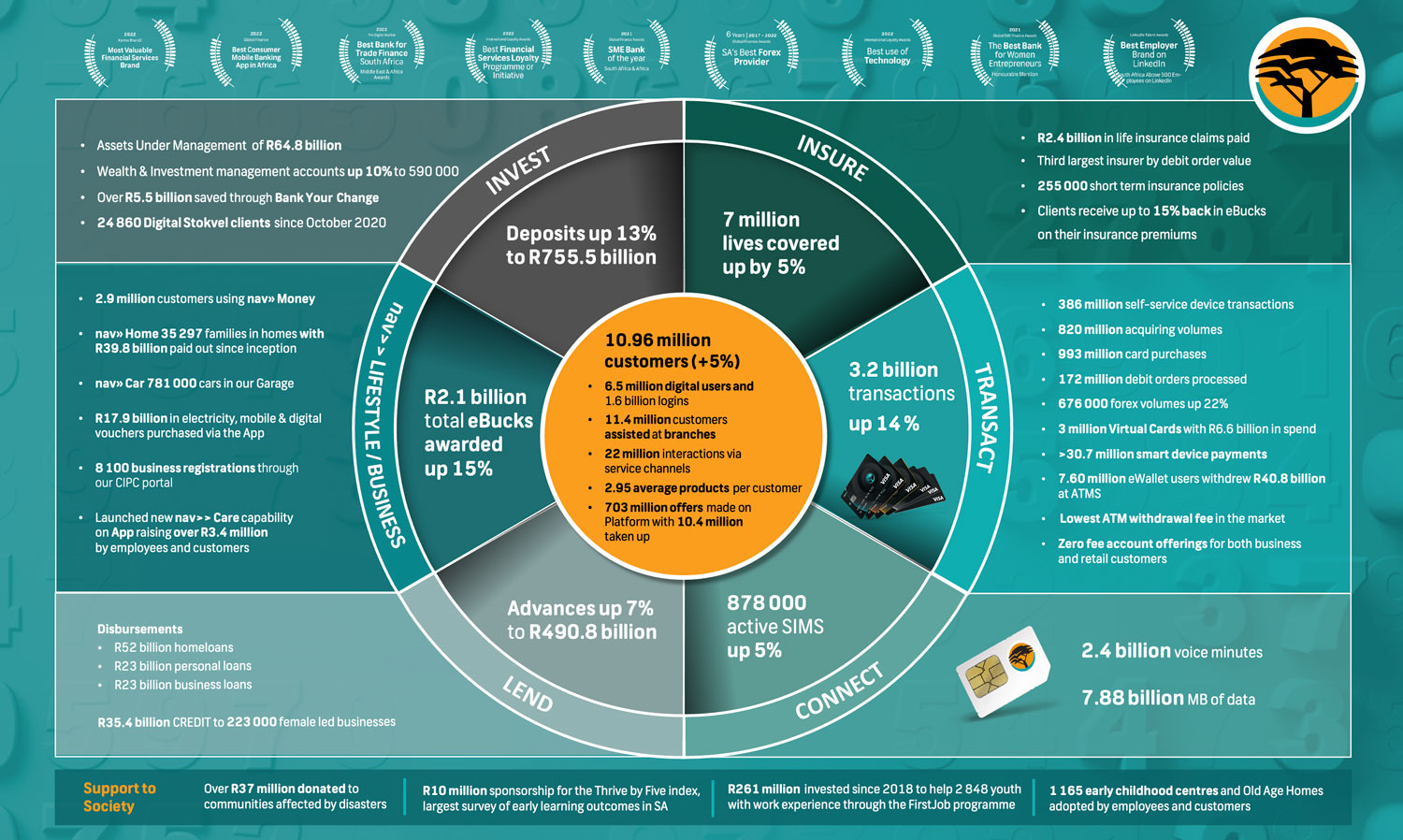

FNB delivered a strong set of financial results for the financial year ending 30 June 2022, as 10.96 million customers continued to place their trust in our ability to help them with their financial, business and lifestyle needs. Our performance was driven by more customers, increased transactional volumes, strong deposit growth, lower impairments, and increased disbursements to our retail and commercial customers.

Some of the key financial highlights are:

- Active customers increased by 5% from 10.48 million to 10.96 million;

- Profit before tax increased by 23% from R23.2-billion to R28.4-billion;

- Deposits increased by 13% from R666.8-billion to R755.5-billion;

- Advances increased by 7% from R459.9-billion to R490.8-billion;

- Overall transaction volumes increased by 14% from 2.8 billion to 3.2 billion;

- Digitally active customers increased from 6.09 million to 6.48 million; and

- Digital logins totalled 1.6 billion.

We want to thank our customers for embracing our strategy and allowing us to help them with their money management and financial wellbeing. As the largest retail household deposit franchise, we are encouraged by our customers’ trust in our ability to meet their expectations. This is also evidenced by the robust growth of our transactional, lending and deposit activity, as well as the increasing demand for our insurance and investment solutions. Pleasingly, we have the necessary resources, including lending capacity, to support our customers’ growth and financial needs.

We remain committed to investing in our digital platform to facilitate our customers’ migration to safer and more efficient channels. Our platform evolution and strategy to increase customer adoption of digital interfaces is yielding results as we continue to experience significant volume and activity growth. Our efforts to protect our customers from fraud continue to be an integral part of our platform innovations, and we are pleased to report positive outcomes in this regard. Our scalable platform offers customers the opportunity to manage their financial needs, securely, 24/7 and ensures customers can engage with us on their preferred device interface, either unassisted on their own devices or assisted by us in our branches, call centres, service suites or secure chat.

Our Retail segment made significant progress in its strategy to offer inclusive and personalised financial services to customers and their families. We strive to assist customers in managing their money better. Our efforts are supported by unassisted money management tools like nav» Money on the FNB App, which is now used by over 2.9 million customers. To assist Retail customers with their credit needs, in the past year we disbursed a total of R52-billion in home loans. We also disbursed R23-billion in personal loans to customers to appropriately facilitate their day-to-day cashflow needs.

In addition to our popular eWallet solution, we also offer Easy Zero and Easy Pay As You Use accounts. Easy Zero is an entry-level transactional bank account with no monthly account fee and it can be opened through cellphone banking with only the individual’s name, surname, and ID number. Easy Pay-As-You-Use has a low monthly account fee of R4.95 that has remained unchanged. These low-cost accounts play an important role in broadening financial inclusion for customers, including those with irregular income.

Commercial segment

Our Commercial segment also delivered strong results, with just under 300 000 new business accounts and strong deposit growth off the back of attractive product pricing and good innovation. We also offer our commercial customers money management support which helped them to better manage their cashflows. Commercial advances have also increased year-on-year, with total disbursements up 35%, as we continue to support and offer innovative solutions to our business customers’ lending needs. In addition, our SME customers benefited from reduced and/or zero-rated fees to assist them in starting, running and growing their businesses.

In Public Sector Banking, we continued to assist clients such as government departments, schools and universities in digitising their services. We increased digital penetration among our public sector clients from less than 50% to more than 85% to date.

Pleasingly, our Broader Africa activities also delivered strong value to our customers with good deposit and transactional activity growth. Disciplined credit and cost management also contributed to their profit growth. The portfolio’s overall performance was largely attributable to resilient results in countries such as Botswana, Namibia, Eswatini and Zambia, and a continued rebound in Mozambique. First National Bank Ghana continued to mature its operations in line with our strategy. Our Broader Africa countries are levering both traditional and alternative distribution channels to deliver more efficient and cost-effective financial solutions to customers.

Social impact

Our efforts to support broader society includes financial inclusion and wellness, community support for social and economic transformation, and environmental sustainability. We were actively involved in efforts to provide relief to flood-affected communities such as KwaZulu-Natal, as well as in providing work experience to youth through an internal FirstJob programme with 468 FirstJobbers employed, up 53% this year and resulting in a total of 2 848 youth gaining invaluable work experience to date. Furthermore, we continue to use our platform for social good by allowing customers and employees to donate to charities and adopt early childhood centres via the FNB App’s nav>> Care functionality.

Some of FNB’s “Help” to society included:

- R181-million donated to FirstRand’s Corporate Foundations;

- R261-million invested since 2018 to help 2 848 youth with work experience through the FirstJob programme;

- Over R37-million donated to communities affected by disasters;

- 8-million to repair infrastructure and provide sanitation in 45 vandalised KZN schools;

- R10 million sponsorship for the Thrive by Five Index, the largest survey of early learning outcomes in South Africa;

- Over R3.4-million raised through nav» Care donations by employees and customers; and

- Some 1 165 early childhood centres and Old Age Homes adopted digitally by employees and customers.

We recognise that the societal impact of our business efforts is critical to establishing trust. As a result, we strive to make a positive impact by collaborating with communities across our markets. We also recognise that our business performance would not have been possible without our customers and hardworking employees, and we extend our gratitude to all as we work to build an even stronger business over the next 184 years.

Some highlights of our activities are (click the image to enlarge):

- The author, Jacques Celliers, is CEO of FNB

- This promoted content was paid for by the party concerned